Published: 2024-11-05T17:09:43.000Z

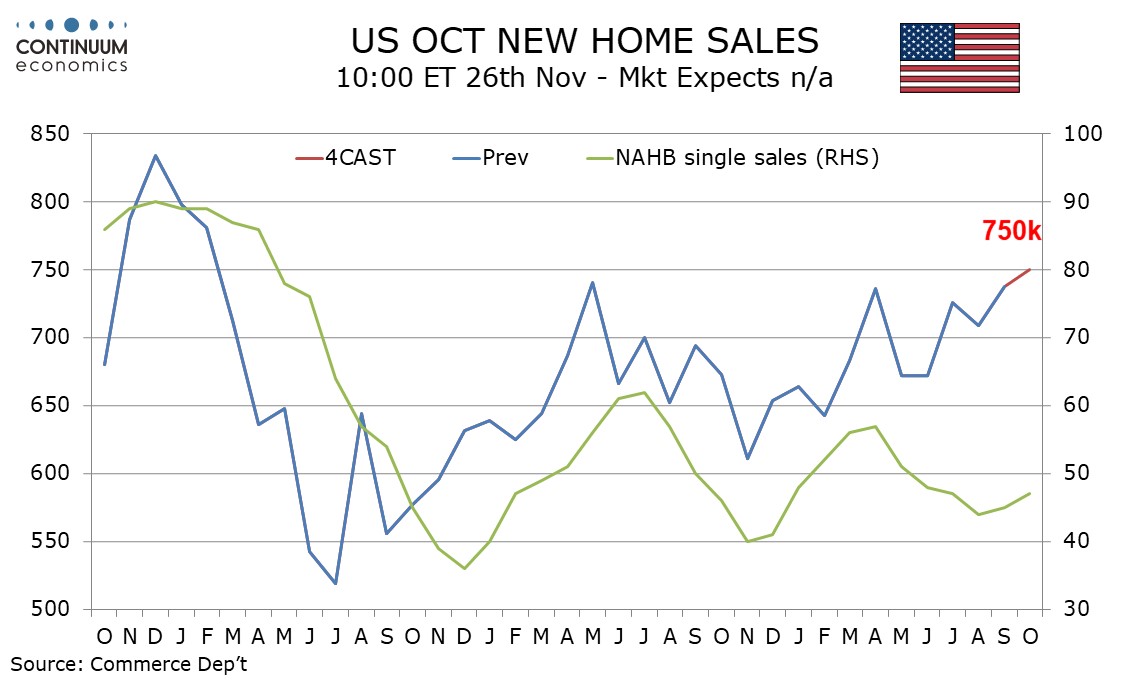

Preview: Due November 26 - U.S. October New Home Sales - To reach highest level since February 2022

2

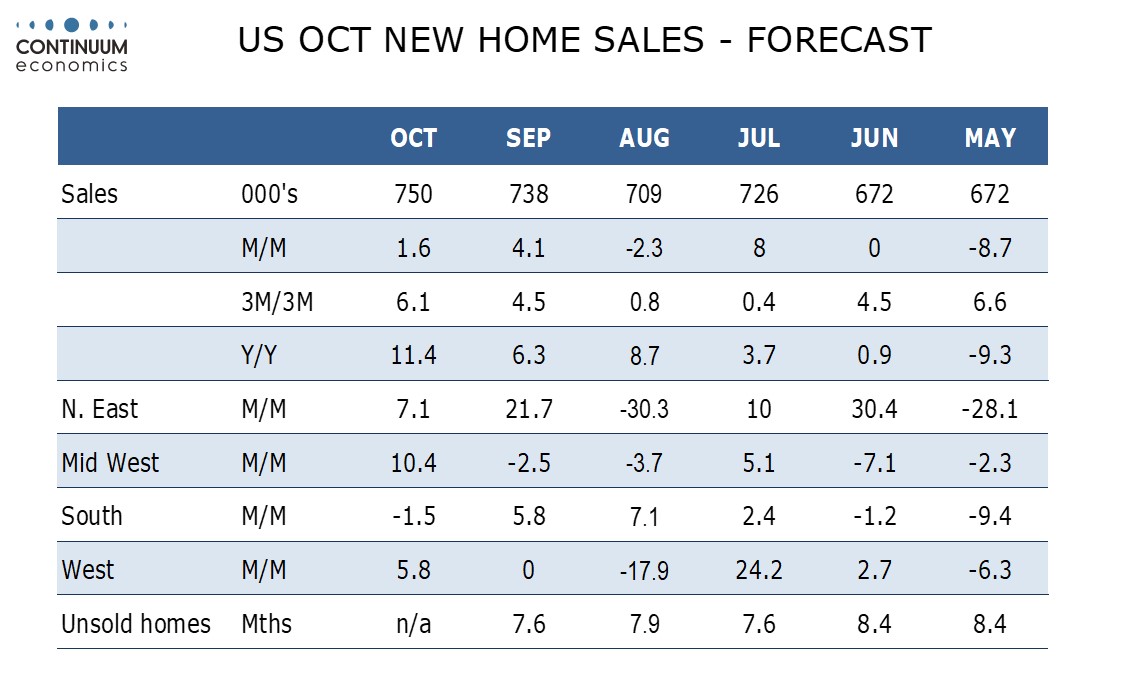

We expect an October new home sales level of 750k, which would be a 1.6% increase if September’s 4.1% increase to 738k is unrevised. This would maintain an improving trend and take the level to the highest since February 2022.

The NAHB homebuilders’ index improved in October but recent gains in new home sales have gone beyond what NAHB data had been implying, suggesting improvements in supply as well as demand. We expect gains in three of the four regions in October, the exception being the South where recent hurricanes may provide some temporary restraint.

We expect monthly declines in prices of 1.0% in both the median and average after increases seen in September. This would however give a boost to yr/yr data, with the median rising to 1.1% from unchanged and the average less negative at -0.6% from -2.7%.