FX Daily Strategy: APAC, Sep 10th

US PPI a focus after sharp gain in July

USD will likely be more sensitive to stronger data

NOK/SEK may have potential to extend gains

JPY still has most potential to make gains against the USD

US PPI a focus after sharp gain in July

USD will likely be more sensitive to stronger data

NOK/SEK may have potential to extend gains

JPY still has most potential to make gains against the USD

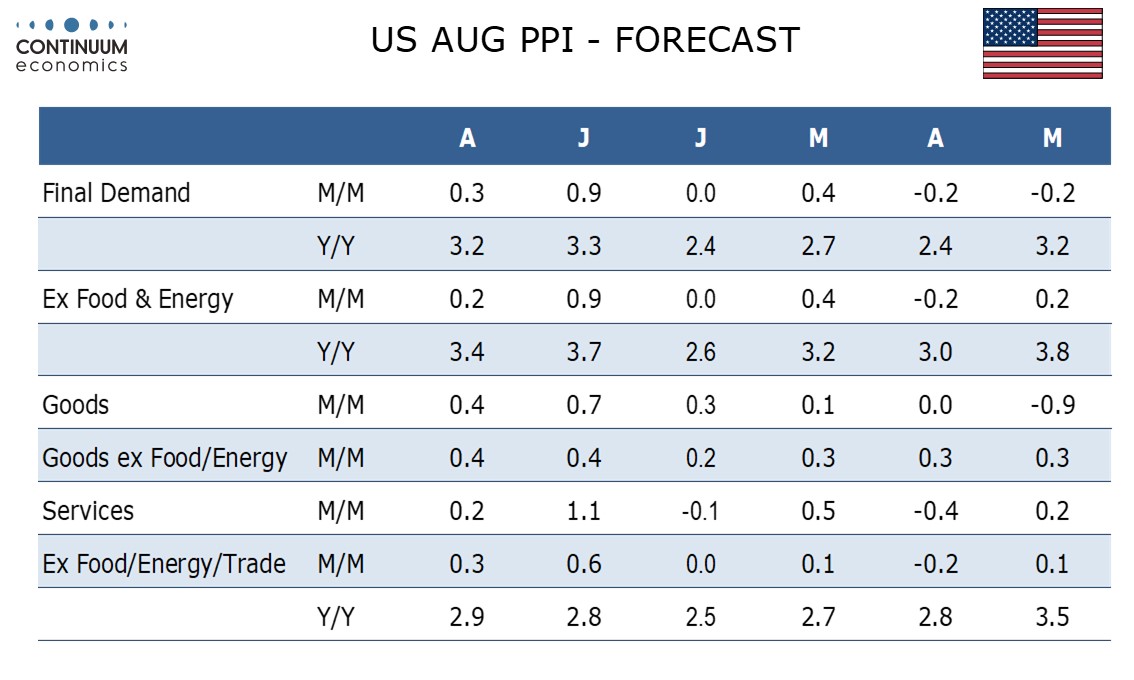

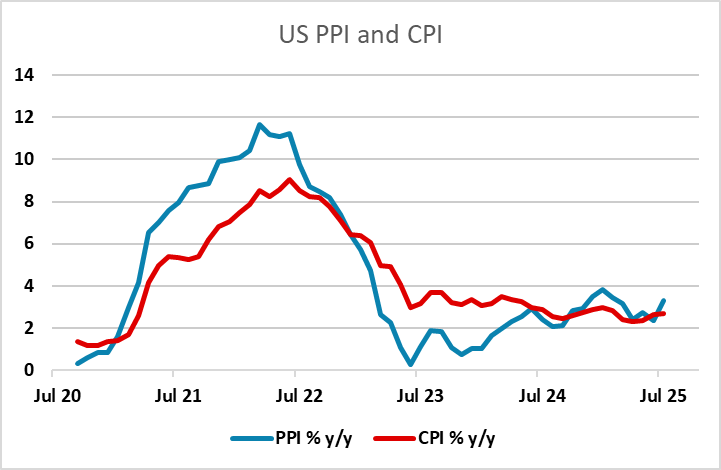

Wednesday sees US PPI data for August. The CPI data on Thursday is the main data focus of the week, and the PPI will be seen as a potential lead, although this is not always the case. We expect August PPI to rise by 0.3% overall and 0.2% ex food and energy, moderate gains after shocking surges of 0.9% in each series in July, which broke a string of mostly subdued outcomes from February through June. Ex food, energy and trade, we expect a 0.3% increase to follow a 0.6% rise in July. We expect goods ex food and energy to rise by 0.4% for the second straight month, continuing to accelerate as tariffs feed through. Trend in the first half of the year was 0.3% per month while trend in the second half of 2024 was on the low side of 0.2% per month. We expect overall goods prices to also rise by 0.4%, though we expect both food and energy to be slightly firmer at 0.5%. This wont necessarily provide much of a lead on CPI, but a stronger number would likely be seen as more significant after the 0.9% gain in July.

