FX Daily Strategy: N America, August 12th

RBA cut the policy rate, AUD risks starting to shift to the downside

US CPI a major focus but impact likely to be modest

GBP a little firmer after labour market data

RBA cut the policy rate, AUD risks starting to shift to the downside

US CPI a major focus but impact likely to be modest

GBP a little firmer after labour market data

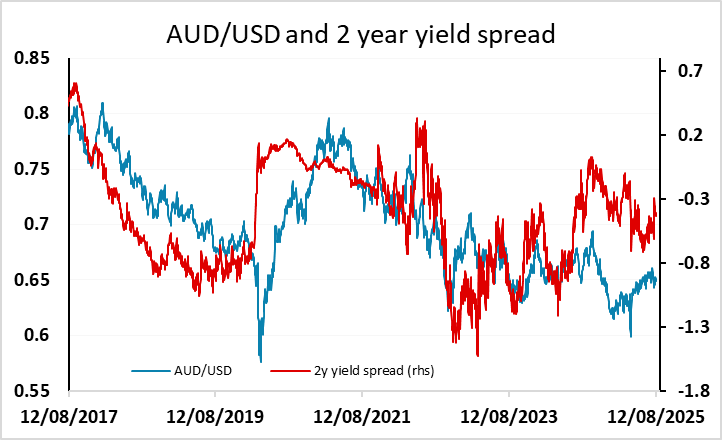

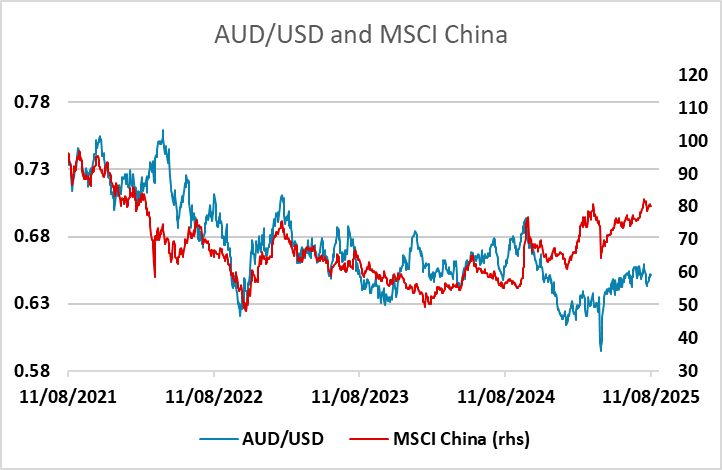

The RBA cut the cash rate to 3.6% in the August 12th meeting as inflationary pressure eases. The combination of lagged effect of easing and uncertainty in inflationary dynamics has kept the RBA from aggressive cutting. With current inflationary dynamic (headline 2.1% and trimmed 2.7% y/y), the RBA forecast underlying inflation to continue its moderation and thus they are more comfortable to cut. Their forward guidance "The Board will be attentive to the data and the evolving assessment of risks to guide its decisions." continues to point towards data dependency and suggest another cut coming soon. AUD/USD iniitlallyedged a little higher after the decision, but fell back in later Asia and European morning trading. Risks look to have shifted to the downside for the AUD, especially if we start to see any weakness n regional equities.

