FX Weekly Strategy: Asia, January 20th-24th

Focus on Trump inauguration and any executive orders on tariffs

USD unlikely to benefit unless he goes ahead with tariffs on Canada and Mexico

GBP looks headed lower one way or another

JPY needs a BoJ rate hike to hold onto recent gains

Strategy for the week ahead

Focus on Trump inauguration and any executive orders on tariffs

USD unlikely to benefit unless he goes ahead with tariffs on Canada and Mexico

GBP looks headed lower one way or another

JPY needs a BoJ rate hike to hold onto recent gains

The main focus of the week will be the Trump inauguration and the executive orders that follow it. While many of these may relate to immigration, the markets will be most interested in any announcements on tariffs. Thus far, his statements have focused on Canada, Mexico, China and Denmark (!), and there is potential for some announcement on the first three of these this week. As it stands, the market is assuming that there won’t be immediate tariffs imposed on Canada and Mexico, with Trump preferring to use the threat as leverage rather than impose tariffs immediately.

In November Trump said he would impose a 25% tax on all products entering the country from Canada and Mexico, and an additional 10% tariff on goods from China, as one of his first executive orders, until those countries satisfactorily stop illegal immigration and the flow of illegal drugs such as fentanyl into the United States. But he subsequently posted on social media that he had spoken with Mexican President Claudia Sheinbaum and she had agreed to stop unauthorized migration across the border into the United States. It seems likely that the decision on Mexican and Canadian tariffs will be delayed, but if it was imposed, it would have a very significant impact on US prices, as these are the US’s second and third largest trading partners.

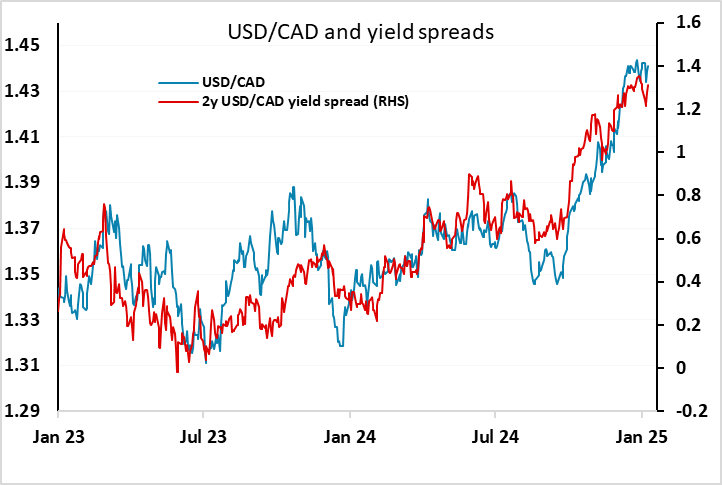

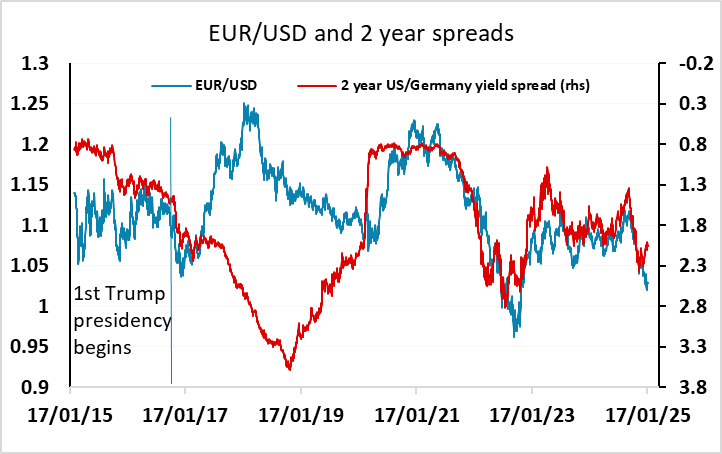

China is the US’s largest trading partner and there is more chance of immediate action here, but provided the increase is fairly modest, market reaction should not be particularly large. The imposition of tariffs in Trump’s first term was initially focused mostly on China, with some increases larger than 10%, so a 10% increase would probably not be seen as particularly significant. The FX impact was also not predictable. While most had expected tariff increases to lead to USD gains, the USD actually fell back sharply through most of 2017 and 2018 when the tariff wars were in progress, significantly underperforming relative to the normal yield spread relationships. As far as FX impact is concerned this time, any imposition of tariffs on Canada and Mexico could be expected to trigger an initial knee-jerk sell off in those currencies, and if the tariff increase was 25%, the reaction could be large (probably 2% or more). However, we don’t see this as the most likely outcome, and judging by Trump’s first term, the USD gains might not last. A modest 10% increase in China tariffs would likely have minimal initial impact, and it seems likely that if we see an extended trade war with retaliatory tariffs being imposed as in 2017/18, we may in the end see the USD weaken in response as it did then.

