FX Daily Strategy: N America, February 13th

USD PPI risks on the upside

EUR gains on Ukraine news

JPY weakness looks stretched

GBP gains on GDP unlikely to extend

USD PPI risks on the upside

EUR gains on Ukraine news

JPY weakness looks stretched

GBP gains on GDP unlikely to extend

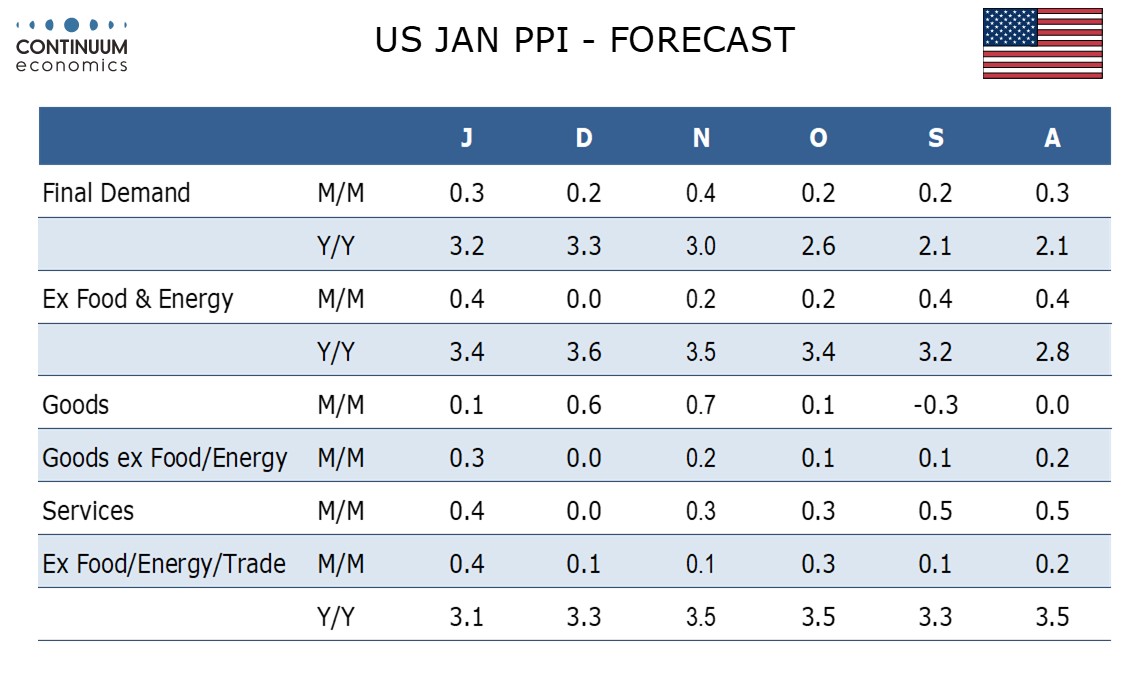

Following on from US CPI Thursday sees US PPI data. We expect January PPI to pick up from a below trend December, rising by 0.3% overall and 0.4% in both core rates, ex food and energy and ex food, energy and trade, as new year price hikes are introduced. However, a stronger rise in January 2024 will allow yr/yr rates to slip. Our core forecasts is above the market 0.3%, so could extend the USD positive reaction seen after the CPI data.

