GBP flows: GBP slightly firmer after BoE

Split MPC vote, but higher inflaiton forecast hows Bank doesn't see more rapid easing than the market

The Bank of England decided to leave rate unchanged as expected, with a 3-way split on the vote, with two voting for a hike and one for a cut. The tightening bias seems to have gone, with the Bank no longer saying "further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures". However, the forecast for inflation in 2 years’ time based on market interest rates was up to 2.3% from 1.9%in November, no doubt largely because market rates are lower.

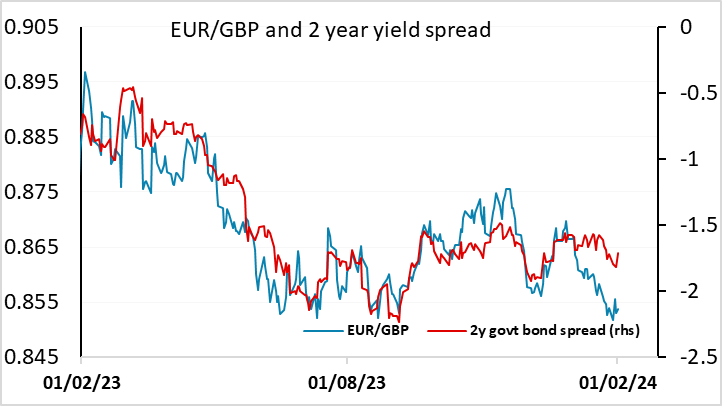

The tone of the statement is broadly in line with expectations, but the higher inflation forecast emphasises that there is no imminent rate cut seen and that the Bank sees market pricing as approximately correct. There was a risk of a more dovish stance so GBP has recovered slightly from early losses, but EUR/GBP will now likely be range bound in the 0.8510-0.8560 range near term, even though yield spreads still suggest some upside risks.