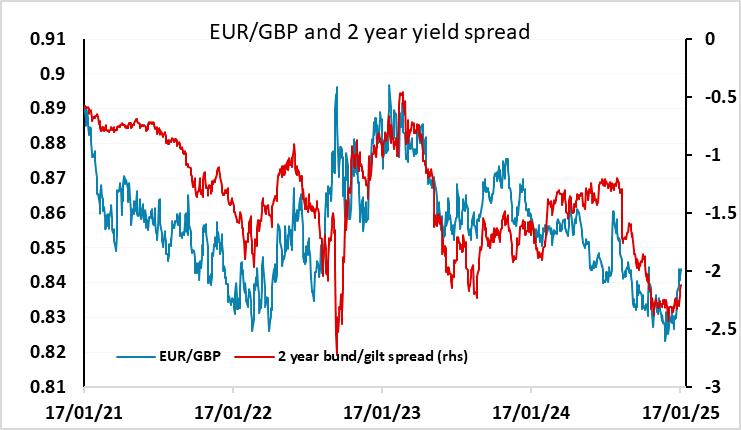

Elsewhere, GBP remains in focus after slipping back last week. The main part of GBP weakness was actually seen in conjunction with higher UK yields, while the decline in yields seen after the weaker CPI data saw the pound recover. While GBP did slip lower again after weaker than expected GDP and retail sales data for November and December respectively, it still held above the lows seen before the CPI data. This behaviour is unusual and reflects concern about the health of the UK economy in general and the fiscal situation in particular. Declines in GBP that go hand in hand with declines in gilts suggests some foreign selling of gilts and/or some concern that higher yields will undermine the scope for government spending, leading to weaker growth and putting further pressure on the public finances. We saw such behaviour before around the Budget last year and, more acutely, after the Truss Budget in 2022.

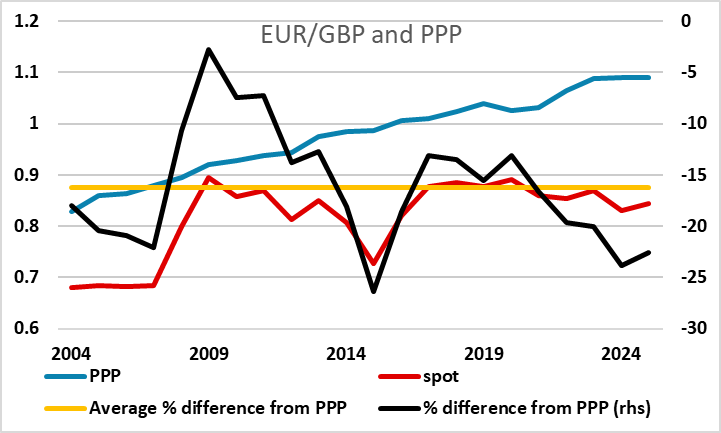

At this stage, the level of GBP remains quite high by historic standards, with weakness against the USD a reflection more of USD strength than GBP weakness, so there is still plenty of potential for GBP to decline from here. And while the recent GBP weakness has come with higher yields, the longer term correlations still suggest GBP declines are more likely to be seen if we see lower UK yields. There may still be some upward pressure on long term yields due to public finance concerns, but there is plenty of scope for short term UK yields to decline if the BoE see growth weakening and inflation under control. This latter condition is the limiting one, since despite the lower than expected December CPI data, there are still those on the MOC that are concerned about the underlying inflation trends, in particular related to strong UK age growth. Thus the labour market data this week will be important. Evidence of a decline in wage growth to go with the evidence of weakening in labour demand should lead to expectations of more BoE easing and more GBP weakness. But it’s hard to see much upside for GBP in any scenario, since if the inflation data don’t allow lower yields, the markets may once again start worrying about the combination of weak growth and high yields undermining public finances. We therefore look for EUR/GBP to head up to 0.85 and beyond, almost regardless of the data, although it would happen more healthily with softer wage inflation numbers.