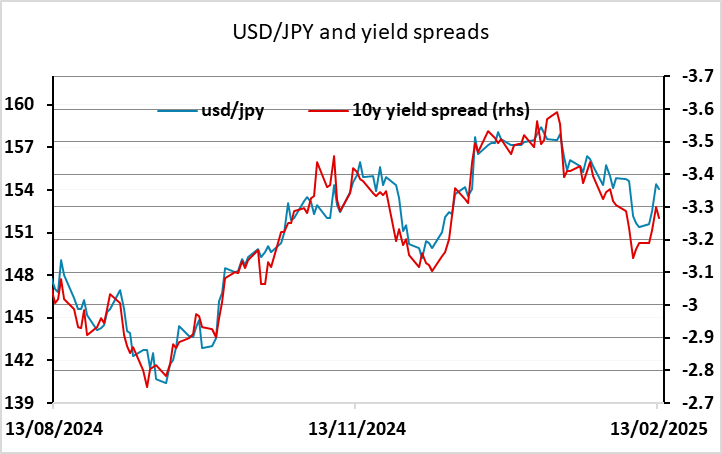

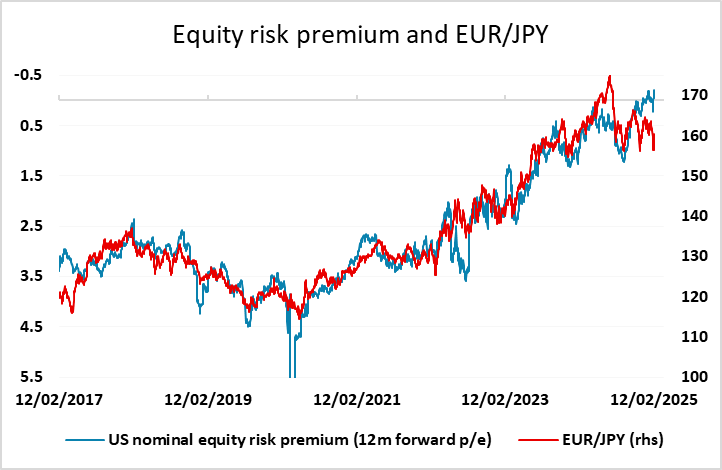

In fact, only USD/JPY and to a lesser extent USD/CHF really sustained the gains seen after the CPI data. EUR/USD recovered back to pre-data levels by the end of European trading, helped by a very resilient equity market performance on the back of perceived positive news on Ukraine, which gave support to all the riskier currencies. The JPY has gained on the crosses this year despite US equity risk premia remaining at very low levels. There has been a strong (negative) correlation between EUR/JPY (and other JPY crosses) and (US) equity risk premia in recent years, and the resilience of equities suggests there is some scope for recovery in EUR/JPY and other JPY crosses. The EUR also gained support from EUR yields being dragged higher by US yields.

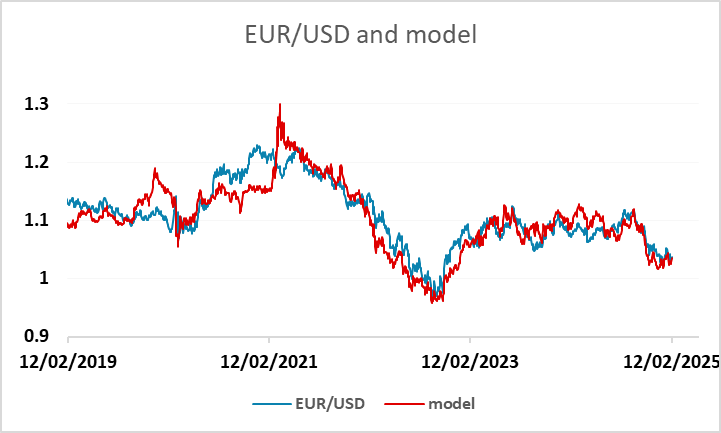

Even so, our models don’t suggest any EUR/USD upside above 1.04, and yield spreads suggest USD/JPY gains above 154 are also overdone, so that EUR/JPY above 160 is also likely to be a medium term selling area.

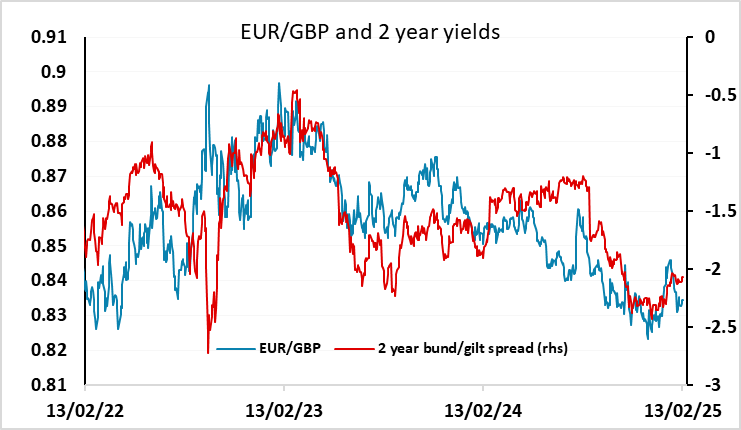

EUR/GBP has moved around 10 pips lower to 0.8340 on the back of a stronger than expected UK Q4 GDP numbers, which showed a rise of 0.1% against market expectations of a 0.1% decline. However, the data is still not particularly encouraging. From an output perspective, the gain was, once again, entirely in services, and from the expenditure side, the rise was due entirely due to the change in inventories. Business investment fell and household consumption was flat. Furthermore, GDP per capita fell 0.1%. None of this suggests any significant strength, and shouldn’t really change market expectations of BoE policy. While EUR/GBP has edged a touch lower, we would expect the 0.83 level to remain strong support and still see medium term risks on the upside.