USD flows: Employment report should be broadly neutral

Net of revisions, the employment report looks close to consensus

The US April employment report has come in slightly on the strong side, with non-farm payrolls 47k above consensus, but downward revisions in the previous 2 months amounted to 60k, so in the end it’s hard to see this as significantly away from expectations. The unemployment rate was unchanged as expected at 4.2%, and average earnings growth was a little below consensus at 0.2%, while the workweek was slightly above consensus. So including revisions, the data could be argued to be marginally on the soft side, but in reality its hard to see this as anything other than broadly neutral.

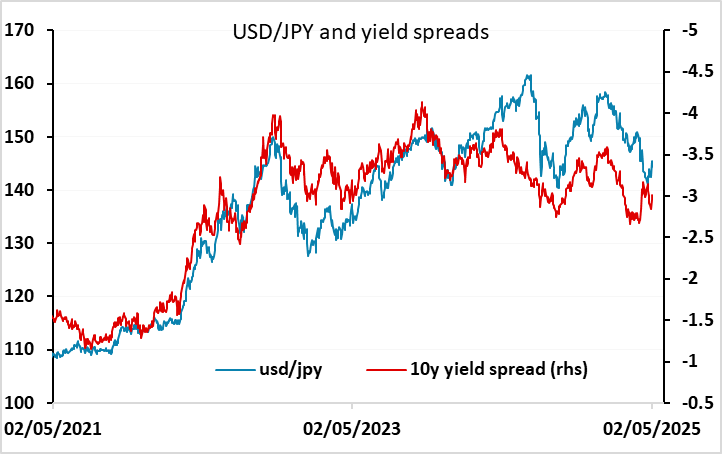

The USD has initially made some small gains on the data, presumably reacting to the stronger headline number, but given the revisions we doubt gains will be significant or sustained. We continue to see the JPY as somewhat oversold in the last week, so there may be some potential for a modest recovery, but a relatively quiet end to the week seems likely.