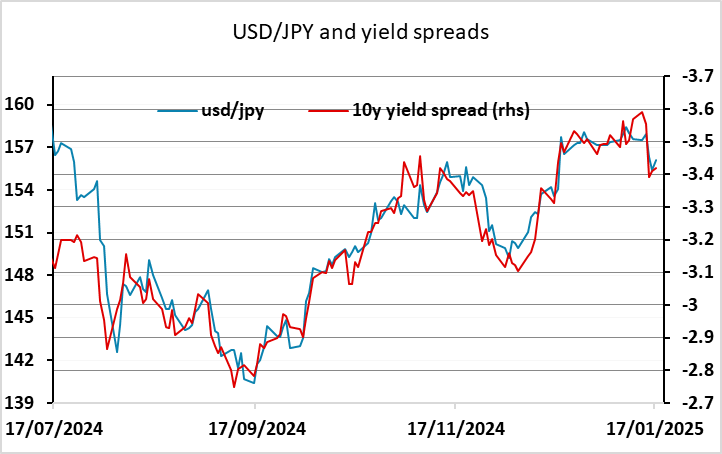

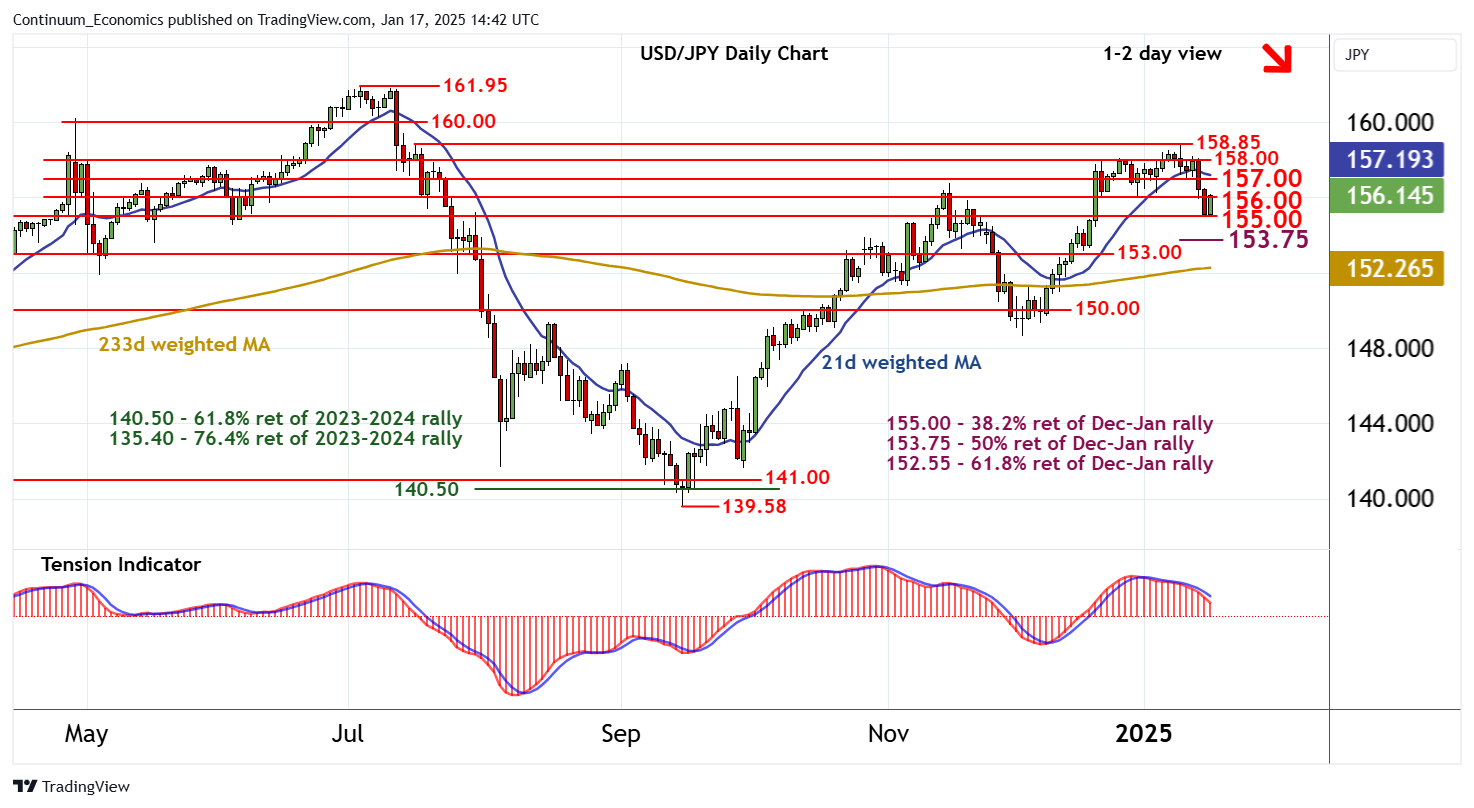

The other main event of the week should be the BoJ meeting on Friday. The market is now pricing in around an 80% chance of a 25bp rate hike form the BoJ, after some more hawkish comments from Ueda over the last week. We are a little less confident than the market, as the BoJ is clearly concerned to avoid a repeat of previous cycles when they have tightened too early and failed to break out of the deflationary spiral that has persisted since the 1990s. For the JPY, a rate hike looks necessary to sustain recent gains in the short term, but we remain positive about the JPY’s prospects in the longer term.

