FX Daily Strategy: N America, January 18th

AUD needed strong employment data to halt its decline and was left empty handed

Philly Fed takes on greater importance after weak Empire survey

USD strength against the JPY will be hard to extend from here

CHF/JPY remains the most obviously overvalued pair

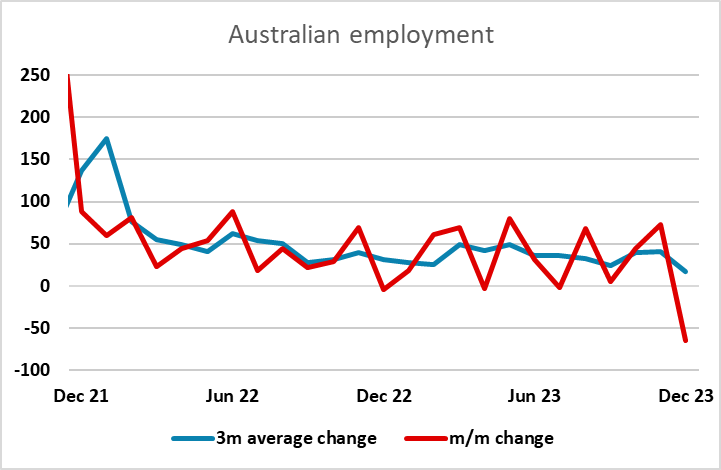

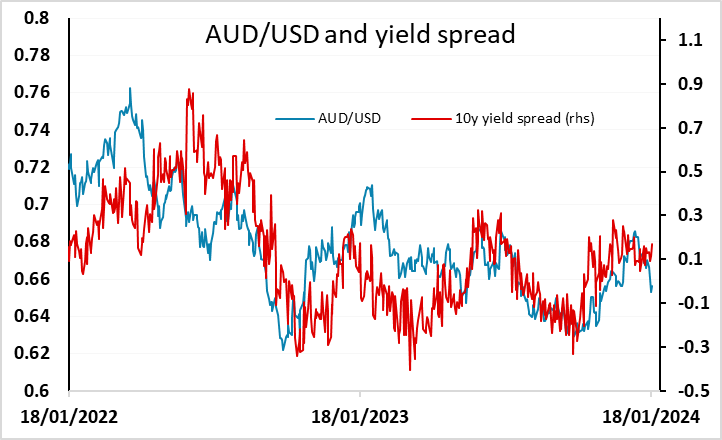

AUD needed strong employment data to halt its decline and was left empty handed

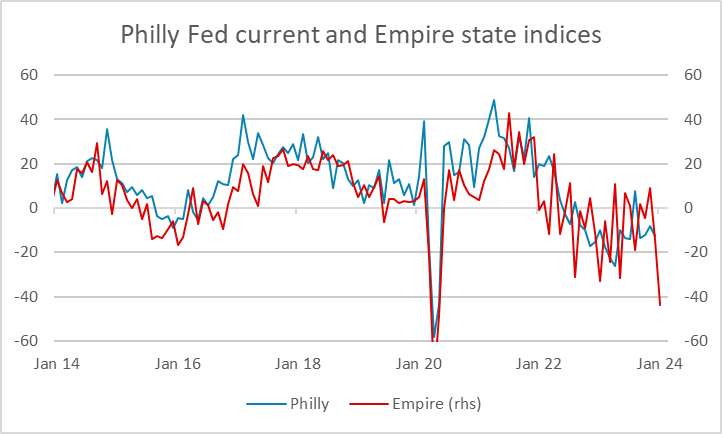

Philly Fed takes on greater importance after weak Empire survey

USD strength against the JPY will be hard to extend from here

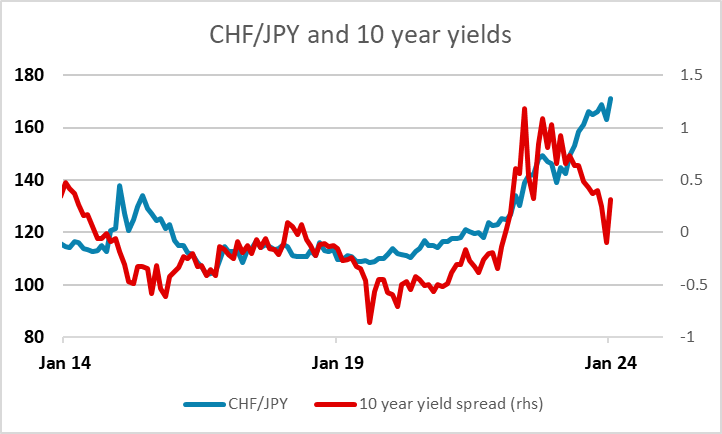

CHF/JPY remains the most obviously overvalued pair

Thursday started with Australian employment data, and the AUD was in need of some support after a week of losses due to rising US yields and declining Chinese equities. Yield spreads are still at a level that would normally be attractive for the AUD at current levels, but a lot of downward momentum has built up so a positive event is likely to be necessary to halt the decline. The Australian Dec labor missed estimate badly at -65.1K with expectation of +17.6K and unemployment rate at 3.9%. The participation rate also fell from 67.2% to 66.8%. The December report more than neutralized November's strength but should not be used to determine a significant weakening in the Australian labor market as one single month is not comprehensive enough. The the knee-jerk slump in the Aussie was cushioned by a soft USD through the session, so the AUD actually finished higehr in Asia, but after the weak employment numbers, and more losses in Chinese equities, it's hard to see a sustained recovery.

