U.S. March Consumer Confidence - Future expectations weakest since 2013

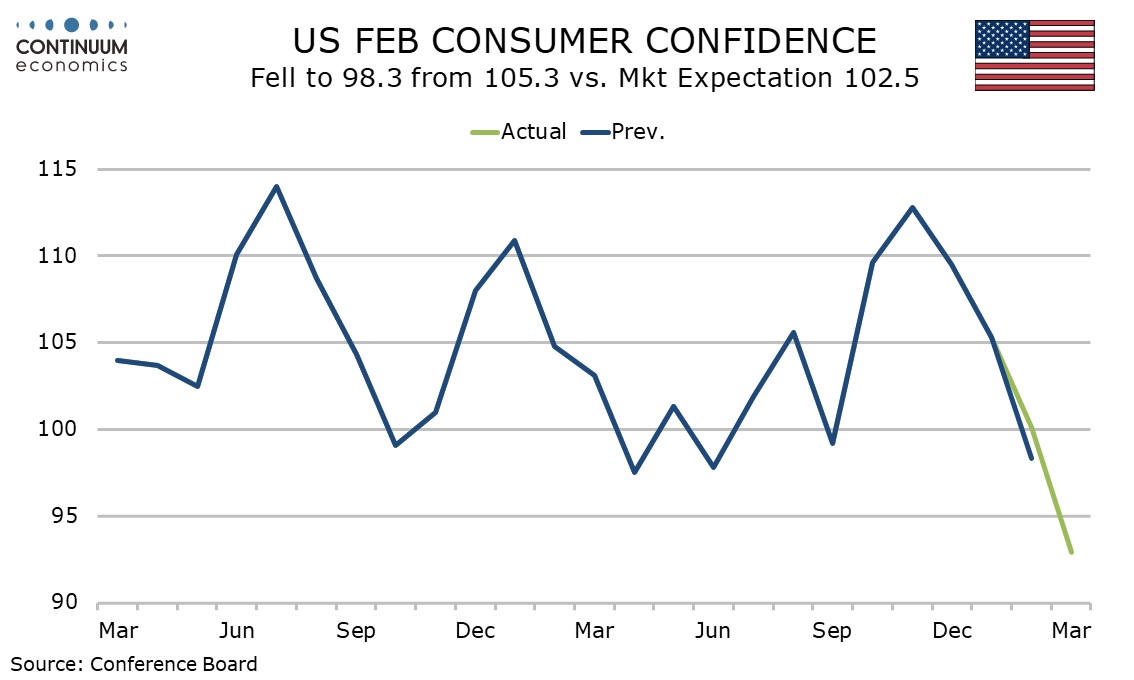

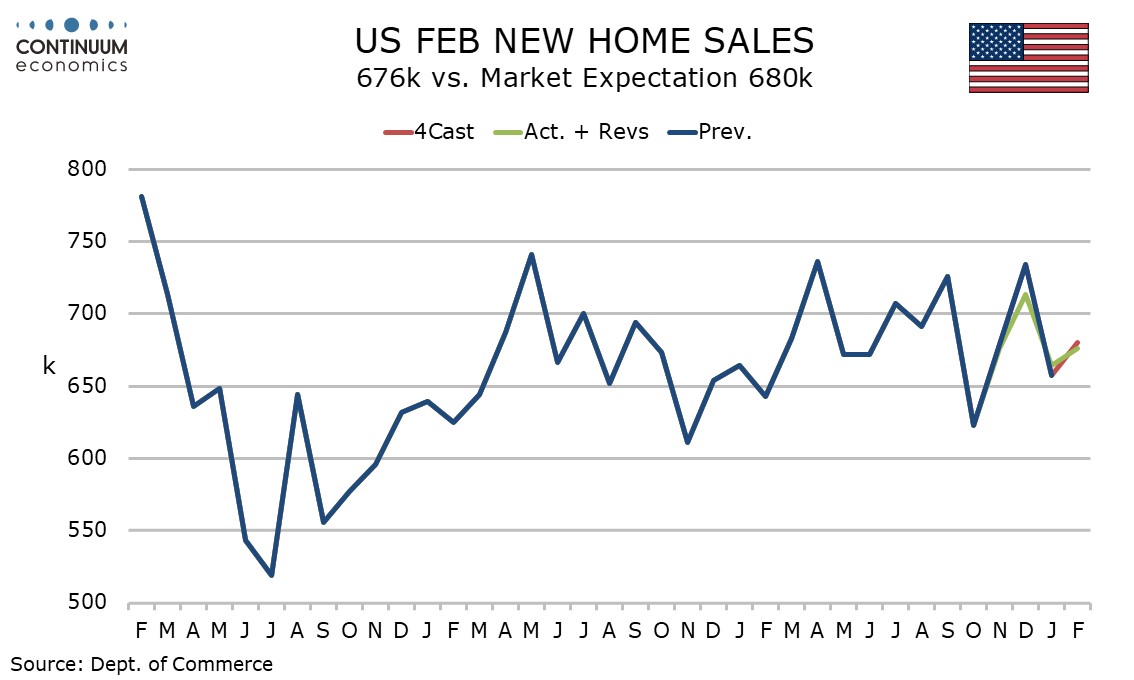

March consumer confidence at 92.9 from 100.1 has seen a fourth straight decline and is weaker than expected. The fall has been led by future expectations, which are at their lowest since March 2013. A 1.8% increase in February new home sales to 676k is in line with expectations.

The overall index is the weakest since January 2021 and the 7.2 point fall is the steepest since August 2021. If recent gains in equities can be sustained, April data may get some support. Much will depend on Trump’s April 2 tariff announcement.