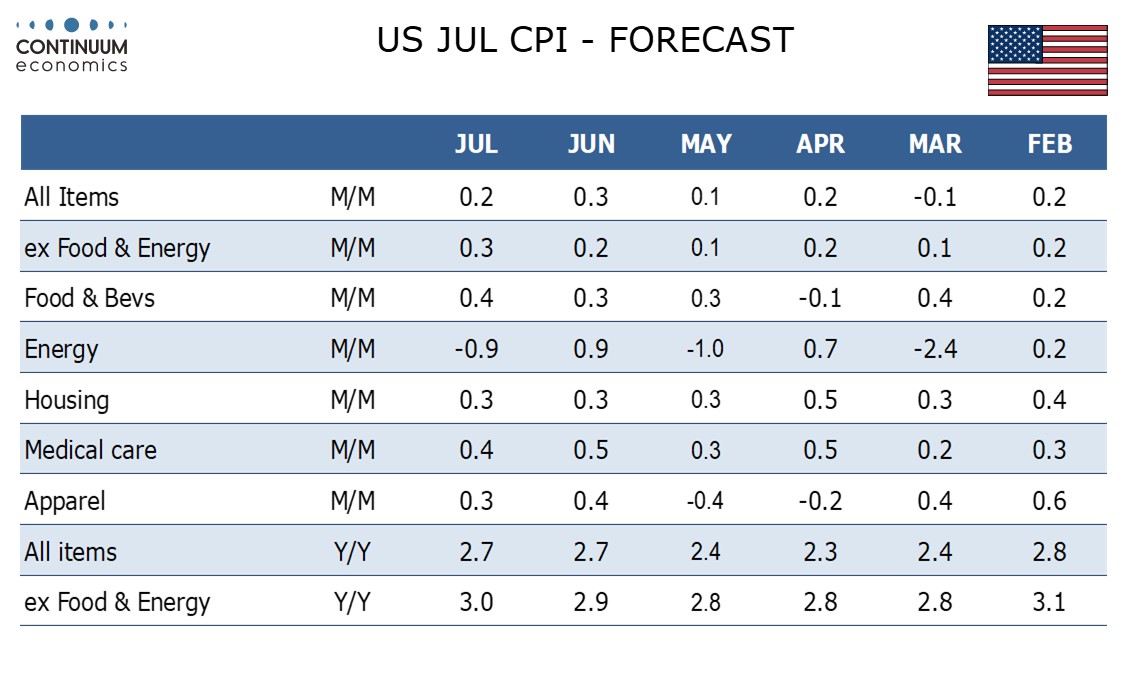

The US CPI data will be the main focus of the day. We expect July CPI to increase by 0.2% overall and by 0.3% ex food and energy, with the overall pace close to 0.2% even before rounding but the core rate rounded up from 0.26%. This would still be the strongest core rate since January and reflect a further feed through of tariffs, something that is likely to continue in the coming months. The data would also mean the y/y inflation rate in the US rising to 2.8% headline and 3.0% core. However, our forecasts are in line with consensus, and this outcome wouldn’t be seen as a reason for a significant change in market expectations of Fed policy. As it stands, it is unclear what evidence of a mild trend increase in inflationary pressure due to tariffs would mean for policy, as the key question is whether it would be accompanied by a significant slowdown in growth and employment growth. In the absence of further evidence of growth weakness, we would tend to see the risks for US short term yields and the USD to be on the upside. But the impact of a modest undershoot or overshoot of consensus would likely be small as without evidence of the broader impact on growth the policy reaction is unclear.

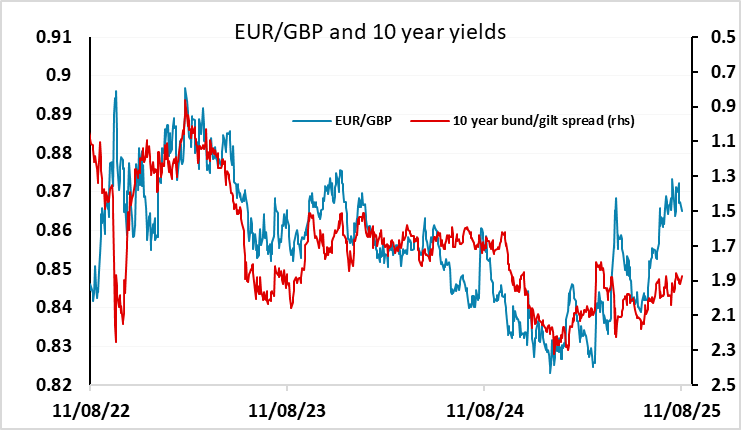

GBP has risen in response to the UK labour market data, although the data can best be described as mixed. While the official ONS data for the 3 months to June showed a larger than expected increase in employment of 238k, unemployment also rose by 59k, reflecting a rise in the labour force, and the HMRC data for July showed another decline in employment of 8k on the month, although last month’s sharp decline was revised from 41k to just 26k. Average earnings growth was atad weaker than expected at 4.6% y/y in the 3 months to June in the ONS data, but the HMRC data still showed earnings growth at 5.6% y/y in July.

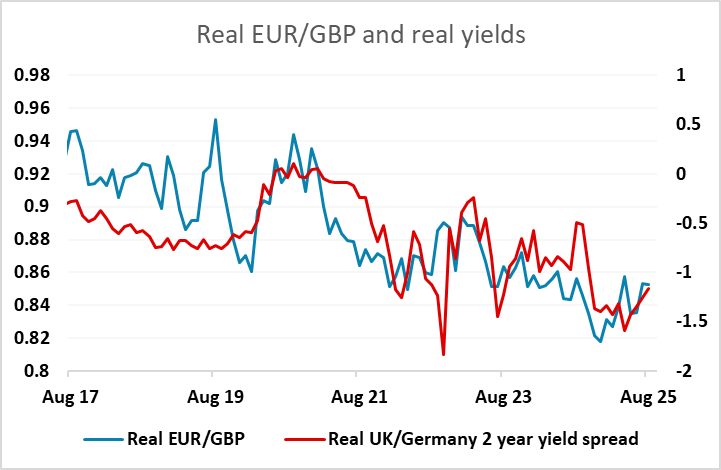

All in all, the data still paints a picture of a softening labour market, but the MPC hawks might still regard the picture as mixed and the earnings growth as too high to be consistent with the inflation target. But with the market not even fully pricing one more rate cut by year end, the risks look to be to the downside for front end yields and consequently also for GBP. It may still require more evidence of weak growth to push the BoE back towards considering a cut as early as the November meeting, but with the budget in October also likely to deliver tighter fiscal policy, the risks should be that way.