FX Daily Strategy: Asia, July 1st

Data looks unlikely to move markets

USD and JPY remain under pressure

CHF strength looks puzzling and excessive

GBP could be vulnerable to more dovish BoE comments

Data looks unlikely to move markets

USD and JPY remain under pressure

CHF strength looks puzzling and excessive

GBP could be vulnerable to more dovish BoE comments

The week is focused on the US employment numbers on Thursday, but Tuesday sees the US ISM manufacturing survey and the Preliminary Eurozone CPI data, as well as speeches from all the major central bank heads at the ECB conference in Sintra. We also have the Japanese Q2 Tankan survey, but this has failed to have much market impact in recent times, and has shown minimal volatility in recent quarters.

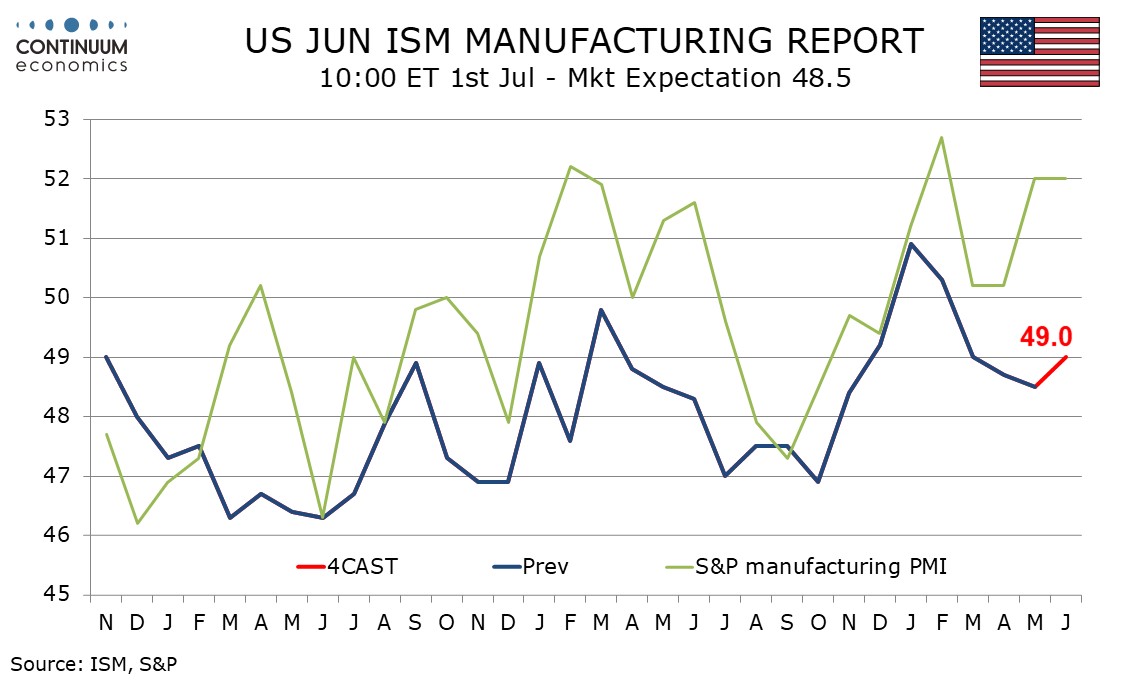

We expect a June ISM manufacturing index of 49.0, which would be a marginal improvement from May’s 48.5, which was the weakest since November 2024. However the index would remain below the neutral 50 which was beaten in January and February for the first times since October 2022. Our forecast is marginally above the market consensus of 48.8, but seems unlikely to have a significant impact, with more interest in the services survey due on Thursday.

