FX Daily Strategy: Asia, January 29th

U.S. Narrower October deficit looks unsustainable for November

The Sharp Correction in JPY to be Continued?

Tier Two Kiwi data Unlikely Push the Bird Higher

Trump Will Likely Do Anything for Mid Terms

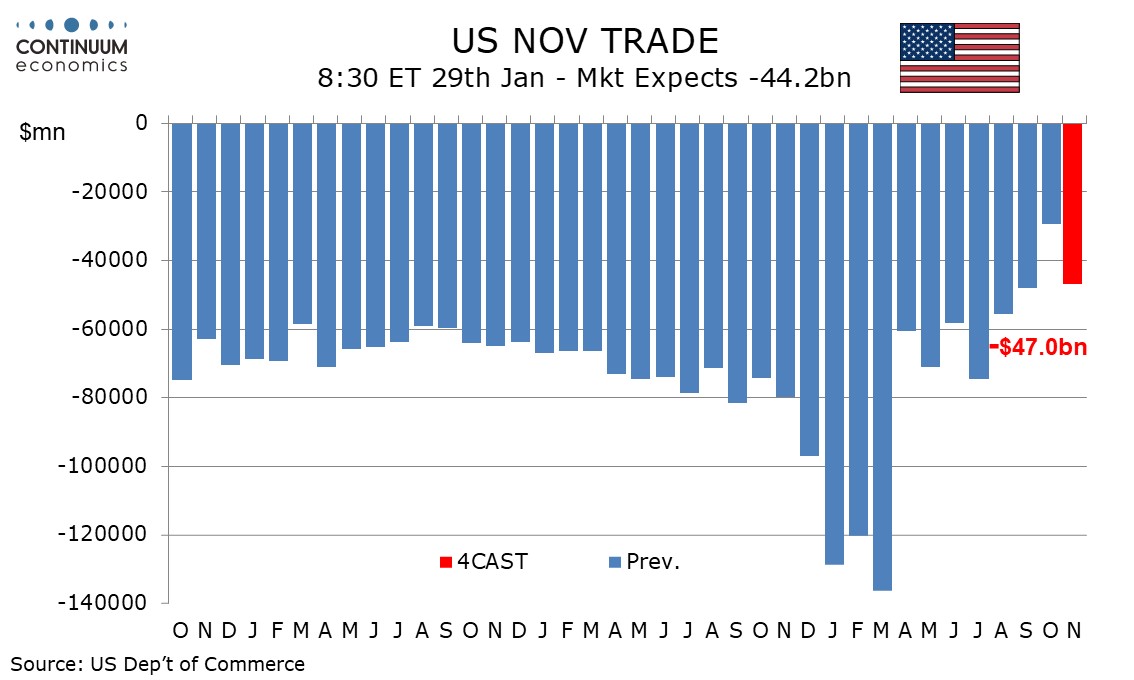

We expect a November trade deficit of $47.0bn, up from October’s $29.35bn which was the lowest since June 2009 and which looks unsustainably low, but still slightly narrower than September’s $48.14bn, which was itself the narrowest since March 2020. The sharp narrowing in October’s deficit came largely from a second straight sharp rise in exports of nonmonetary gold, and a sharp fall in imports of pharmaceutical preparations which more than fully reversed a strong rise in September. While it is far from certain that data will return to underlying trend as soon as November, such a move would see a sharp fall in goods exports reversing most of the September and October gains, and goods imports somewhere between the levels of September and October.

We expect goods exports to fall by 6.0% after gains of 5.6% in September and 3.8% in October while goods imports rise by 2.5% after a 4.3% fall in October that followed a 1.0% increase in September. Price gains will contribute around 0.5% to the November gains in each series. We expect service exports to rise by 0.5% after a 0.7% October gain while service imports rise by 0.1% after bouncing by 1.4% in October, leaving overall exports down by 3.7% and overall imports up by 1.9%. It will be some time before the underlying trade picture becomes clear given continuing volatility in policy but it is likely that the deficit remains below underlying trend after surging in Q1 ahead of the tariffs. The average deficit in the first 10 months of 2025 is $78.3bn, not far from an average monthly deficit of $75.3bn in 2024.

The sharp correction in USD/JPY was triggered by Fed rate check and has been offered since. The correction is long overdue from yield basis. The speculative mood from PM Takaichi's bet in economic stimulus and snap election seems to be overcame by intervention fears. In fact, the joint intervention between BoJ and the Fed is the only intervention that could sustainably put a lid on JPY weakness as theoretically the Fed can flood the market with USD while BoJ's own intervention has their own reserve limit. Along with the fall of JPY is JGB yields, while it is illogical in normal times, the sell off in JGB is with fear of fiscal chaos which in turn suggest calmer market sentiment now.

On the chart, the pair steadied at the 152.10 low as prices consolidate Tuesday's break of the 154.00 level. Consolidation see prices unwinding the stretched intraday studies but bearish momentum keep pressure on the downside. Break here and the 152.00, 38.2% Fibonacci level, will open up room for continuation to support at 151.00/150.92 congestion and August high where reaction can be expected. Below this will see room to the 150.00 figure. Meanwhile, resistance at the 153.00/30 congestion and Monday's low now expected to cap. Only above here will open up room for stronger corrective bounce.

