FX Daily Strategy: N America, January 17th

GBP slips on retail sales weakness

US housing data could be a USD negative

GBP slips on retail sales weakness

US housing data could be a USD negative

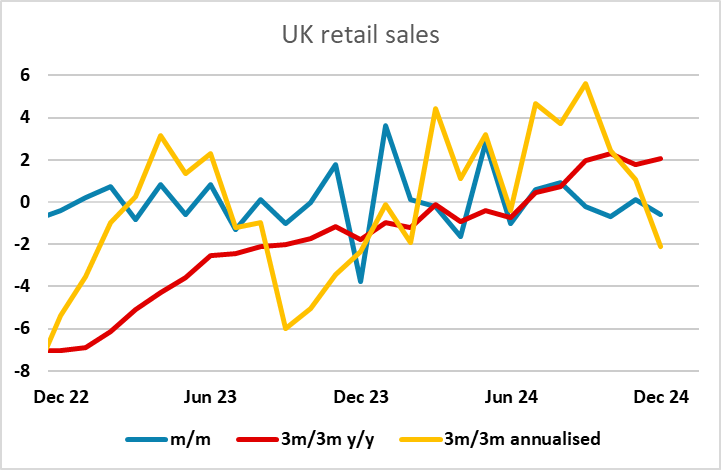

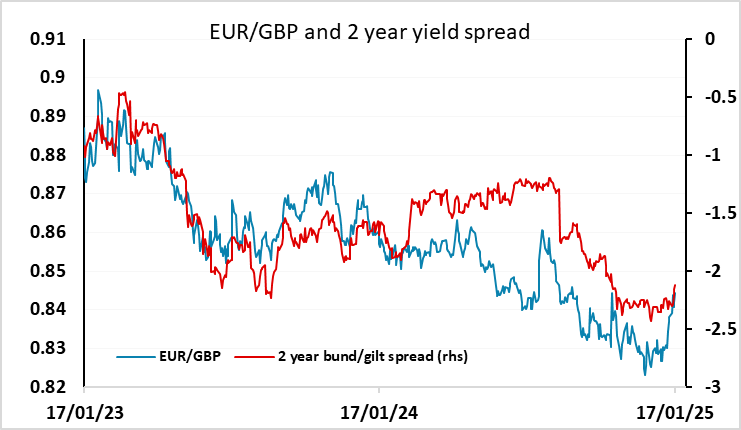

GBP weakened after softer than expected UK December retail sales data which showed a 0.6% m/m decline, taking the underlying 3m/3m trend negative for the first time since June and to its lowest level for a year. EUR/GBP gained 25 pips to 0.8550 before dropping back to 0.8540 by the end of the session. it’s hard to see much upside for GBP in any scenario, since if the inflation data don’t allow lower yields, the markets may once again start worrying about the combination of weak growth and high yields undermining public finances. We therefore look for EUR/GBP to head up to 0.85 and beyond, almost regardless of the data, although it would happen more healthily with softer wage inflation numbers.It’s hard to see much upside for GBP in any scenario, since if we dont see lower yields, the markets may once again start worrying about the combination of weak growth and high yields undermining public finances. We therefore look for EUR/GBP to head up to 0.85 and beyond, almost regardless of the data, although it would happen more healthily with softer wage inflation numbers next week.

