USD flows: Recovers after initial dip on CPI

CPI marginally on the soft side, but USD recovers after initial dip with dovish Fed view already priced

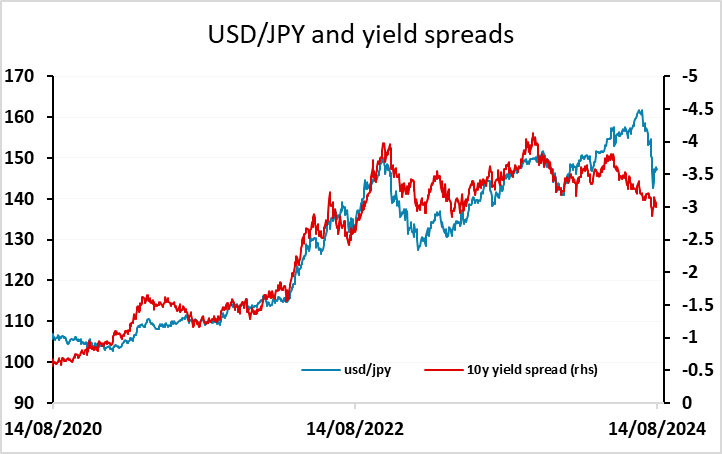

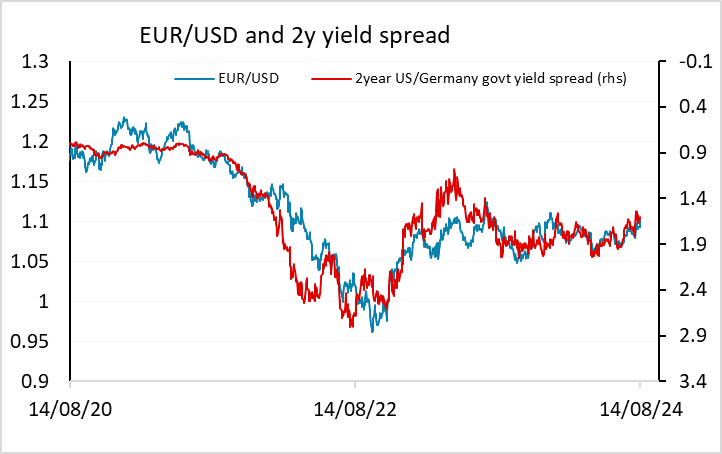

US CPI much as expected at 0.2% m/m for both headline and core, but the rise was a low 0.2% (0.153% headline, 0.165% core) so that the headline y/y rate fell to 2.9%. This supports expectations of Fed easing, but it still isn’t clear to us that it supports the market pricing of a 40% chance of a 50bp cut in September (60% chance of a 25bp cut). In the absence of clearly weaker real sector data and/or a more significant decline in risk assets, the Fed are unlikely to do more than cut 25bps. So it isn’t entirely surprising that the USD bounced sharply after the initial dip on the data. It had already fallen back after PPI, and with a fairly dovish Fed take already priced in, there is little scope for further USD weakness against the EUR. USD/JPY still looks to have potential for further declines, but these may have to wait for less risk friendly conditions.