FX Daily Strategy: APAC, December 5th

US jobless claims unlikely to move the market ahead of the US employment report

USD/JPY downside sill favoured

EUR/USD looking vulnerable given background French uncertainty

SEK could benefit from CPI, but seasonal flow could be a negative

US jobless claims unlikely to move the market ahead of the US employment report

USD/JPY downside sill favoured

EUR/USD looking vulnerable given background French uncertainty

SEK could benefit from CPI, but seasonal flow could be a negative

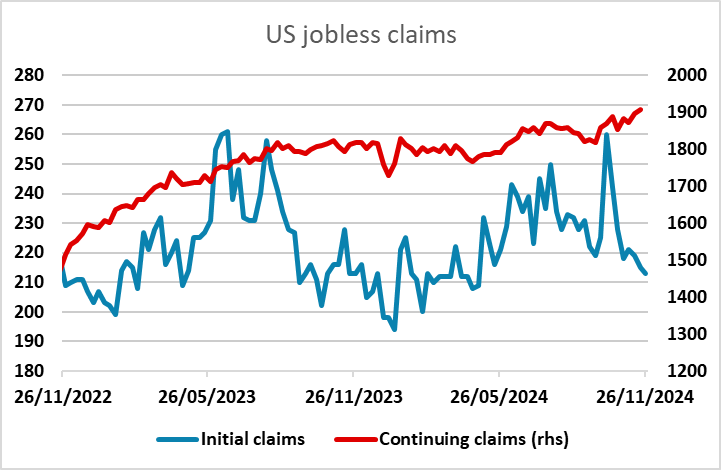

Thursday is unlikely to see a great deal of activity ahead of the US employment report on Friday. The main US data is the jobless claims numbers, which have been steady and indicative of a solid labour market in recent weeks. Even if we see some deviation from recent trends, it’s unlikely to have a big market impact ahead of the employment data.

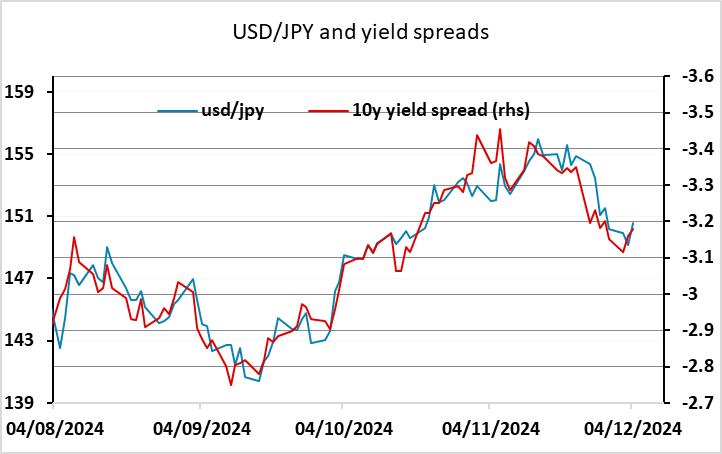

Both EUR/USD and USD/JPY look close to fair around 1.05 and 150 based on the recent correlations with yield spreads. USD/JPY was somewhat better bid on Wednesday as US yields initially rose, and is likely to continue to show more volatile reactions to moves in US yields. On a trend basis, Japanese yields are likely to remain on a shallow uptrend as the BoJ tightens over the coming months, while US and European yields are still likely to fall further, so we continue to favour USD/JPY declines. This also reflects the fact that JPY valuation remains extremely cheap from a fundamental perspective, while longer term yield correlations also suggest JPY upside risks.

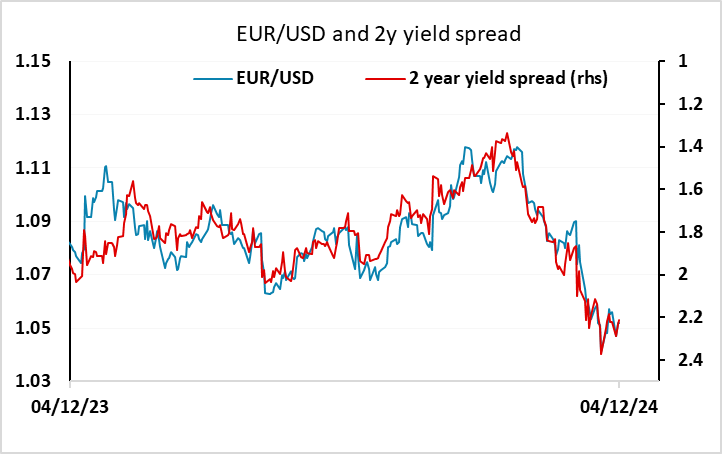

For the EUR, while there is initial focus on the French political turmoil, in the end EUR/USD continues to be driven by short term US/Germany yield spreads, and the French situation probably won’t change these much in the immediate future unless French budget concerns lead to a further large widening in France/Germany yield spreads. In that case, the ECB might be inclined to ease policy more aggressively, bringing EUR/USD lower. But while the French budget is major longer term concern, it will probably not lead to a major re-rating of France in the short run. Even so, EUR/USD risks remain on the downside.

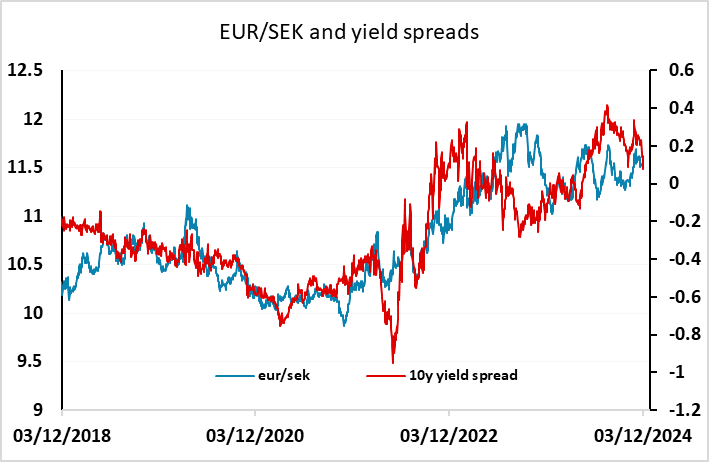

Before the US data on Thursday there is Swedish CPI data for November. The consensus is for the y/y rate to remain stable at 1.6%, but for the targeted CPIF measure to rise to 1.9% y/y. As it stands, the market is pricing a 75% chance of 25bp Riksbank rate cut at the December 19 meeting. A rise to 2% or above on the CPI could endanger that, and lead to some SEK appreciation. However, there is a potential seasonal negative for the SEK in December. The Swedish annual premium pension payment flows (PPM flow) take place in early December and the estimated SEK 8-9 billion flows can work against the SEK as the bulk of these deposits are invested in foreign assets, which can push EUR/SEK higher in early December. However, it is worth noting that EUR/SEK fell nearly 6% between November and the end of December 2023, so this is by no means a guarantee of a weak SEK. As it stands, EUR/SEK looks close to fair based on yield spreads, but spreads have been moving in the SEK’s favour of late and given the uncertainty in France the SEK may have a mild upside bias.