USD flows: USD shrugs of mildly weak US employment report

US emloyment report modestly weak, with lower than expected private payrolls and a rise in unemployment. But USD reverses initial decline

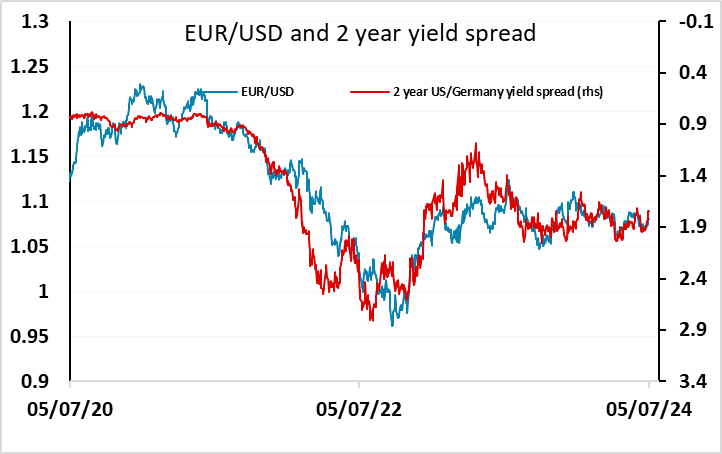

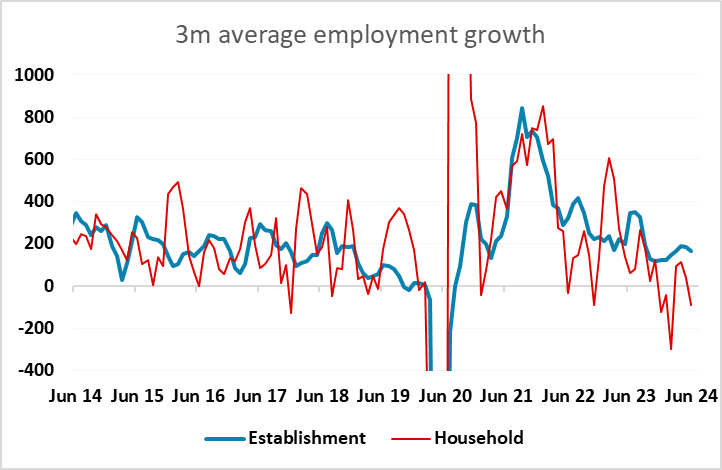

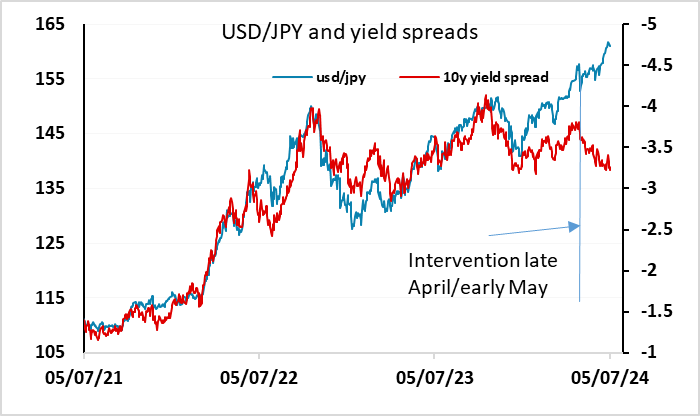

The US employment report is on balance slightly weaker than expected since even though the total rise in non-farm payrolls was a little higher than consensus at 206k, much of this was government, and private payrolls rose less than expected at 136k. Also, the unemployment rate rose slightly to 4.1%. Average earnings as in line with consensus at 0.3%. The numbers aren’t radically away from consensus, but US yields are modestly lower in response and the USD initially fell slightly across the board, although the USD has subsequently bounced and is now slightly higher, notably against the JPY. On the face of it, with yields lower in Europe as well as the US, the JPY and the AUD should benefit the most, but the JPY remains unloved as long as the BoJ refrain from intervention, and although yield spreads have been pointing lower for USD/JPY for a month or more, more obviously negative risk sentiment looks to be required to turn the trend.

The US employment report is on balance slightly weaker than expected since even though the total rise in non-farm payrolls was a little higher than consensus at 206k, much of this was government, and private payrolls rose less than expected at 136k. Also, the unemployment rate rose slightly to 4.1%. Average earnings as in line with consensus at 0.3%. The numbers aren’t radically away from consensus, but US yields are modestly lower in response and the USD initially fell slightly across the board, although the USD has subsequently bounced and is now slightly higher, notably against the JPY. On the face of it, with yields lower in Europe as well as the US, the JPY and the AUD should benefit the most, but the JPY remains unloved as long as the BoJ refrain from intervention, and although yield spreads have been pointing lower for USD/JPY for a month or more, more obviously negative risk sentiment looks to be required to turn the trend.

The CAD is the least likely to benefit from the slightly softer US data, as the Canadian employment report showed a decline in employment of 1.4k in June and a rise in the unemployment rate to 6.4%, although wage growth remained strong at 5.6%.