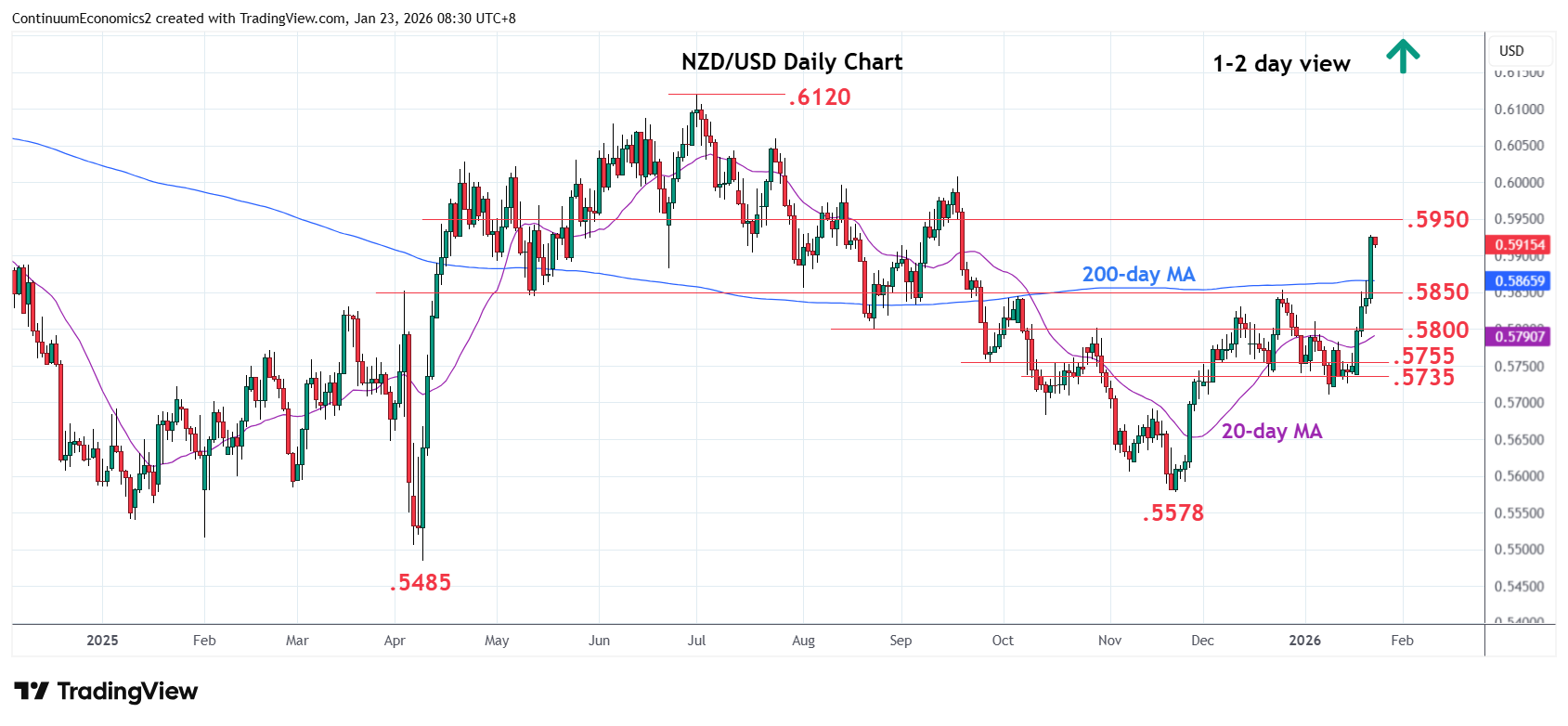

We have a slate of tier two data for Kiwi on Wednesday but we doubt such i going to move the Kiwi. The Kiwi has been pushing forward on stronger commodity prices, weaker USD and higher than target range inflation. However, without a pivot form the RBNZ, the existing catalyst is unlikely to push Kiwi through 0.6 round figure. With most of the good news are out, it will just take a simple complication to persuade market participants to turn from bid to offer. What is clear is the RBNZ has been reinforcing their easing stance despite expected higher inflationary figure and that is not supportive for the Kiwi in a medium term.

On the chart, follow-through above the .5850 resistance has seen sharp rally to reach fresh year high at .5928 as retrace the July/November losses. Daily and weekly studies are tracking higher and suggest room further extend strong gains from the .5710 low of last week. Higher will see continuation to .5950 congestion then the .6000 figure. Meanwhile, support is raised to the .5900 level. Below this will delay bulls and see room for consolidation to strong support at the .5853/31 December highs.

It is clear that Trump is doing everything he can to seize attention for the mid terms. From Venezuela to Cuba and Iran, he is trying to accomplish mission that hasn't been completed in the past century by taking down these "hostile, communist" countries and gain support from hawks. On the other hand, he is putting maximum pressure on trade partners, like South Korea, to make sure they are delivering results of negotiation, to show off for his voters that he got stuff done. All of this point towards Trump trying to consolidate his position, especially after Minnesota's shooting that is shaking the political environment, even with Republicans.

When Trump is seeking accomplishment, it is likely he will make some bold/aggressive decision. Such decision could turn the market upside down. The closest area to watch for is intervention in Iran and Cuba. Cuba would be strategically easier as ships has already been placed near the area before to capture Maduro. Iran, on the other hand, would be a bigger target as Tehran has long been considered an unstable factor.