GBP flows: GBP fails to sustain gains on stronger CPI

GBP initially gains on stronger CPI, but fails to sustain rise. GBP supported by yield spreads, but remains expensive and upside progress likely to be tough.

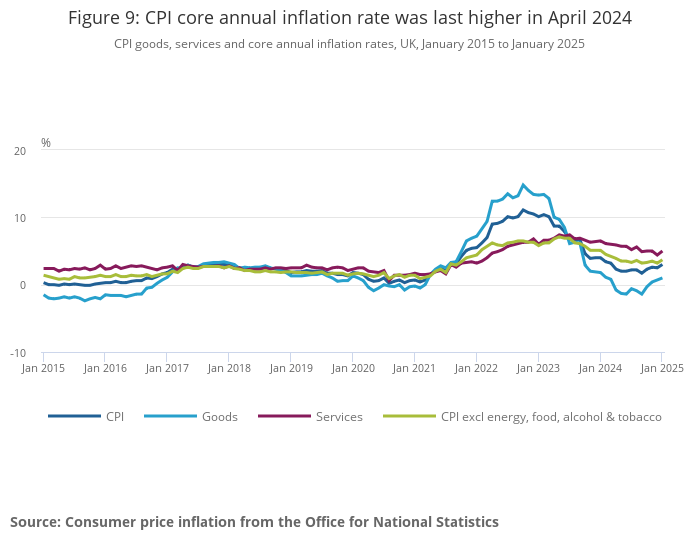

UK January CPI has come in on the strong side of expectations, with broad based gains taking the y/y rate up to 3.0% y/y against a market consensus of 2.8%. There was strength in food and energy prices, but clothing and education also saw gains on a y/y basis, with the tax on private schooling hitting the education index. Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.7% in the 12 months to January 2025, up from 3.2% in December 2024; the CPI goods annual rate rose from 0.7% to 1.0%, while the CPI services annual rate rose from 4.4% to 5.0%. The data is significantly above expectations and will make it hard for the BoE to ease policy. Coming into the data the market was looking for two more rate cuts this year, with the next move seen likely to be in May, but this data may mean that the cuts are pushed back.

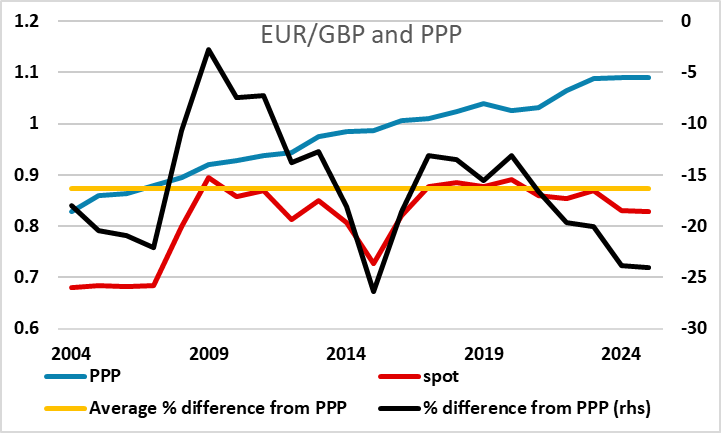

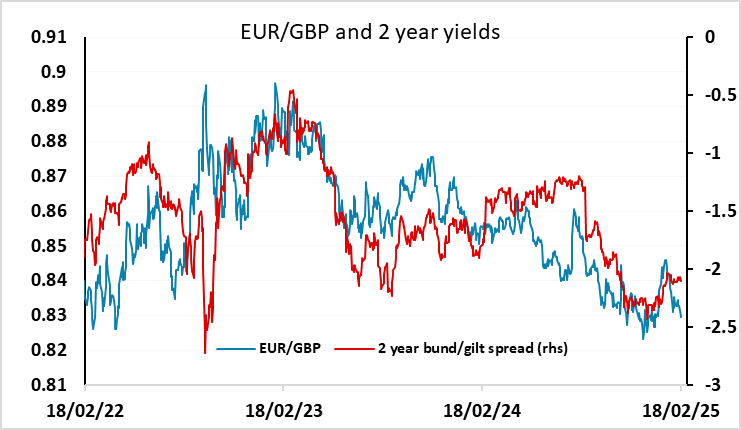

GBP has initially strengthened modestly on the news, with EUR/GBP dropping 10 pips to 0.8275. While the data is likely to mean higher short term UK yields, EUR/GBP already looks a little low relative to yield spreads, and from a longer term value perspective GBP is expensive here against the EUR, trading some 24% below PPP, the most since before the Brexit vote in 2015. While the strength is to some extent justified by relatively high UK yields, it is unlikely that spreads over the EUR will remain this high for long, with little case for UK real yields being above those in the Eurozone. So even if UK rate cuts are slow, progress sub-0.83 is likely to be tough.