FX Daily Strategy: N America, January 17th

AUD disappointed by Chinese data

USD gains look a little overdone

GBP has only modest scope for gains on stronger CPI

AUD disappointed by Chinese data

USD gains look a little overdone

GBP has only modest scope for gains on stronger CPI

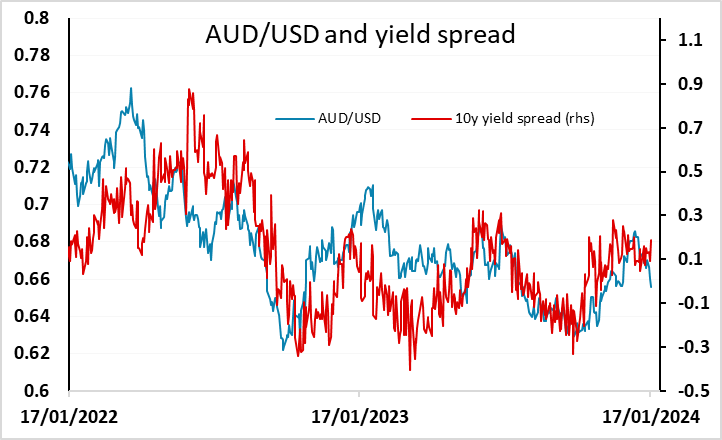

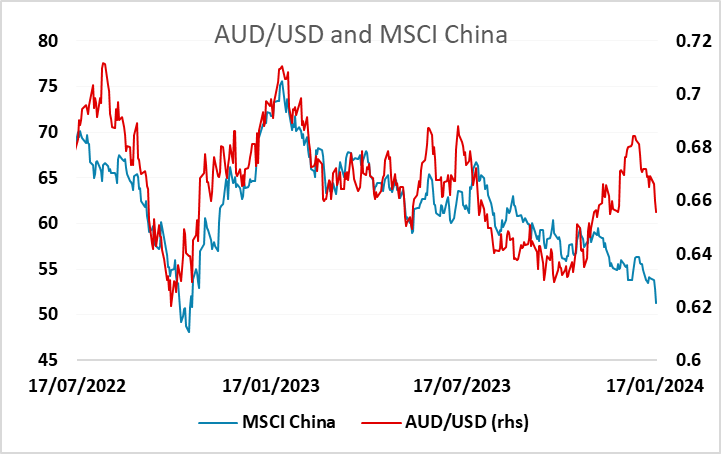

First up on Wednesday was the Chinese Q4 retail sales, industrial production and GDP data, which set the tone for risk sentiment. Soft Chinese data, notably CPI, has been slightly negative for global risk sentiment this year, with the AUD in particular struggling as a result. The AUD/USD dip below 0.66 on Wednesday took it to its lowest in more than a month, but it remains well above the level consistent with the correlation with Chinese equities that held for much of the last couple of years. China Q4 GDP came in slightly lower than 5.3% estimate at 5.2% despite improving from 4.9% in Q3, it shows a 1.0% q/q improve which meets estimate. Overall, it meets thew Chinese government goal of 5% growth but is not the bright economic data market looking for. The other Chinese activity data showed a mixed picture which is in line with the ongoing scenario in China. Regional equities are subsequent lower on downbeat Chinese growth sentiment, giving the Aussie little support, and the AUD has slipped to another new lows for the year.

