FX Daily Strategy: APAC, April 17th

ECB to cut 25bps but more focus on future intentions

EUR/USD unlikely to be much affected by the decision

AUD to be sensitive to March employment data after February dip

USD may manage a bounce into the Easter weekend

ECB to cut 25bps but more focus on future intentions

EUR/USD unlikely to be much affected by the decision

AUD to be sensitive to March employment data after February dip

USD may manage a bounce into the Easter weekend

Thursday sees the ECB meeting and rate decision, but there is no real uncertainty about this month’s decision going into the meeting, with a 25bp cut in the deposit rate unanimously expected. The market focus will therefore be on what it communicates about policy thereafter. The change in rhetoric last month to suggest the policy stance had become less restrictive is already out of date as the ECB instead grapples with increasing downside risks to both growth and inflation. These risks stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of intertwined slumping business confidence and capex intentions as well as the surging euro damaging competitiveness, the latter accentuating already tighter financial conditions.

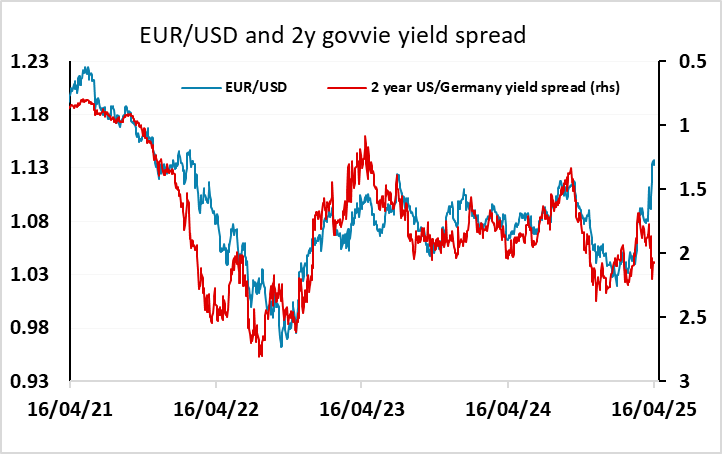

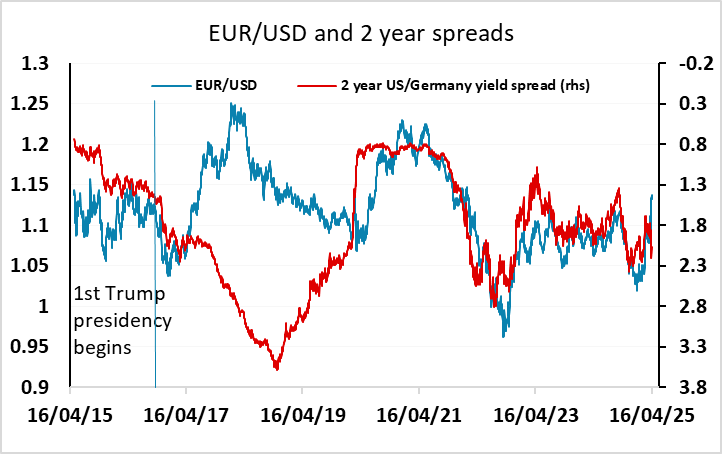

The market is currently pricing a total of 3 ½ more rate cuts, including this month’s move, which is in line with our thinking, so we wouldn’t anticipate a substantial market reaction. There could be some impact if the ECB decide to pare back the QT program, but the EUR has been gaining in recent weeks not because of any yield spread move but because of a perceived safe haven status, which, for now, the USD has lost. There has been a clear negative correlation between yield spreads and EUR/USD, reversing the normal relationship seen in recent years, although we did see similar behaviour in the first Trump presidency. This suggests reduced demand for US bonds and increased demand for European bonds. While tariff uncertainty continues, it is hard to oppose this trend, although the more stable trading seen in the last few days in equities, bonds and FX may allow a halt to the recent trend gains in the EUR.

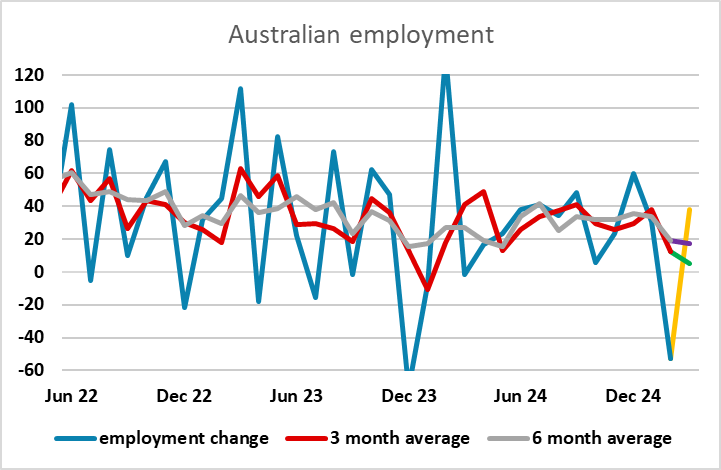

Before this we have the Australian March employment report, which takes on greater significance than usual after the surprise large decline in employment reported in February. The consensus expects a rebound in employment, although the 39.8k rise expected would still leave employment down over the last two months. The risks may be biased towards a larger recovery if the February decline was merely erratic. The consensus would leave the 3 month average barely above zero at its lowest since January 2024, and the AUD might struggle if we see that outcome. However, a number above 50k that boost the 3 month average closer to trend could trigger AUD/USD gains and threaten a break of the key 0.64 level.

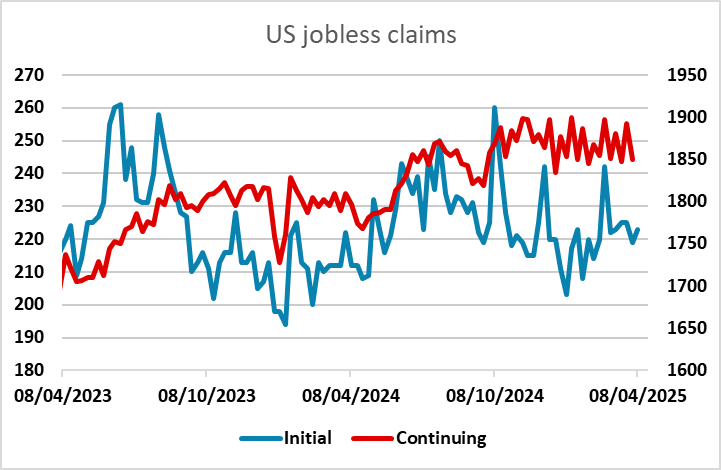

In the US, there is the usual jobless claims data, housing starts and the Philly Fed survey. The claims data have so far shown no real evidence of any weakness, and another week of as expected numbers might allow a mild USD recovery into the Easter weekend. This in any case may be the bias, as the tendency may well be to square what are likely to be mostly short USD speculative positions into the weekend, with US/JPY and USD/CHF probably most vulnerable.