FX Daily Strategy: N America, February 12th

Expect Turbulence after NFP

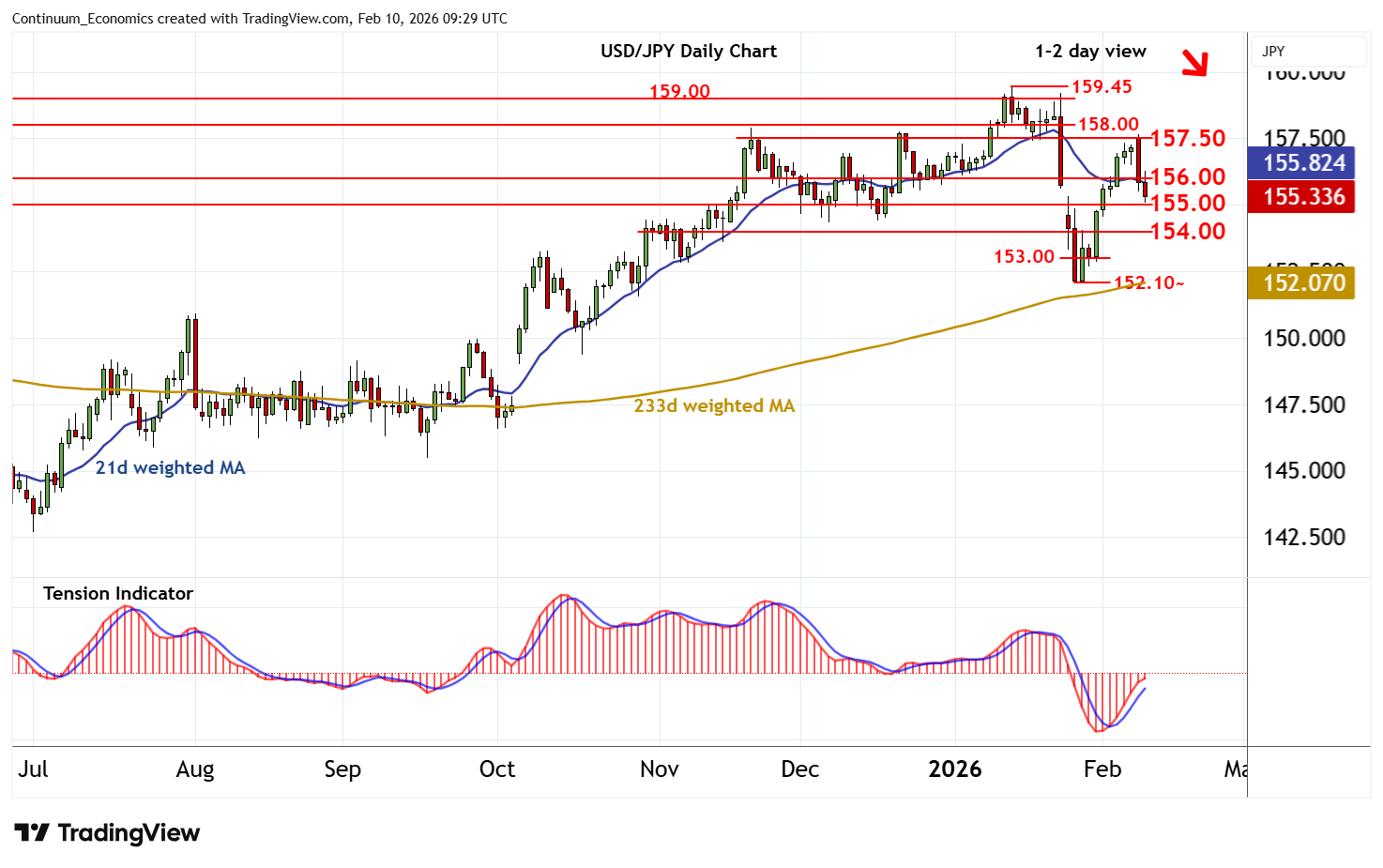

Likely in USD/JPY

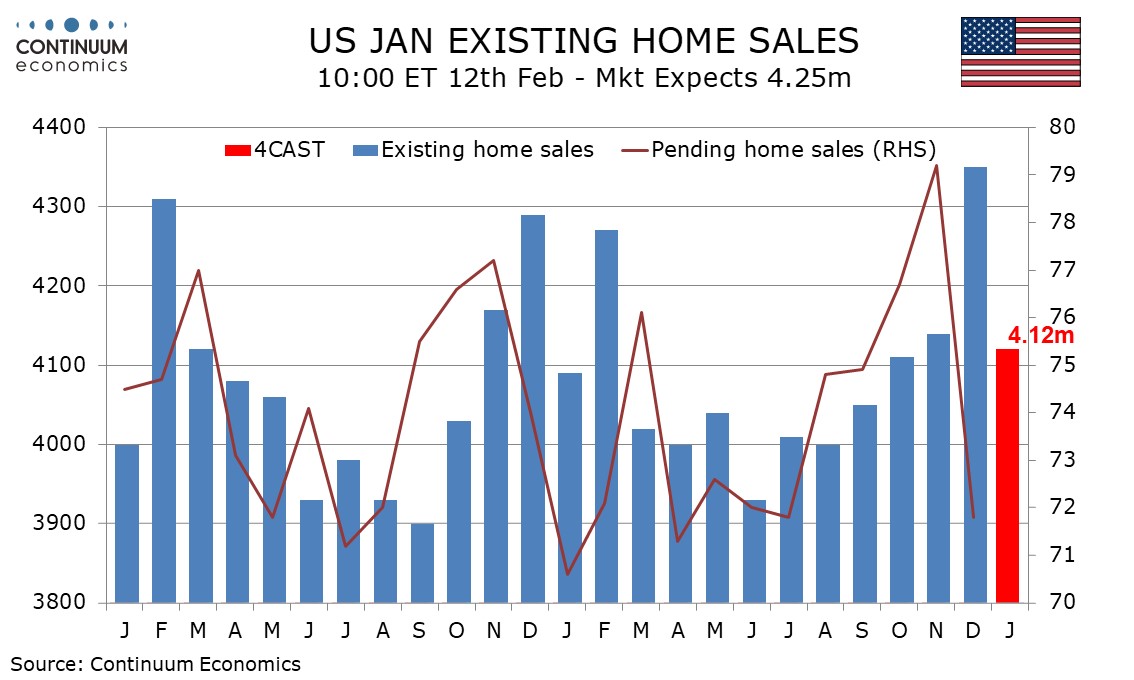

U.S. January Existing Home Sales Reversing a strong December gain

UK GDP To Show Underlying Economy Fragility Continues?

As major FX pairs on the sidelines beofre U.S. NFP, one must expect turbulence after the release. We believe the major pair that could be severely affected would be USD/JPY. USD/JPY has been on a three day correction phase after the sweeping election results. With market confidence partially recovering, evidentially in long end JGB yields, the speculation offer of JPY has dissipated. However, the pair is heavily affected by USD movement as anticipation of a move from the BoJ remain months away. The story for speculative longs on Takaichi fiscal irresponsibility could revert to a Fed story and determine the strength of USD.

On the chart, the anticipated break below 156.00 has reached 155.10~, where flat oversold intraday studies are prompting a bounce into consolidation around 155.30. Rising daily studies are flattening and broader weekly charts are under pressure, highlighting room for further losses in the coming sessions. A break below support at 155.00 will add weight to sentiment and open up congestion around 154.00. However, already oversold intraday studies could limit any immediate tests in consolidation, before further losses unfold. Meanwhile, resistance is lowered to congestion around 156.00. A close above here, if seen, will help to stabilise price action and prompt consolidation beneath 157.50.

We expect January existing home sales to fall by 5.3% to 4.12m, more than fully erasing a 5.1% December increase. Pending home sales are signaling a sharp decline and bad weather late in the month is a further downside risk. The most powerful signal for a sharp decline in existing home sales come from December pending home sales, which fully erased four straight gains. If matched by existing home sales that would imply a level similar to August’s 4.00m. However January’s NAHB index, while weaker, suggests a more moderate decline, and weekly MBA house purchase indices have generally held up well.

