FX Daily Strategy: N America, December 2nd

Eurozone CPI has minimal impact

JPY gains likely to require weaker equities and/or intervention despite BoJ rate hike expectations

AUD preferred to EUR in risk positive markets

GBP back to pre-Budget levels – decline still expected longer term

Eurozone CPI has minimal impact

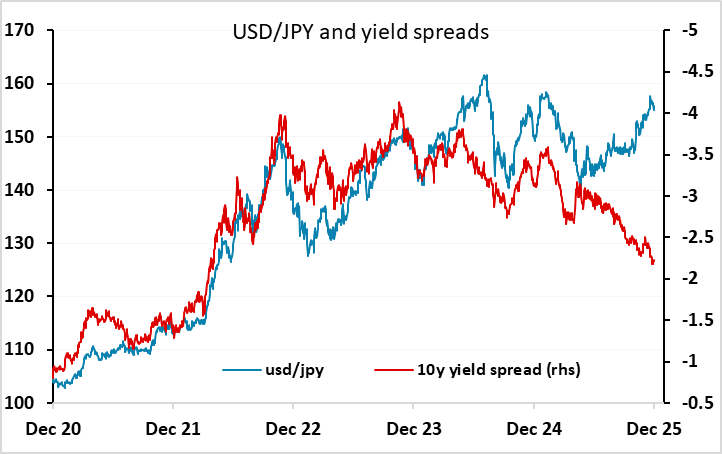

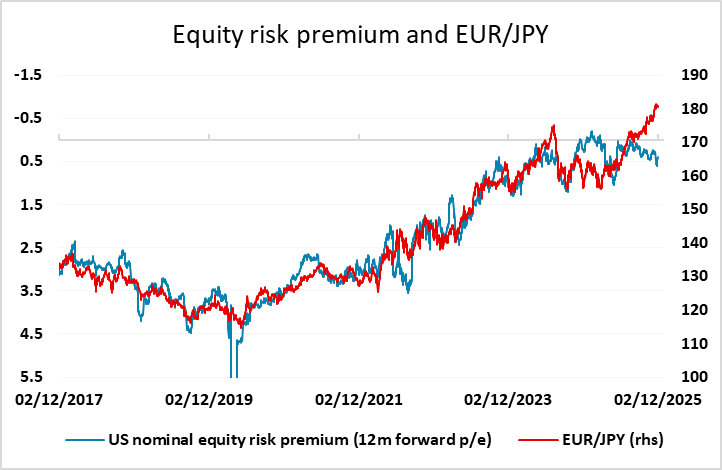

JPY gains likely to require weaker equities and/or intervention despite BoJ rate hike expectations

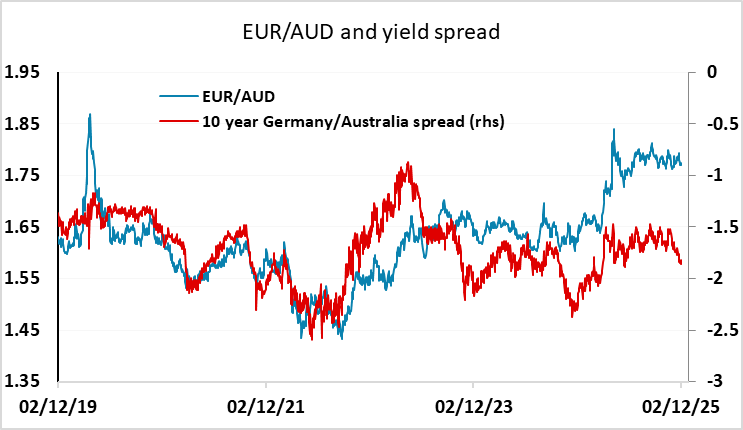

AUD preferred to EUR in risk positive markets

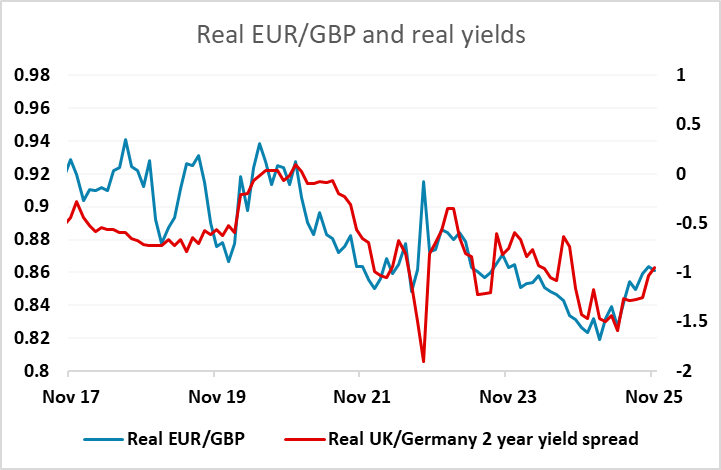

GBP back to pre-Budget levels – decline still expected longer term

The calendar is quiet on Tuesday. Preliminary November Eurozone CPI didn't surprise as the French, German and Spanish CPI data was already released last week. The headline was slightly above consensus at 2.2%, but core was in line at 2.4%. The equity market still looks likely to provide the main source of volatility. Monday saw JPY strength as equities slipped a little lower, and it does look hard for the S&P 500 to move much higher from here without news, with the all time highs above 6900 well within reach. But the JPY has reversed Monday's gains already. The FOMC decision next week on December 10th still looks like the most likely trigger for the next significant volatility.

JPY strength on Monday was partly due to weaker equities, partly to rising JGB yields after a speech from BoJ governor Ueda that some saw as indicating a higher chance of tightening in December. In reality, Ueda didn’t say much new, but yields did move higher. However, it has been the case for 6 months that yield spreads have been moving in the JPY’s favour, but USD/JPY has been moving in the opposite direction. So higher yields on their own may not be enough to boost the JPY. For a period it did appear that JPY weakness, particularly on the crosses, was related to the declining equity risk premium, but that relationship has also broken down since the start of the Takaichi premiership. It is therefore unclear what will be enough to turn the JPY. We still suspect a round of FX intervention may well be necessary, but this won’t happen unless we see the JPY move below the November lows.

Other than the JPY the FX markets were mostly quiet on Monday, although the EUR did show a mild positive tone. We still don’t see a strong rationale for EUR gains, as the EUR has outperformed yield spreads this year while the JPY and AUD have been dramatically underperforming. There should be a lot more value in the AUD in risk positive markets, and a lot more value in the JPY if sentiment turns risk negative.

GBP has broadly returned to pre-Budget levels after a modest post-Budget rally. While the Budget itself did little to encourage GBP bulls, the forecasts underlying it suggested that the UK fiscal position is less immediately concerning than was previously thought. This seems to have taken away a little of the risk premium from both GBP and gilts. But we would still expect a BoE rate cut in December and gradual convergence in real rates with the Eurozone in the coming years, so we still favour the EUR/GBP upside, albeit at a slow pace.