FX Daily Strategy: APAC, November 14th

USD strength still the theme

Mild downside USD risk on PPI

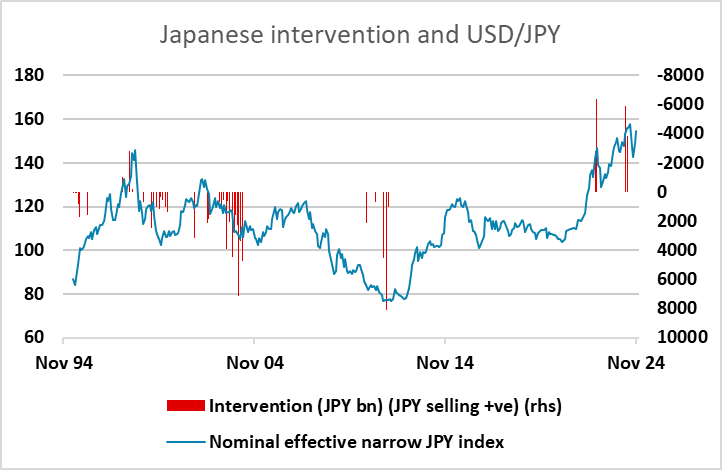

JPY weakness getting to near intervention levels

AUD should outperform EUR

USD strength still the theme

Mild downside USD risk on PPI

JPY weakness getting to near intervention levels

AUD should outperform EUR

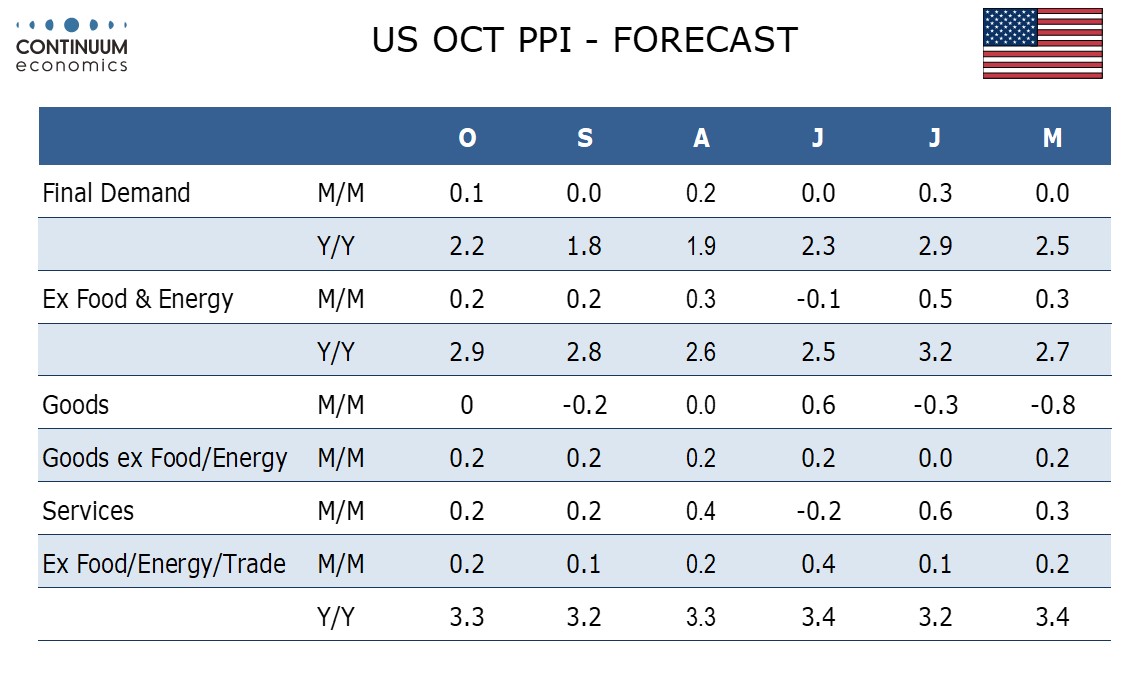

There is nothing of any great import on Thursday’s calendar. US PPI data has the most potential to move markets, but with CPI having come in in line with consensus on Wednesday, it’s unlikely PPI will change market expectations of Fed policy. For what it’s worth, we expect October PPI to maintain a subdued profile, rising by 0.1% overall and by 0.2% in both core rates, ex food and energy and ex food, energy and trade. This would be in line with recent trend but slower than seen in the first half of the year. This is below market consensus of 0.2% and 0.3% respectively, so may serve to curb the USD strength seen since the election.