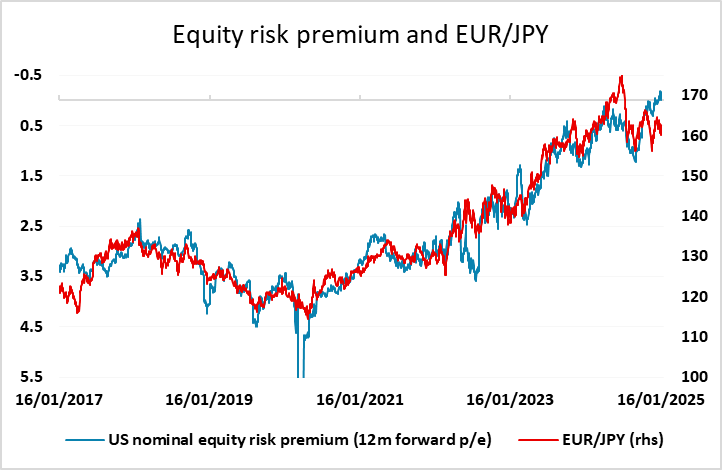

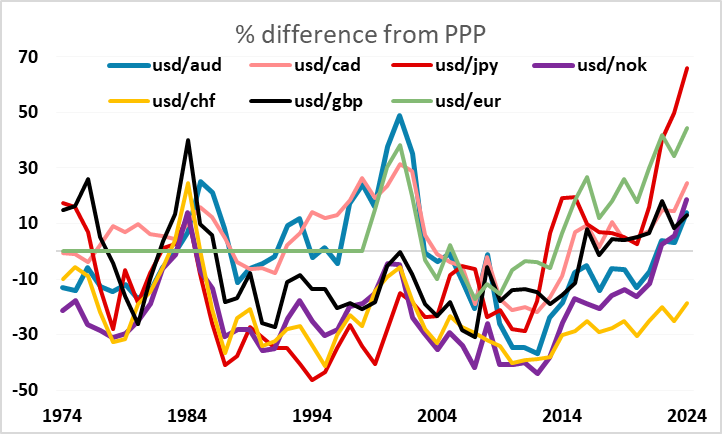

There is some evidence that the correlation with equity risk premia that has supported EUR/JPY in recent years is breaking down, and there is also some potential for the JPY’s undervaluation to lead to some support for a JPY revaluation from the Trump administration. This was suggested by ex-MoF official Yamasaki last week, and although there has been no statement from Trump on this, Trump’s preference for a weaker USD was clearly and often expressed in his first term. The JPY remains much the most undervalued of the G10 currencies from a long term perspective, and while the short term path continues to be driven by nominal yield spread moves, in the longer term a valuation correction is likely in order to correct the real decline in the JPY that has been seen due to relatively low Japanese inflation in recent years. While the focus will be on the BoJ this week, and a rate hike is needed to sustain recent JPY gains, it is still the case that most of the volatility in the US/Japan yield spread and consequently in USD/JPY tends to come from the US side. So Trump’s policies on tariffs, taxes and directly on FX will remain key.

Data and events for the week ahead

USA

The US is on holiday for Martin Luther King Day on Monday, but it is also the day of President Trump’s inauguration and markets will be watching his early policy announcements, with particular attention on his promise to impose tariffs on Canada, Mexico and China on day one. For the rest of the week the data calendar is quiet and Fed speakers will be too ahead of the January 29 rates decision.