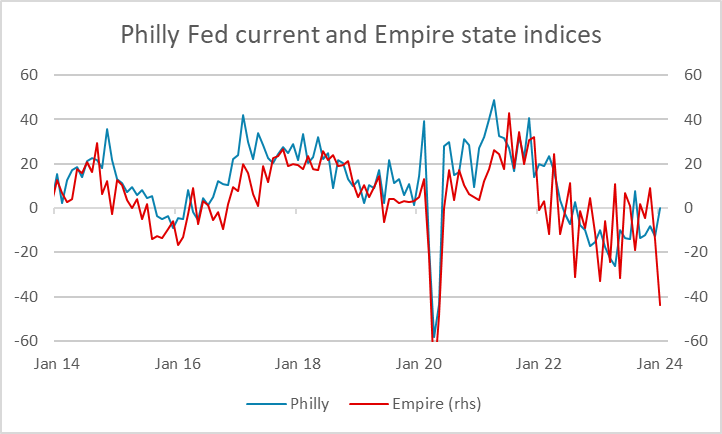

US retail sales is the main US data on Wednesday. We expect a 0.4% rise in December retail sales, with gains of 0.3% both ex autos and ex autos and gasoline. The data will show that consumers still have some momentum, though Q4 will be slower than the strong Q3. Our forecast is marginally stronger than consensus, but probably wouldn’t have any noticeable market impact. USD strength persisted through Tuesday trading in spite of a very weak Empire manufacturing survey. This is a choppy series but the survey was the weakest since the pandemic. Nevertheless, it didn’t prevent a strong rise in US yields and a consequent rise in the USD. USD strength looks overdone given this sort of data, but the rise in yields may to some extent be reversing the decline after PPI last week, which looked overdone and may have been long weekend related. For now, it’s hard to oppose the USD’s strength, but we would see USD/JPY in particular as being too high here relative to yields.

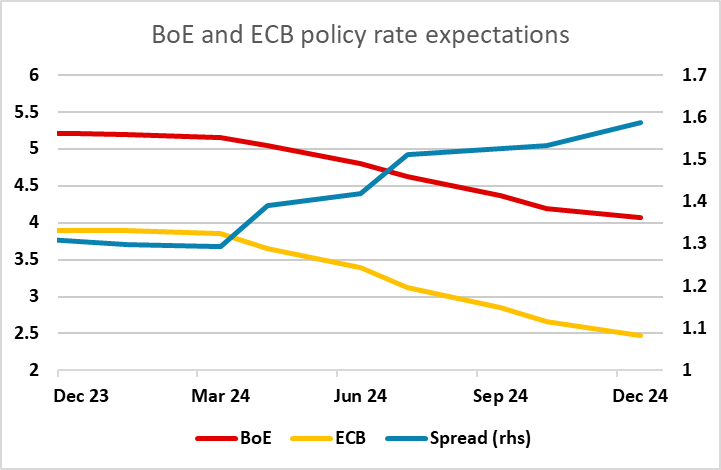

GBP has made modest gains on the stronger than expected UK CPI data. All the main indices were slightly above expectations, but y/y core CPI was unchanged from November at 5.1% and headline up only 0.1% to 4.0% y/y. Although it’s the first rise in the y/y rate since February, inflaiton remains below the BoE projection in the November MPR, and these numbers shouldn;t have much impact on BoE thinking. Seasonally adjusted CPI gains remain on track to take inflation back to target.

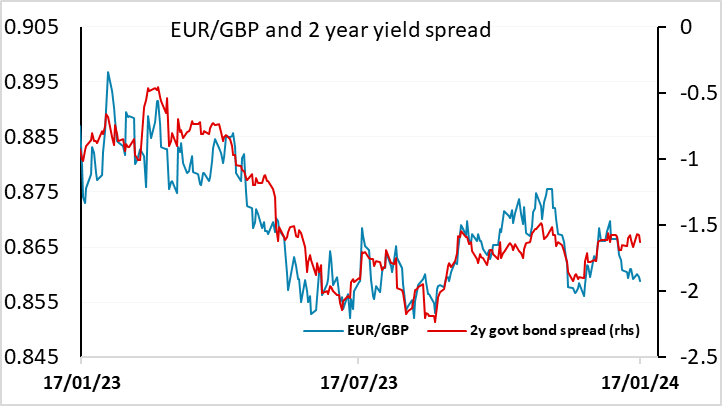

While UK yields have risen on the data, there isn’t a lot of scope for UK short term yields to rise, as the UK money market already discounts much less easing than we see in the US and Eurozone curves. And EUR/GBP is already trading some way below the level that would be expected based on the correlation with short term yield spreads that has guided it through most of the last year. So while we are likely to see a little progress below 0.86 in the aftermath of the data, we doubt that 0.8550 will be threatened.