We expect sharper declines in the Northeast and South than the Midwest, which has seen less strength in recent months, and the West, which has been less impacted by bad weather. We expect a 1.5% decline in the median price on the month, though that will be largely seasonal. Yr/yr growth would then pick up to 1.5%, from 0.4% in December and 1.4% in November.

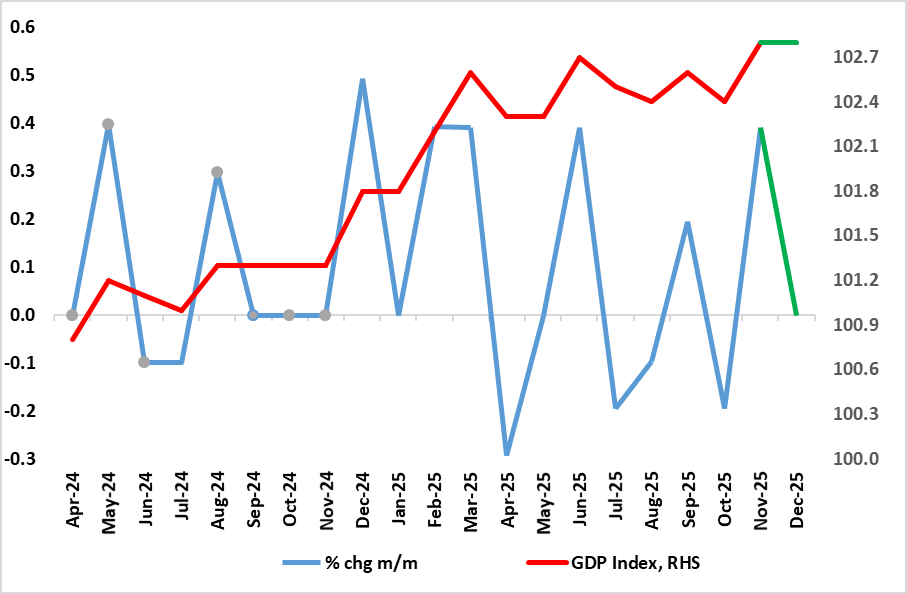

Figure: GDP Growth Volatile but Hardly Strong?

Even given the surprisingly solid November GDP release, this merely returns the level of GDP to where it was in June, albeit briefly as for the latter. Partly undermined by wet and warm weather through the month, we see no change on the December figure, in m/m terms (Figure), thus no reversal of the 0.3% November that following an unrevised fall of 0.1% in October 2025 and a growth of 0.1% in September 2025 (revised up from our initial estimate of a fall of 0.1%). This means that Q4 is set for a 0.2% q/q rise which would result in 2025 growth of 1.4%. But we see no more than 0.8% this year; this actually and merely being an extension of the anticipated Q4 result. Regardless, we remain wary about the GDP numbers. Although there have been some better business survey numbers, other such insights provide still sobering reading as do non-official employment indicators, the latter actually suggesting a worsening backdrop of late.

It is unclear how uncertainty (especially related to budget worries) affected activity in October and whether a degree of more fiscal clarity even ahead of the actual Budget may have helped sentiment in November. But businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025. These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies.

Regardless, for some time, we have discerned very feeble momentum, which may actually be nearer zero, especially once ever-clearer construction weakness is incorporated. Indeed, GDP has hardly moved since March and is just a notch above the most recent peak in activity set in June. Admittedly, solid GDP outcomes early in the year suggest that UK GDP growth in 2025 will be around 1.4% - the highest in the G7 according to the IMF but this masks what is very much a weak(er) picture in per capita terms, this being a politically important issue amid current immigration issues. Indeed, the IMF see a cumulative per capita growth of 0.9% for 2025 and 2026, the weakest in the DM world save for a similar soggy outlook for Germany. Regardless, the 0.8% GDP projection we have penciled in for this year actually constitutes some modest pick-up in activity momentum and thus may actually be too optimistic, something that surveys would suggest given their weakness. In fact, GDP growth this year may now be as soft as 0.6%, especially if the recent support from government spending ebbs, let alone reverses. This supports our view that the BoE will cut rates down to 3.0% by end 2026!