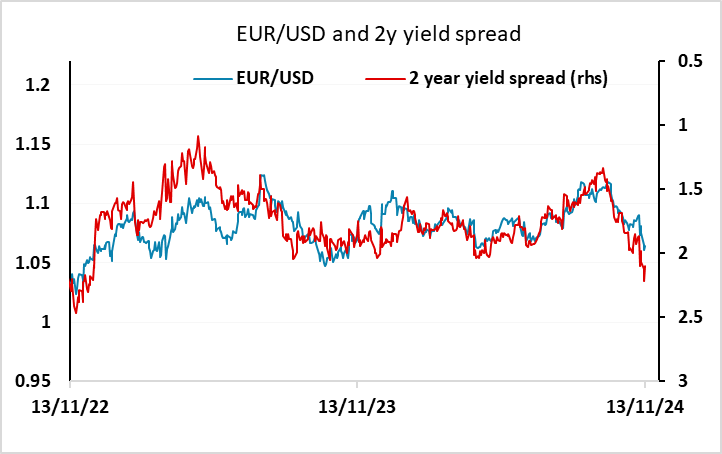

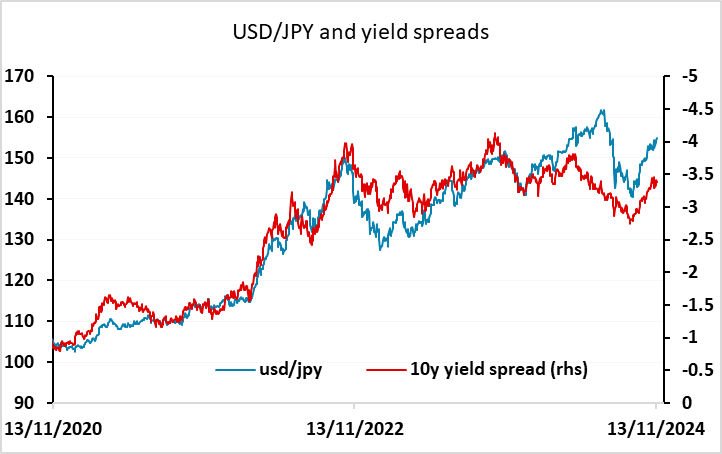

We did see some profit-taking on USD long positions after CPI on Wednesday, but this proved short-lived with the USD moving to new highs after a brief correction. Even so, we are getting to levels that look dangerous in USD/JPY, with verbal intervention being heard from the ex-currency chief Kanda on Wednesday. Intervention was seen close to these levels back in April and May. Yield spreads are also less clearly supportive of USD/JPY strength than EUR/USD weakness.

However, for the JPY to outperform we typically need to see a rise in US equity risk premia. i.e. either a decline in US yields which doesn’t lead to higher equities or a decline in equities without a rise in yields. As it stands, we are at the lowest equity risk premia since the early 2000s, with the nominal risk premium turning negative for the first time since then on Tuesday. This is unsustainable, as it suggests outperforming growth over a sustained period, and this is unrealistic starting from close to full employment with a large budget deficit.

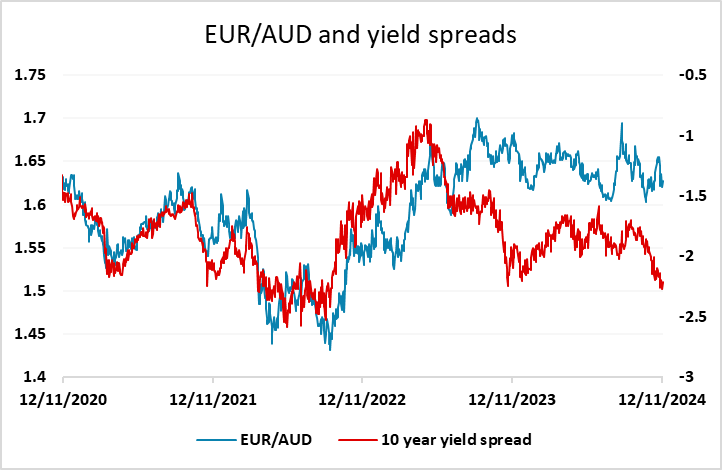

The USD is driving everything at the moment, with precious little independent movement in crosses. AUD/USD dipped below 0.65 on Wednesday, its lowest since August, and was the weakest performer on the day. Higher US yields are putting upside pressure on the USD across the board, but the AUD is one of the few currencies with similar yield attraction and would normally benefit in an equity positive environment. However, concerns about the impact of a big tariff increase on Chinese goods may be undermining sentiment. Even so, from a yield spread perspective, AUD looks more attractive than the EUR here.