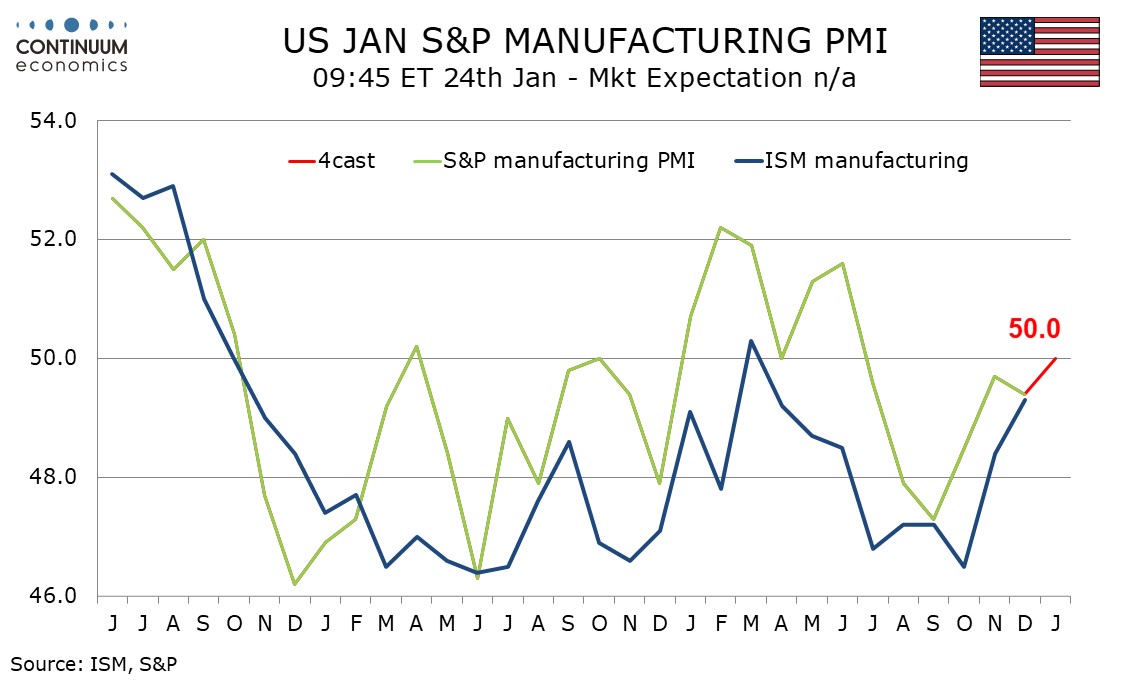

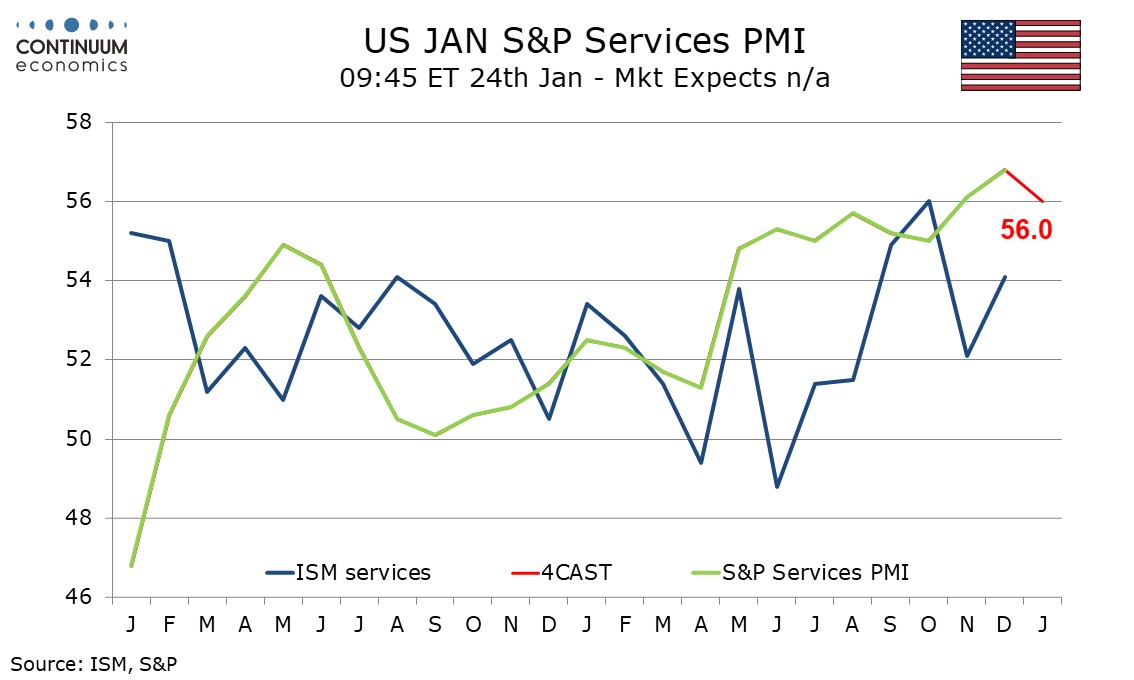

There is no significant data due on Tuesday or Wednesday, but Thursday sees weekly initial claims, which will cover the January non-farm payroll survey week and could be impacted by the Los Angeles fires. On Friday we expect the January S and P manufacturing PMI to rise to 50.0 from 49.4 but services to slip to 56.0 from 56.8. We also expect December existing home sales to rise by 3.6% to 4.30m. Final January Michigan CSI data is also due. The preliminary data was noted for higher inflation expectations, as a sharp rise for Democrats outweighed a sharp fall from Republicans.

Canada

Canadian focus will be on whether Trump imposes tariffs, though the Bank of Canada will also release its Q4 business Outlook Survey on Monday. On Tuesday we expect December CPI to see yr/yr growth slowing to 1.7% from 1.9%, largely because of a temporary sales tax holiday which started in mid-December. December’s IPPI and RMPI follow on Wednesday. Thursday sees November retail sales, for which a preliminary estimate of unchanged was given with October’s report.

UK

The MPC will probably be very much keen to see labor market figures (Tue) which may show more signs of job losses, alongside what may be mixed to higher hints regarding earnings. The data on payrolls is becoming ever more important, both given the repeated falls they have reported of late but also questioning the validity of the BoE’s interpretation of how tight the labor market actually is, as they suggest far fewer inactive workers than official ONS numbers. Friday sees PMI data which are already pointing to slumping business optimism – we see the headline edging down slightly, these coming just after GfK consumer confidence readings. Beforehand, come public borrowing numbers (Wed), the latter still likely to show borrowing in the first nine months of 2024-25 is running broadly in line with year-before, but above the monthly profile consistent with the OBR’s October forecast.

Eurozone

After consumer confidence data (likely to remain weak), the week ends with PMI data for December, and as with the UK, important not just to assess if the economy is slowing but also the extent to which price and cost pressures may be ebbing further. At 49.6, the December index was up from November’s 48.3, indicating a deterioration that was not only softer than the previous month, but just marginal overall, but still soft enough to worry the ECB, especially once construction weakness is considered too. We see little change for the January flash. Other business surveys are due, including those from the French INSEE (Thu). And there is wide array of ECB speakers next week, many from Davos, and led off by Lagarde on Wednesday and Friday.

Rest of Western Europe

There are some key events in Sweden, most notably labor market data on Friday. In Norway, the Norges Bank is expected to keep rates on hold. It has the choice of cutting rates, having flagged a move more likely at the meeting due in March, and could do this both to reflect weaker price pressures (especially excluding what are pro-cyclical rises in rents) and then signal to markets that the recent repricing of policy ahead and inter-related rise in bond yields is very much unjustified. But this would be inconsistent with the overly cautious Norges Bank Board which instead is fixated on the weaker currency despite the latter still seeing falling imported inflation. Thus, another (i.e. ninth successive) widely expected stable policy decision should be forthcoming in Thursday’s verdict so that the policy rate at 4.5% will then have been in place for over a year. But it is possible that the Board may be more vocal about the scale and timing of easing ahead, still very much in its plans, having to resort to rhetoric as new forecasts will not be published until March.

