USD flows: USD firm but risks to the downside

USD gains since the employment cost index put it at levels that look vulnerable

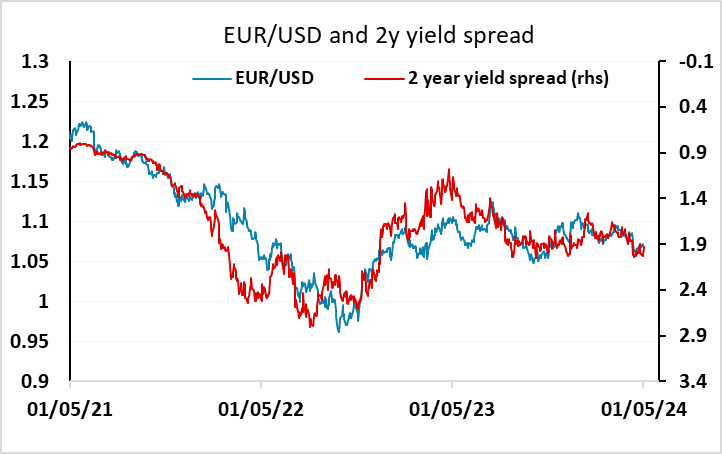

With most of Europe on holiday it’s unlikely we see much FX action in the European morning. The USD has nevertheless retained a firm tone in early trade, the USD having been well bid since yesterday’s report of a stronger than expected employment cost index for Q1. However, there isn’t much support in yield spread moves for a weaker EUR, with the EUR gaining support from yesterday’s stronger than expected Q1 Eurozone GDP data. The FOMC meeting tonight is the main focus, and FX will likely drift ahead of then, but with only one Fed rate cut now priced in for this year, it will take a significantly hawkish statement for the USD to advance further, and we would see some upside risks for EUR/USD.

USD/JPY looks like more of a waiting game, with the general firm tone to yields globally helping to maintain a bid in USD/JPY in the absence of further BoJ action. Typically in these situations the BoJ take advantage if the market becomes overextended rather than trying to force the JPY higher, and we wouldn’t anticipate an attempt to drive USD/JPY lower. But if USD/JPY moves above important technical levels above 158 the BoJ may well react.