In the US, there are the usual Thursday jobless claims numbers, but also the Philadelphia Fed survey, which takes on slightly greater significance after the weakness in the Empire manufacturing survey reported earlier this week. It’s likely that the decline in the Empire survey was erratic, but if we saw similar weakness in the Philly Fed survey, it should be enough to curb the market’s enthusiasm for the USD.

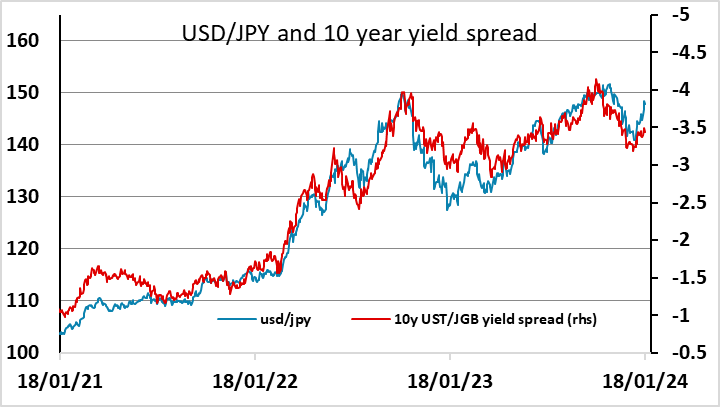

USD strength this week, particularly against the JPY, has been built on higher US yields, with the rise in yields being helped by the strong retail sales data on Wednesday. Even so, USD/JPY looks some way above the level that would be expected based on the recent correlation with yield spreads, and the US data hasn’t been so strong that it justifies further significant yield rises. USD/JPY should find gains more difficult to achieve above 148, with technical retracement levels having been achieved.

The USD has seen general strength this week, but the JPY and the AUD have been under the most pressure. The JPY has tended to be the most directly sensitive to rising yields, as European yields have risen with the US and JGB yields have been subdued due to soft price and wage data. The AUD has suffered from the negative risk implications of rising US yields as well as concerns around China. While European currencies have also weakened, notably the scandis, GBP, EUR and CHF have been relatively resilient. CHF/JPY hit a new all time high on Wednesday, and remains the most obviously overvalued cross, with little yield spread advantage to justify CHF strength, and no more SNB buying of CHF to support the currency.