Japan

We have the national CPI next Friday but will likely be overshadowed by the BoJ interest rate decision on the same day. While the market is seeing a good chance of at least a 10bps hike, we remain cautious about that as the credibility of BoJ has dissipated from previous talks. The decision to hike has been well supported and thus we do not see a margin for hawkish surprise, rather a dovish one. There is also trade balance on Thursday.

Australia

A rather empty calendar with only PMIs on Friday.

NZ

Business PMI on Tueday and CPI on Wednesday. While the later will carry more weight, unless there is a huge beat, it will not derail the RBNZ’s plan of easing.

This week's recap

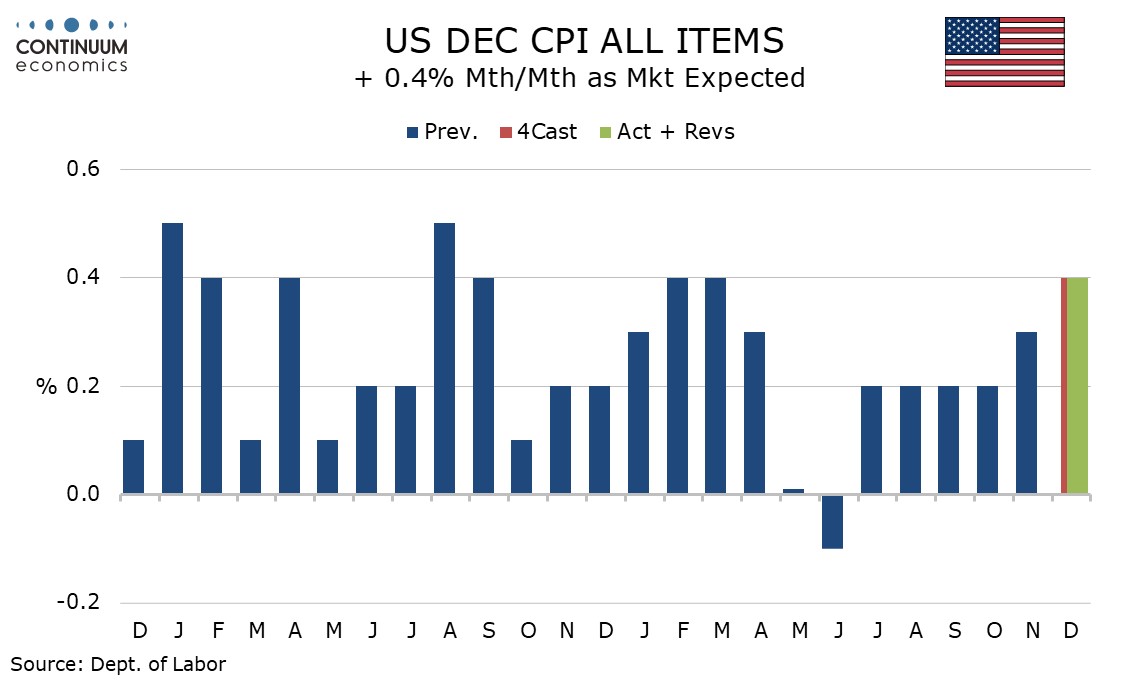

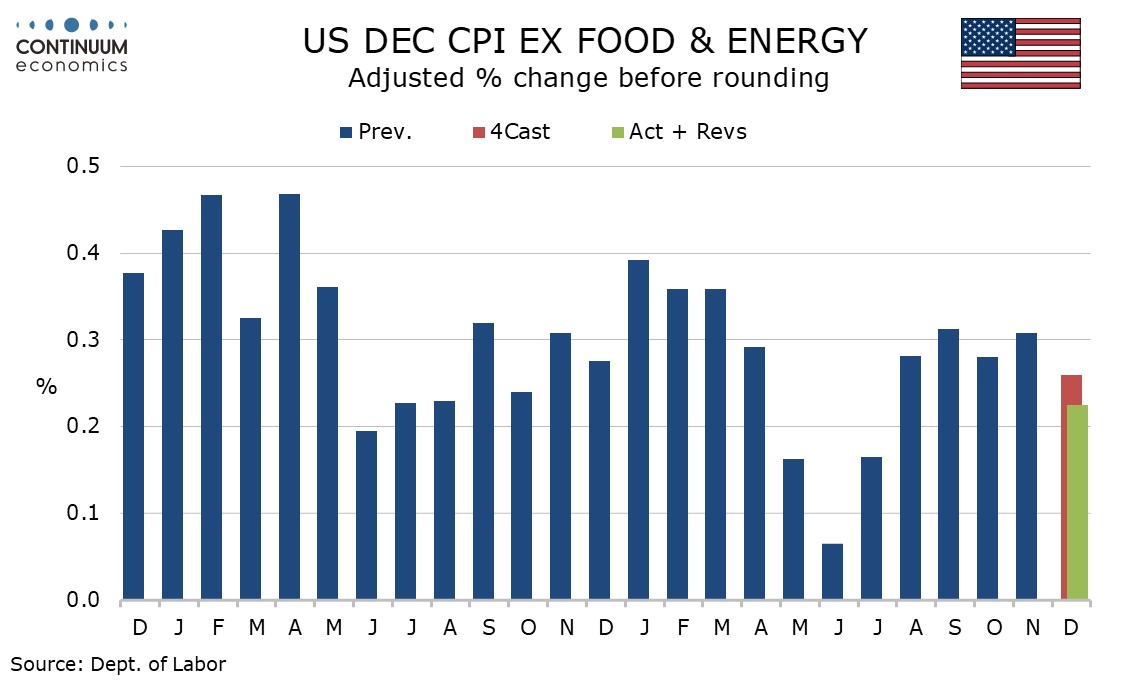

While December’s headline CPI is in line with expectations with a 0.4% increase, the core rate ex food and energy is subdued at 0.2% following four straight gains of 0.3%, and a downside surprise is quite comfortable with the gain before rounding being 0.225%. Price data did however pick up in January's Empire State survey.

