Published: 2024-04-03T06:58:01.000Z

CHF, NOK flows: CHF weak, NOK strong as value makes a comeback

Senior FX Strategist

-

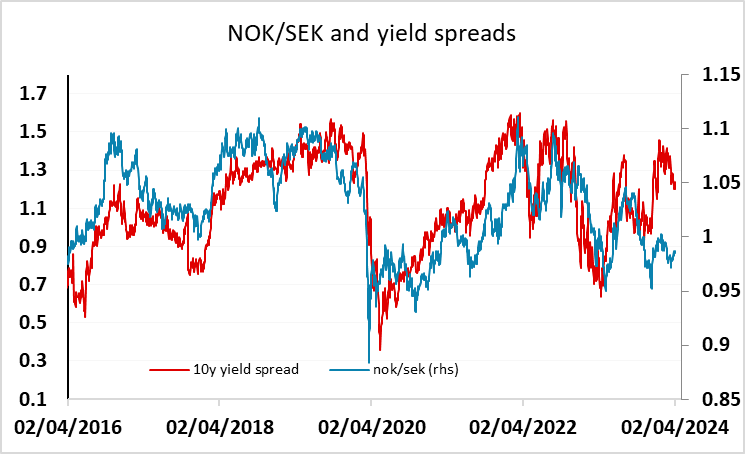

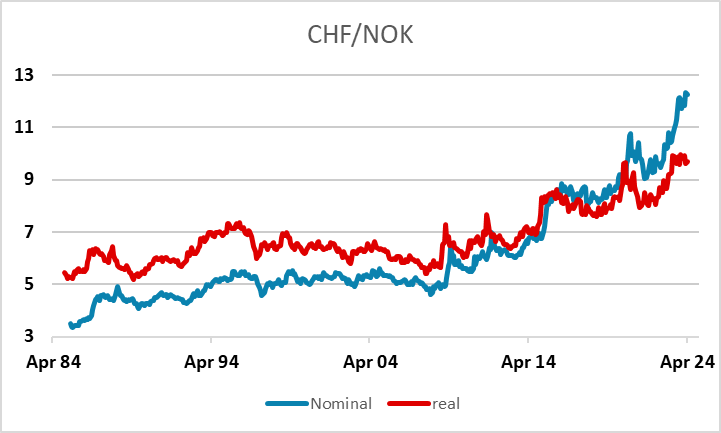

CHF/NOK sees big decline as value starts to become a factor

It’s looking like a quiet day for FX, with little movement overnight and a fairly light data calendar. Tuesday was fairly quiet as well, but we did see a return to CHF weakness after the pre-Easter recovery. The best performer was the NOK, with CHF/NOK down 1.5% on the day. This is a classic carry trade, favoured in quiet conditions, with the NOK offering the highest yield in Europe (after GBP) and the CHF the lowest. Valuewise there is also a clear case for NOK gains with CHF/NOK close to all time highs of 12.30 and coming off a Fibonacci retracement level at 12.10. We have seen the NOK as undervalued for some time, not just against the CHF but against the SEK, with NOK/SEK underperforming its usual yield spread correlation. 2024 is starting to shape up as the year when we see some valuation correction after several years of CHF strength and JPY and scandi weakness. While the JPY has been weaker than the scandis, in risk positive markets the scandis may outperform, with the NOK preferred.