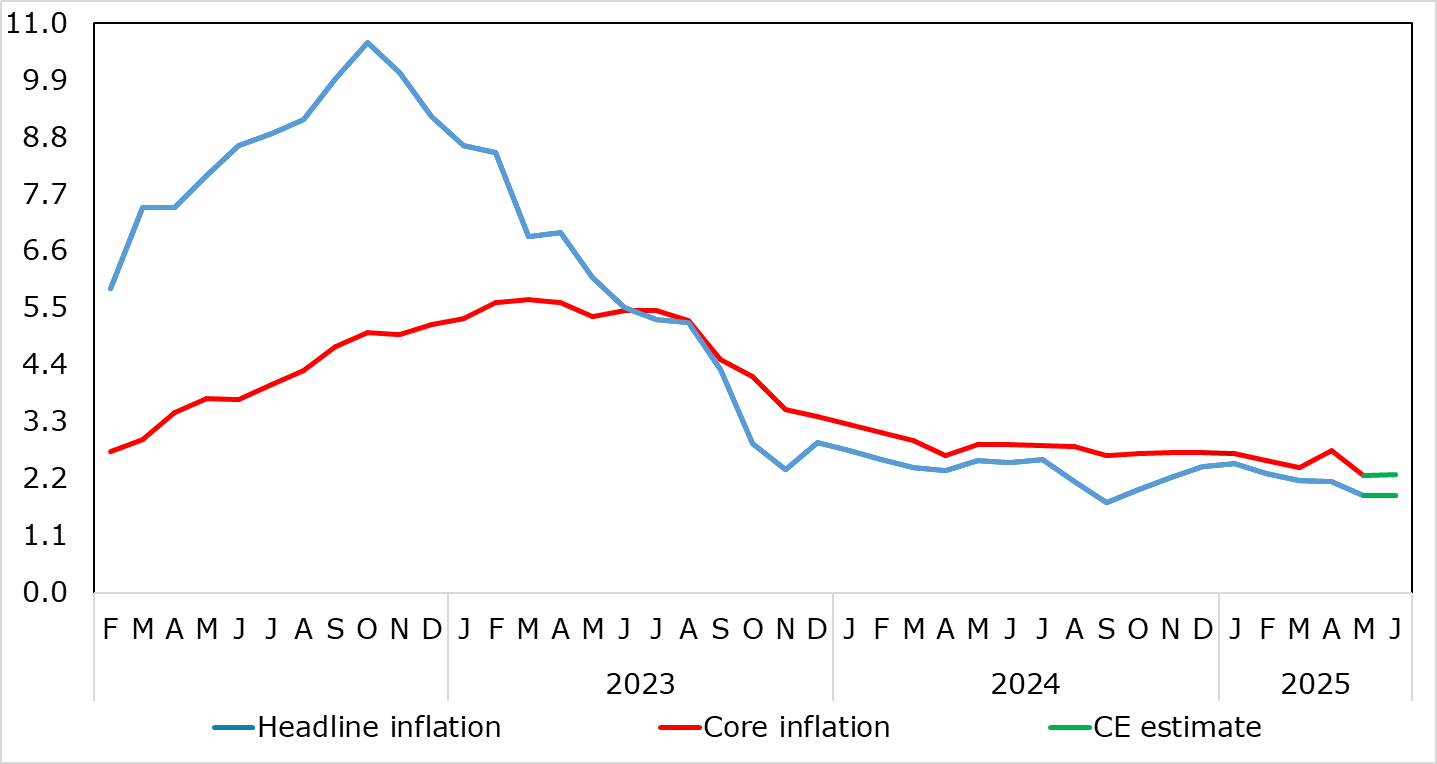

Eurozone Headline CPI Back Below Target as Services Rise Reverses

Source: Eurostat, CE, ECB

Eurozone CPI also seems unlikely move markets much, as we have already had the data from Germany, France, Italy and Spain. These were mixed, with Germany and Italy weaker than expected and France and Spain stronger, but the risks are slightly on the downside relative to the consensus for core to be unchanged at 2.3%. While we are starting to see some downside risks for the Eurozone economy, following weaker German retail sales data and slowing money data released on Monday, at this stage the EUR looks likely to hold levels above 1.17 awaiting the main data of the week.