Services less energy rose by 0.3% for a third straight month. Air fares saw a strong month with a rise of 3.9% but auto services have lost their previously strong momentum, with overall transport services up by 0.5%. Owners’ equivalent rent rose by 0.3% after a 0.2% November gain which corrected a 0.4% rise in October but housing was restrained by a 1.0% decline in lodging away from home. Yr/yr core CPI slipped to 3.2% after three straight months at 3.3%, but remains ahead of overall CPI, which at 2.9% from 2.7% saw a third straight acceleration from a recent low of 2.4% seen in September.

After four straight months of modest disappointment the December core CPI will be a modest comfort to the Fed but after the strong non-farm payroll is unlikely to put a January easing on the agenda. Early 2025 data will be crucial going forward. If the strength of early 2024 is not matched, yr/yr data will fall.

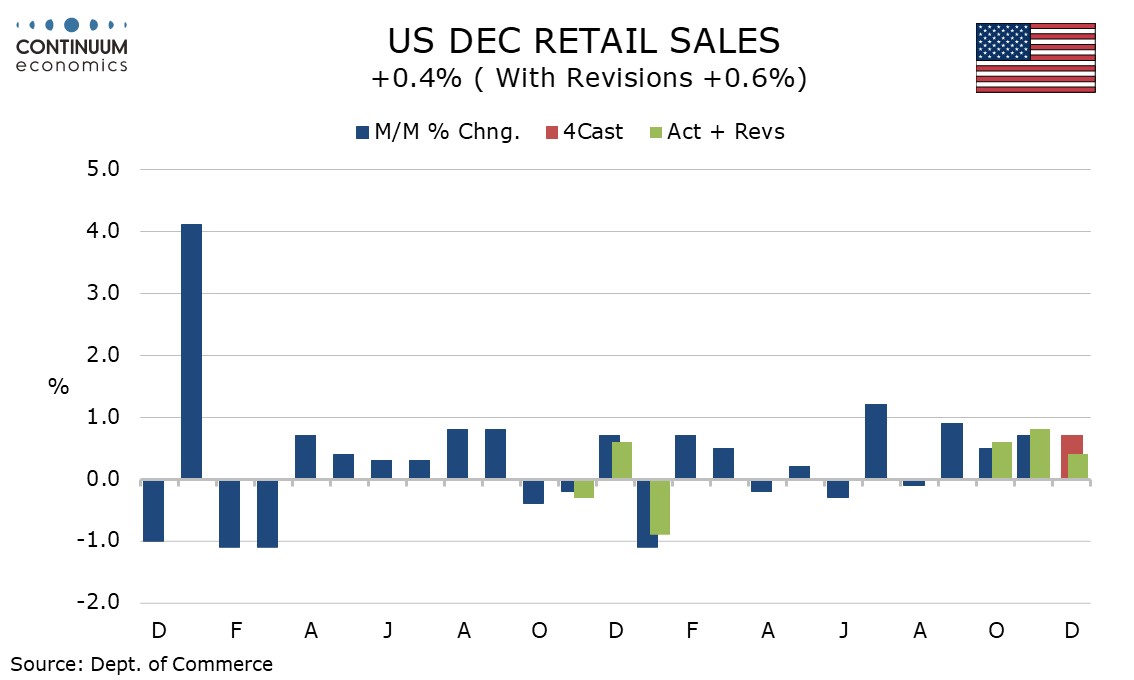

December retail sales with a 0.4% increase overall and ex auto, 0.3% ex autos and gasoline, are on the weak side of expectations but maintain respectable momentum, particularly in the control group which contributes to GDP, which rose by 0.7%. A strikingly strong January Philly Fed manufacturing index of 44.3, up from -10.9 in December, has also been released.

The main restraint on retail sales was building materials, where a 2.0% fall could be a hint that rising bond yields are starting to hit housing. Strength was seen in furniture, up by 2.3%,while clothing and gasoline each rose by 1.5%, the latter supported by prices. Food rebounded from a November decline with a rise of 0.8% but sales at eating and drinking places fell by 0.3%. Despite the modest disappointment in December, Q4 saw a strong rise of 1.8% (not annualized), the strongest since Q1 2023. Ex autos a 1.1% increase matched that of Q3 while ex autos and gasoline at 1.2%, while down from 1.5% in Q3, was still solid.

Market expectations on a January BoH hike ramped up this week as BoJ's Ueda releases supportive remarks. While he has been indifferent on his rhetoric, a slight change in wordings on wage growth has sparked speculation in the market. Not to mention the latest November headline wage reached 3% y/y. However, given the BoJ's record, one must be cautious in believing how hawkish they really are.

