FX Daily Strategy: N America, November 21st

Weaker PMIs put downward pressure on the EUR and GBP

GBP risks already on the downside on retail sales

JPY recovering but gains still corrective

Weaker PMIs put downward pressure on the EUR and GBP

GBP risks already on the downside on retail sales

JPY recovering but gains still corrective

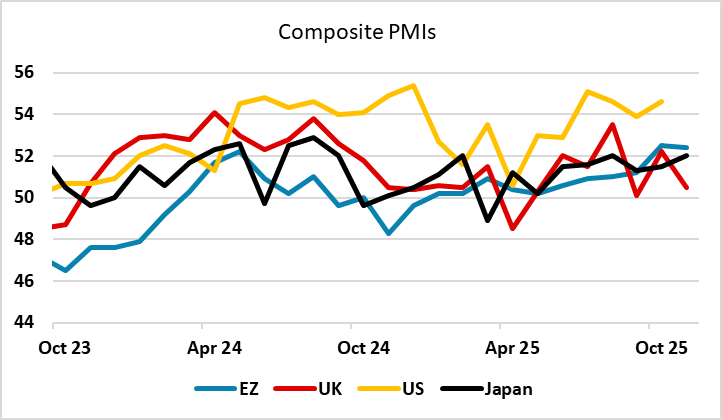

European PMIs were on the soft side, although the services sector in the Eurozone held up better than expected with a recovery in France. The UK numbers were more clearly on the weak side, but have less correlation with the official data. However, with the UK retail sales numbers also weaker than expected today, they should help maintain downward pressure on GBP. EUR/GBP has only edged higher, but risks must now be towards a test of the highs of the year at 0.8865. GBP/USD and GBP/JPY may be even more vulnerable, given the risk negative tone.

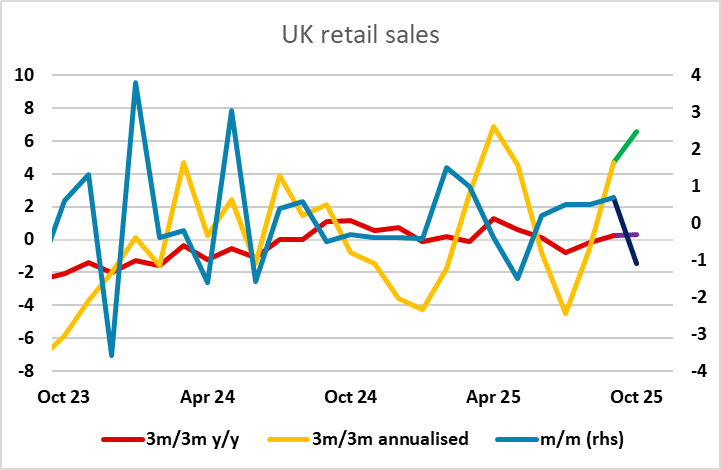

UK October retail sales came in much weaker than expected, falling 1.1% m/m. However, this follows a stronger summer, and the 3m/3m trend remains quite strong, although there have been some revisions that means the y/y rate of growth is now little better than flat. EUR/GBP spiked higher in response, but has settled back to trade close to the opening level at 0.8820. Retail sales numbers are unlikely to have a huge impact on BoE thinking, but with the last vote being 5-4, softer numbers will help convince the necessary one member of the committee (probably governor Bailey) to switch their vote to a cut in December. But with a December cut already priced as an 83% chance, there is limited scope for GBP to weaken much further on the expectation of a rate cut.

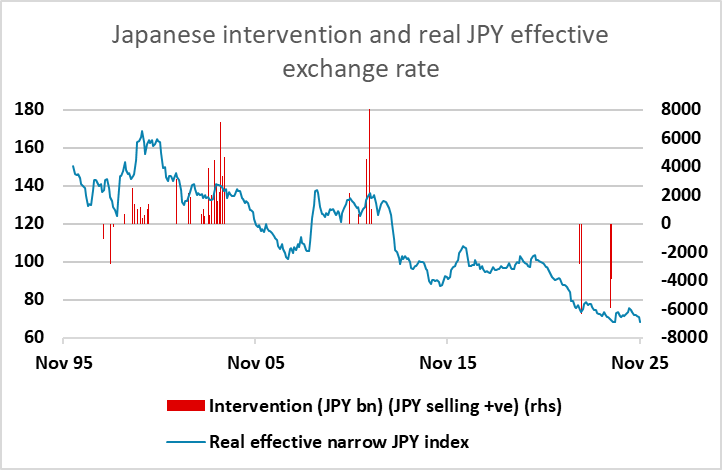

USD/JPY is correcting lower this morning, but at this stage the moves are very much corrective, rather than suggestive of a change in trend. There is scope to test the 156 level just to correct the upward trend since the Katayama/Ueda meeting, and a break of 155 looks necessary to challenge the uptrend seen since the election of Takaichi which saw USD/JPY break above the 200 day moving average.

Finance Minister Katayama did ramp up the intervention danger overnight, specifically threatening to step in if moves were disorderly or excessive, but most don’t expect any action until or unless we see a break of the 158.87 USD/JPY high from January. However, there is little doubt that JPY weakness is already “excessive”, with the real trade-weighted index hitting an all time low on Thursday. The market is more focused on USD/JPY, but EUR/JPY has hit record highs as well as the real trade-weighted level hitting record lows, and history suggests the Japanese authorities do focus on the trade-weighted level as much as on the USD. So intervention could come a little earlier than most expect, but unless we see risk sentiment weaken more persistently, it does look likely to be necessary to turn the trend.