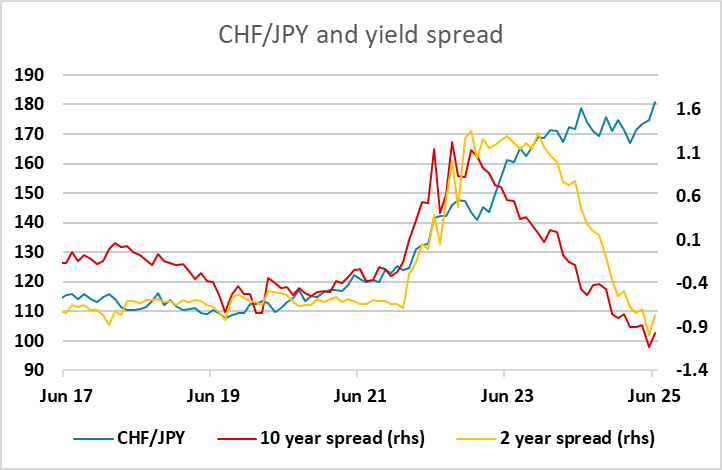

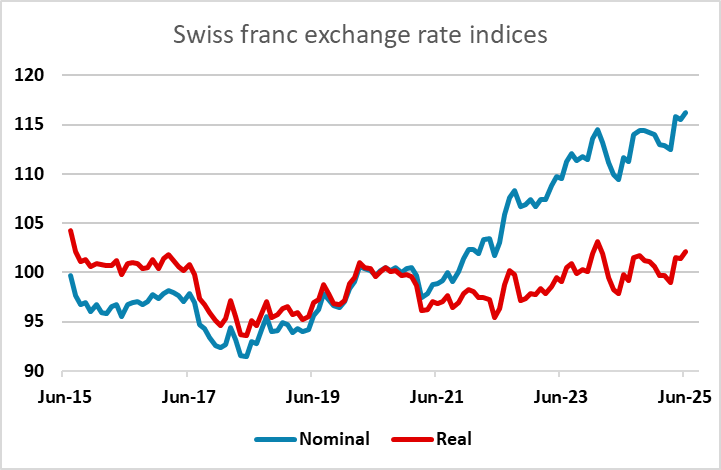

In the FX market, the main theme has continued to be USD and JPY cross weakness, with the riskier currencies, particularly the Europeans, leading the way, although the CHF has actually been the best performer in recent days despite its usual tendency to be seen as a safe haven. The rationale for this is unclear, as there is little evidence of any risk aversion elsewhere in the markets, with the S&P 500 hitting a new all time high once again on Monday, and geopolitical concerns look to have faded. Markets may be testing to see if there is any willingness from the SNB to intervene, but at this stage the CHF is probably not quite strong enough to draw any reaction, as it is still trading within the range of the last 10 years, albeit at the top end. Even so, the CHF looks very expensive here, notably against the JPY with CHF/JPY at all time highs.

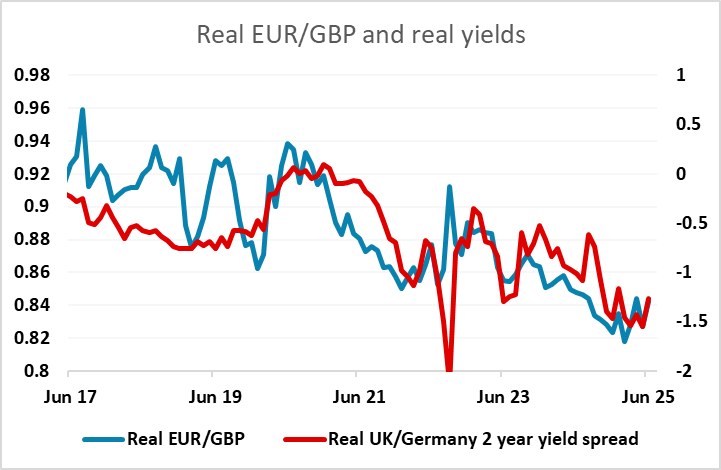

All the main central bank governors are speaking at the ECB conference in Sintra, but it seems unlikely that they will divulge a great deal about policy. Of all of them, BoE governor Bailey may have the most potential to impact the market, which is still only pricing in quite modest BoE easing this year in spite of some clear weakness in the labour market. An August UK rate cut is process as around a 75% chance, with 50bps priced for year end, but cuts could well be more aggressive if we see last month’s weak labour market data repeated. If real yield spreads with the EUR start to turn higher, there is scope for a much more substantial rise in EUR/GBP.