On the chart, consolidation is giving way to a fresh test higher, with prices currently pressuring congestion resistance at 156.00. Rising intraday studies highlight room for a test above here. But daily readings continue to track lower and overbought weekly stochastics are unwinding, highlighting potential for renewed selling interest towards further congestion around 157.00. Following cautious trade, fresh losses are looked for. A close below 155.00 will add weight to sentiment and extend January losses initially towards the 153.75 Fibonacci retracement.

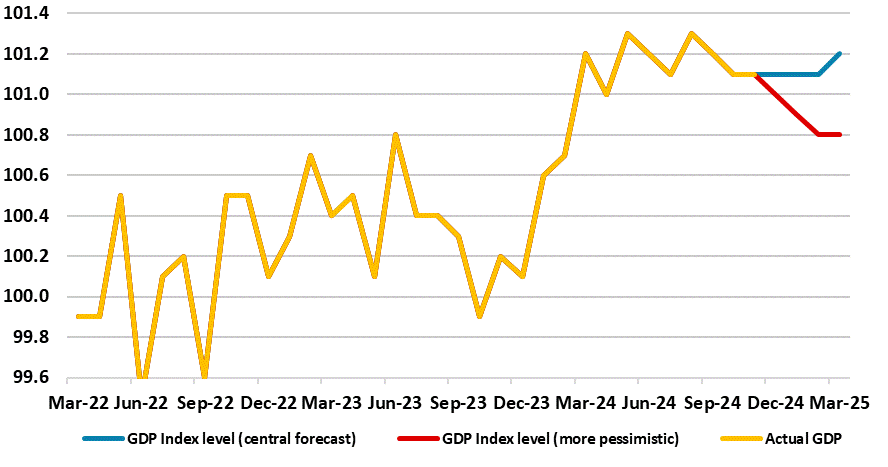

Figure : Momentum Ebbing – Amid Continued Downside Risks?

The latest set of GDP data add to already-growing questions about the UK’s economy’s apparent solidity, if not strength, as seen in sizeable q/q gains in the first two quarters of the year. As we envisaged, November saw a bare almost-0.1% m/m rise, this came after October saw a second successive m/m drop of 0.1%, all below expectations, this adding to what have now been only three positive outcomes in the last eight months of data a period in which the economy has ‘shrunk’ a cumulative 0.1%. This backdrop included evidence that the economy actually fell again in terms of private sector activity in November. Thus the 0.1% m/m rise for November must be seen in that weak and pared –back context and the likelihood remains that Q4 2024 may have seen a small q/q contraction, ie even weaker than the BoE’s recent downgrade to zero. With momentum into early 2025 also ebbing, it is clear that many on the MPC are concerned about activity weakness!

This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Although most evident in a further drop in manufacturing, the data do also suggest weaker services of late. While monthly real gross domestic product is estimated to have grown by 0.1% in November 2024 largely because of modest rebound in services in which the latter output grew by 0.1% in November 2024, after falling by 0.1% in October 2024 (revised down from no growth in our last release), but it showed no growth in the three months to November 2024. Otherwise, production output fell by 0.4% in November 2024, following an unrevised fall of 0.6% in October 2024; production fell by 0.7% in the three months to November 2024, driven by a decline in manufacturing. Construction output grew by 0.4% in November 2024, following a fall of 0.3% in October 2024 (revised up from a fall of 0.4% in our last release); construction also grew by 0.2% in the three months to November 2024. But the whole economy was boosted by the public sector – again!

Figure: Retail Sales Yr/Yr (%)

Though China hit the 2024 GDP growth target of 5.0%, monthly data shows the economy unbalanced. Industrial production/exports and state investment support the economy, with residential property investment negative and consumption sluggish. With monetary policy ineffective, we see Yuan3-5trn fiscal policy stimulus arriving from the March NPC and stick with our 4.5% GDP forecast until we see specific details of the package.

China’s economy remains unbalanced, despite hitting 5.0% GDP growth in 2024 – Yr/Yr at 5.4% in Q4. The December data shows a better than expected industrial production at 6.2% Yr/Yr with a 0.6% jump on the month. High tech manufacturing led the way and is consistent with the strong export picture seen recently. However, December retail sales was only marginally better than expected at 3.7%, with a mere 0.1% rise on the month. The breakdown also shows underlying weakness, with the post COVID boom in restaurants now finished with a slow 2.7% Yr/Yr. Headline retail sales was boosted by the trade in for household appliances, which was 39% Yr/Yr.

Investment also remains imbalanced with residential property investment at -10.6% YTD Yr/Yr. Fixed investment was a slow 3.2% Yr/Yr, with the private sector seeing 0.1% Yr/Yr decline. The latter sluggish private company investment also bodes badly for new jobs, given that the private sector traditionally generates the most employment change.

2025 will likely be harder, as we outlined in the December Outlook (here). Net exports positive contribution will likely become more neutral, as we see the Trump administration threat of tariffs turning into reality at 30% average by mid-year. This will hurt export growth directly to the U.S., especially as exports have recently been front loaded to avoid extra tariffs. With residential investment still likely to be a drag on GDP, plus sluggish consumption, only production and central/local/SOE investment is driving the economy.