FX Daily Strategy: N America, November 19th

UK CPI data to keep some downward pressure on GBP

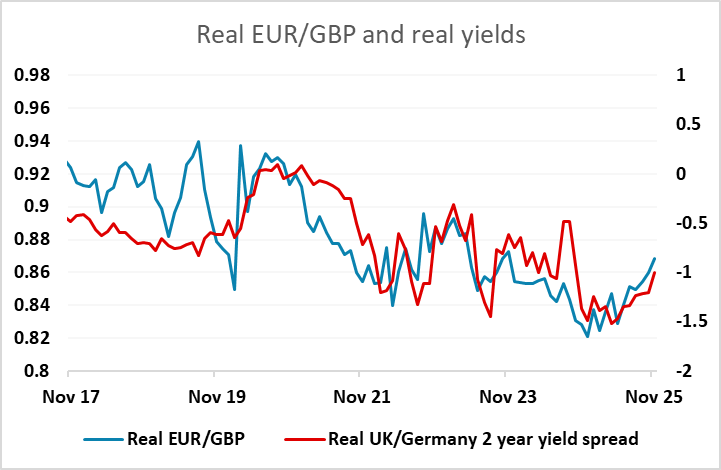

GBP looks set for a steady decline against the EUR

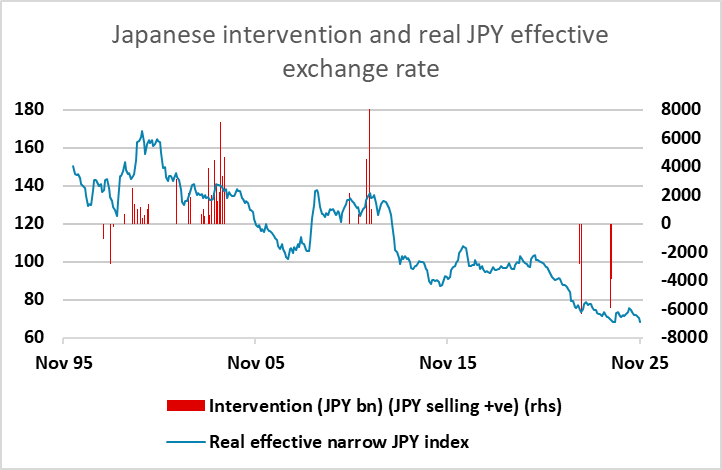

JPY decline is slow but inexorable – official Japanese action likely necessary to halt decline

EUR/CHF extending bounce but upside looks quite limited

UK CPI data to keep some downward pressure on GBP

GBP looks set for a steady decline against the EUR

JPY decline is slow but inexorable – official Japanese action likely necessary to halt decline

EUR/CHF extending bounce but upside looks quite limited

Source: ONS, Continuum Economics

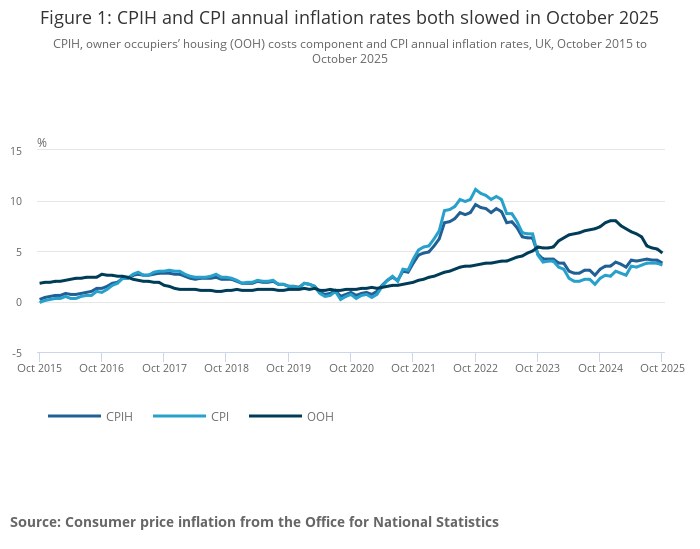

UK October CPI has come in marginally on the soft side of consensus, with the core rising 0.3% m/m against a market consensus of 0.4%, although the y/y rate was still in line with expectations at 3.4%. Services inflation was lower than expected at 0.2% m/m and 4.5% y/y. Stronger than expected PPI output data was offset by weaker than expected PPI input numbers. While the data is close to expectations, the weakening of services prices supports a BoE rate cut in December, and should maintain an upside bias to EUR/GBP. However, with a rate cut already 80% priced in, the upside scope is quite limited, and we would still expect it to be hard for EUR/GBP to break above 0.8850 near term.

Japanese Finance minister Katayama’s comments after her meeting with BoJ governor Ueda didn’t provide any comfort to JPY bulls. She said there was no specific discussion of FX, and while she said she had no problem with Ueda’s stance on policy, there appears to be little effort being made to prevent further JPY declines. The JPY has hit its lowest since January against then USD and another all time low against the EUR in response. Sooner or later the administration will need to realise that unless they take action, the JPY isn’t going to stop declining. The only other chance looks like being a weak US employment report tomorrow that triggers general USD losses, but even that may not help the JPY on the crosses. Nvidia results tonight could have an equity impact, but with the JPY having failed to benefit from the equity decline this week, we wouldn’t expect any significant JPY turn even if the results trigger more equity weakness.

FX markets were generally very quiet on Tuesday, but there was some softness evident in the CHF, which continued its reversal away from the 0.92 support area. This is a little unusual given the weak equity market tone seen through most of the day, but there is still a long way to go to challenge the medium term downtrend seen since August. For now, we would expect EUR/CHF to hold below 0.93, although CHF valuation remains very high and there may yet be scope for bigger correction towards 0.95 if the downtrend breaks.