GBP, EUR, USD flows: EUR falls sharply on PMIs

EUR/USD drop sharply as PMIs fall much moe than expected.

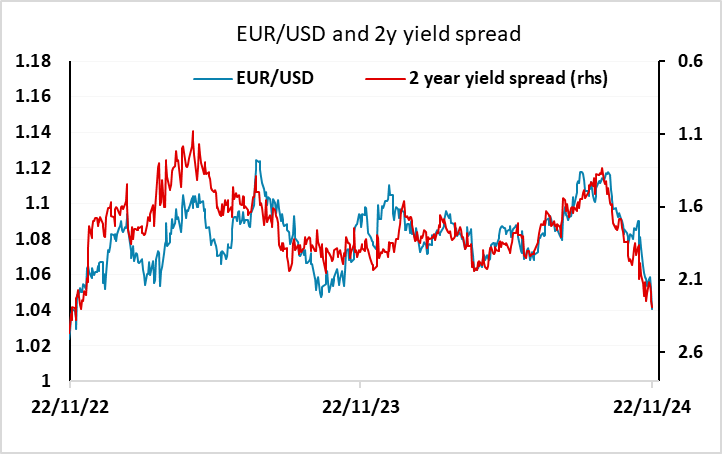

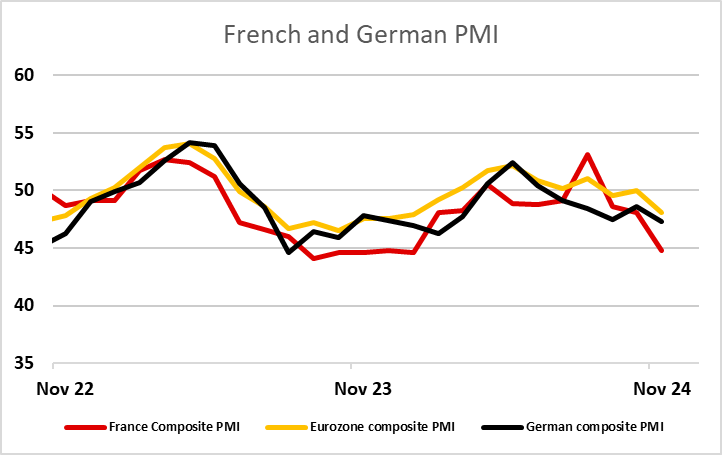

Much weaker than expected Eurozone PMI data has triggered a sharp decline in the EUR across the board. French PMIs were particularly weak, but German PMI also fell significantly. Eurozone PMIs are down to their lowest since January. The data doesn’t necessarily indicate recession, but does increase the chances of faster and/or larger ECB rate cuts. The market is now pricing the December 12 meeting as a 50-50 chance between a 25bp and a 50bp cut. As it stands, this has led to 2 year yields falling around 10bps, and on recent correlations this is consistent with the current EUR/USD level around 1.04. However, if the ECB were to cut 350bps, and/or the Fed were to leave rates on hold on December 18 (currently priced as a 60% chance of a 25bp cut), there is scope for further EUR/USD losses towards 1.02 or lower. For now, we may see EUR/USD hold near 1.04.

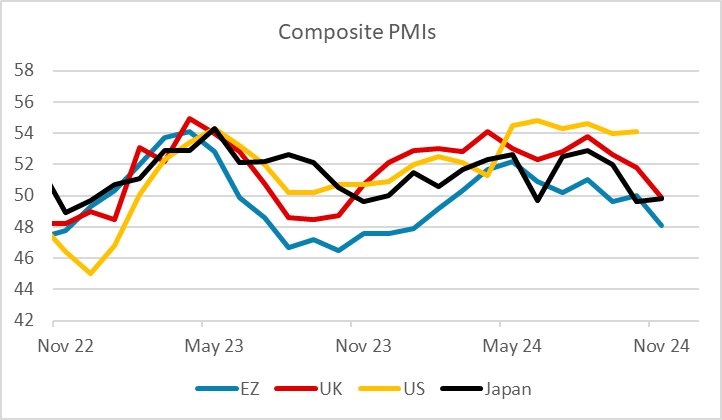

UK PMIs were also weak, albeit not quite as weak as the Eurozone numbers. The UK data also is a less reliable guide to UK GDP, so should be taken with a large pinch of salt. Indeed, the Eurozone numbers are also far from infallible. But for now the USD and JPY should remain very much on the front foot.