For the USD, it isn’t clear whether stronger or weaker numbers would be seen as better. Typically in recent years higher inflation data has been seen as positive for the currency because of the implication of tighter Fed policy, but if the rise in inflation is seen to be causing a slowdown and a rise in unemployment, the implications are less clear. The Fed may currently be more sensitive to growth weakness as a result of tariff increases than to price rises. Nevertheless, initially at least we would expect any strength in the data to be USD positive, although it might not last. Our forecast is in line with the consensus.

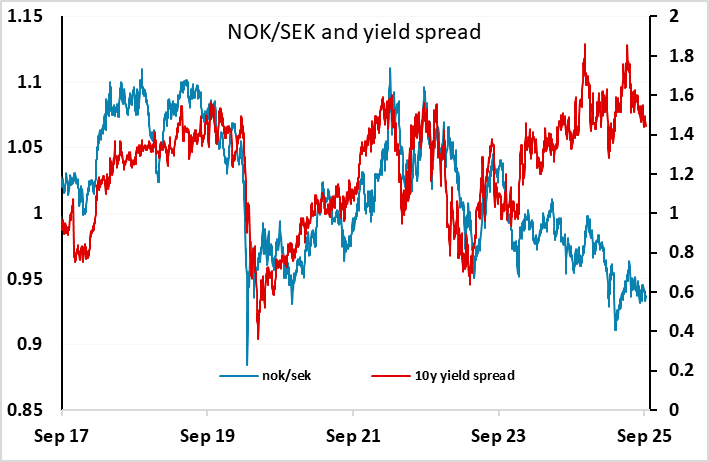

In Europe we have some data from Scandinavia, with Norwegian CPI and GDP and confidence numbers from Sweden. The NOK has been outperforming the SEK for the last couple of days after a brief test of the key 0.93 level in NOK/SEK at the end of last week. This continues to look like a key support area, and any strength in Norwegian CPI and/or weakness in Swedish GDP would suggest scope for further NOK gains. Given the huge SEK outperformance over the last year, it would take a lot to break below 0.93, so we see most of the risks on the upside for NOK/SEK.

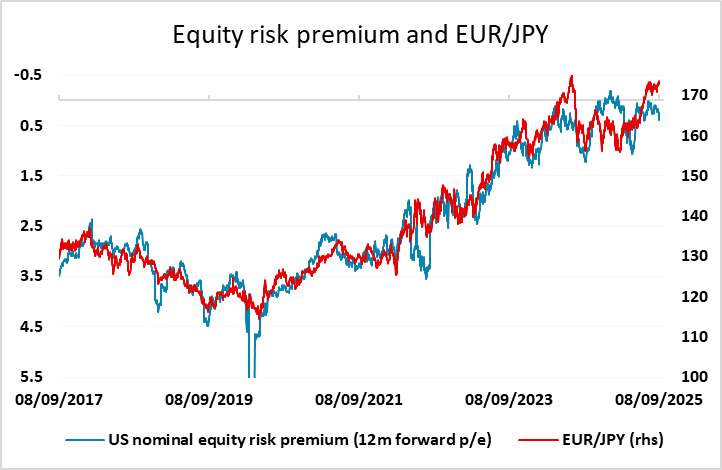

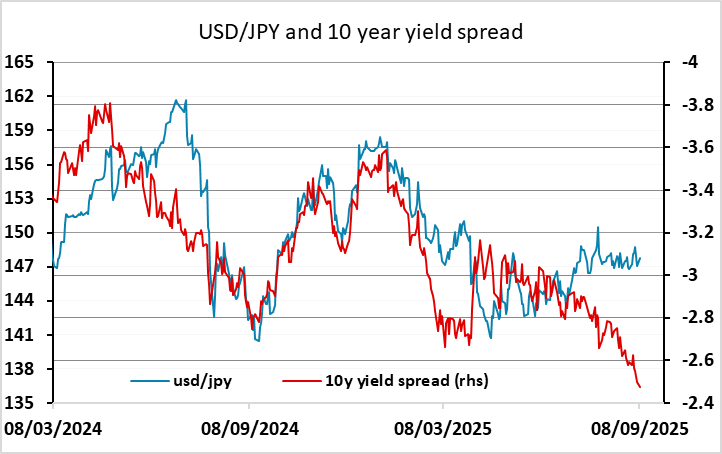

The USD started Tuesday on the back foot, particularly against the JPY, but managed a modest recovery in US hours, shying away from testing the year’s highs in EUR/USD and AUD/USD. We still see scope for substantial JPY gains, but the case for EUR gains remains harder to make given the EUR’s outperformance over the year so far.