USD flows: Post-data dip short-lived

US September PPI and retail sales on the soft side, but impact very limited

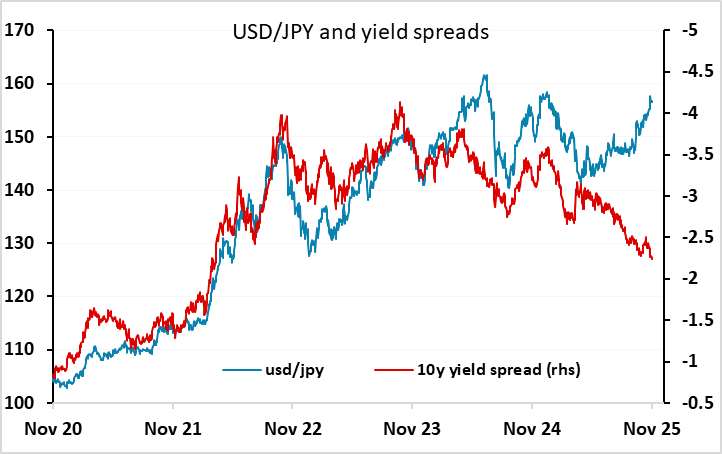

US retail sales and PPI are both on the soft side of consensus, supporting the recent softer tone to US yields and increasing the likelihood of a December Fed rate cut. The weakness is not dramatic, and the data is for September so a little out of date, but the 0.1% decline in the retail sales control group, which is the relevant measure for GDP, suggests there should be a mild negative impact on the USD. The knee-jerk negative reaction has, however, been short-lived, and the USD has rebounded and is now above pre-data levels. This may in part reflect a correction to the softer tone to the USD in Europe and Asia, and we would still see some modest downside pressure on the USD resuming, particularly against the JPY, with USD/JPY likely to target the support area in the mid 155s.