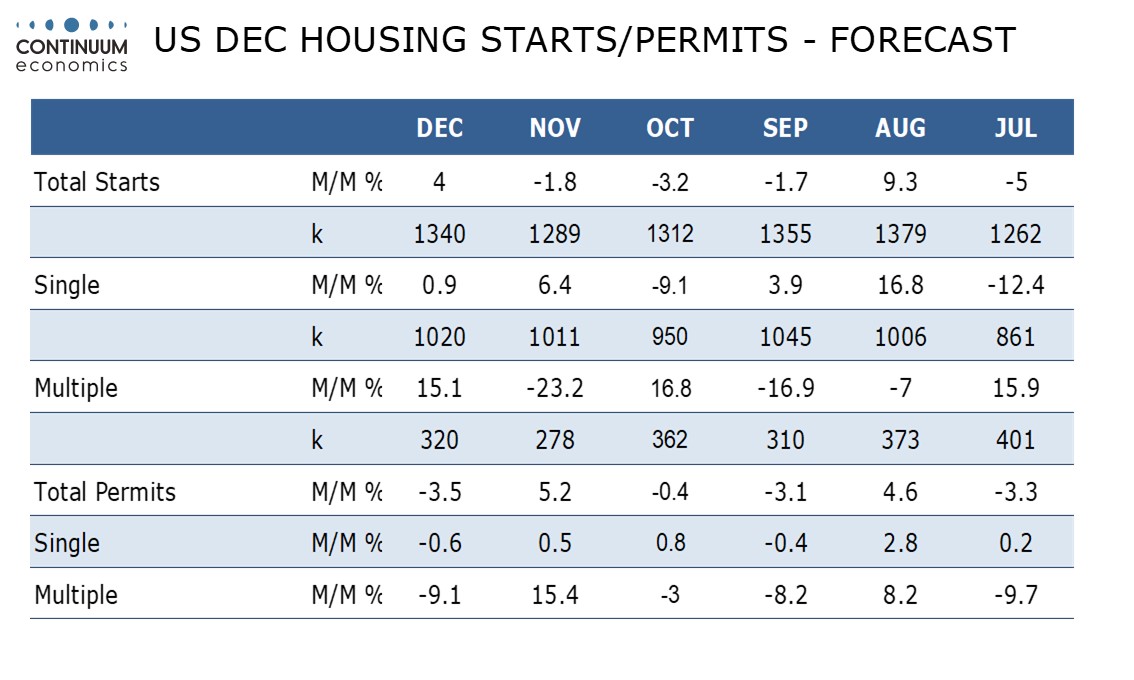

In the US, housing starts and building permits are the main data. We expect December housing starts to rise by 4.0% to 1.34m while permits fall by 3.5% to 1.44m. The starts rise will be following three straight declines while the permits fall will be correcting a 5.2% November increase. The underlying picture looks fairly flat. Looking forward the picture looks set to weaken in response to fading expectations of Fed easing and higher UST yields. Bad weather is likely to be an additional negative in January. This sector looks like one of the potential weaknesses in the economy, so the USD risks are to the downside with another decline potentially ringing alarm bells.

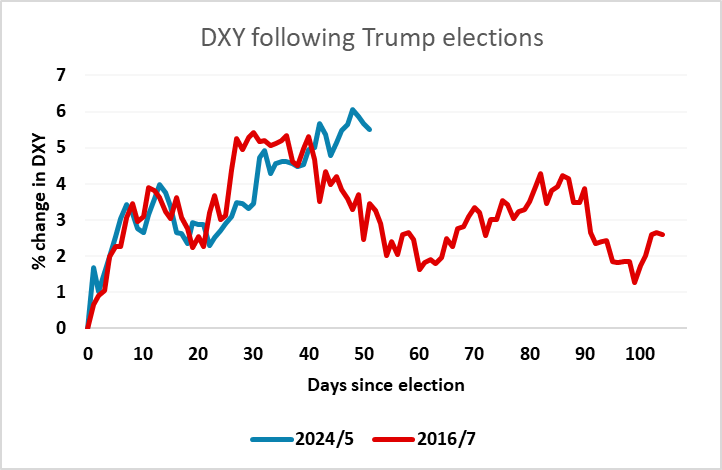

Big picture the market focus is moving to next week’s main event of the Trump inauguration. The inauguration itself is of less market interest than the executive orders that are likely to follow over the rest of the week. Most of this will be about immigration, but the market will be sensitive to anything on tariffs. In practice, the USD might not benefit from significant increases in tariffs – certainly that was the case in 2017/8. But in the initial stages any announcement of higher tariffs could be expected to benefit the USD against the target country.