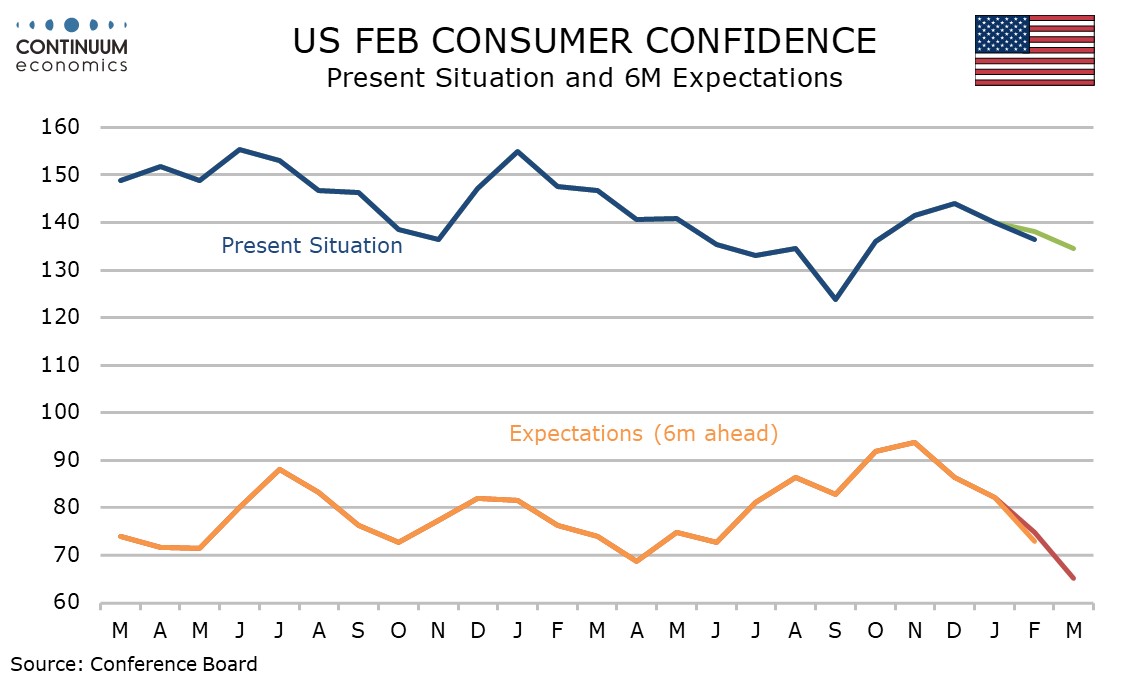

The present situation fell by 3.6 points but was weaker as recently as September 2024. Expectations however plunged by 9.6 points to the weakest level since March 2013. This is likely to reflect Democrats getting increasingly pessimistic while Republicans may be a little less optimistic.

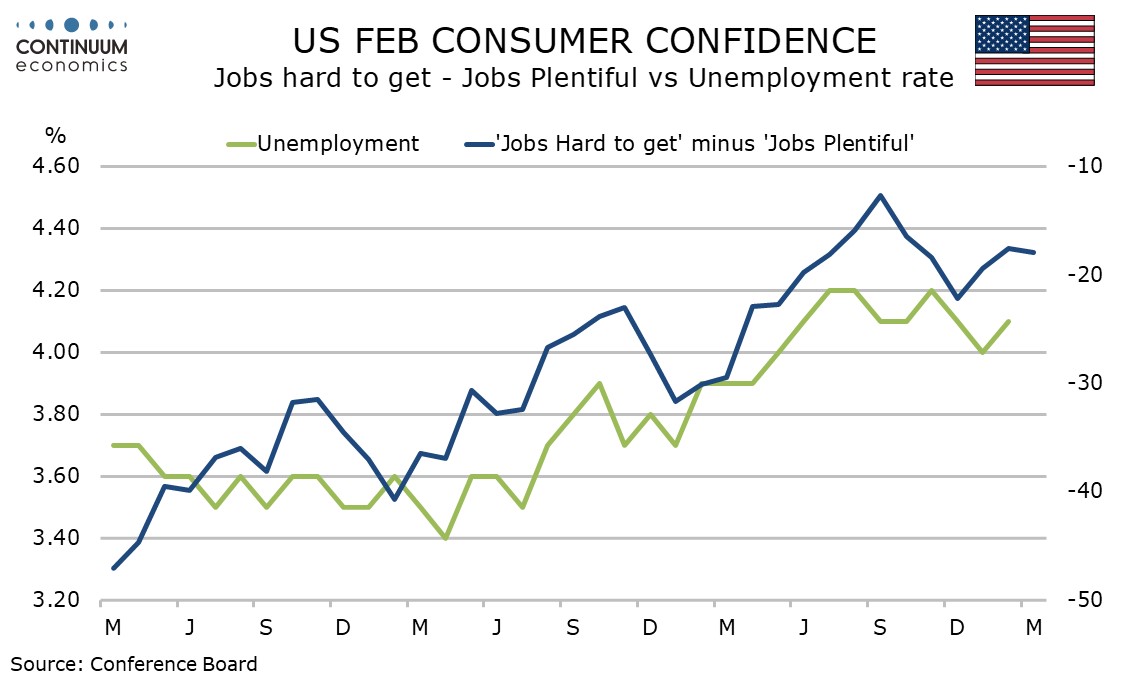

Perceptions on the labor market are actually marginally improved, with those seeing jobs as plentiful exceeding those seeing them as hard to get by 17.9%, up from 17.6% in February, though still below January’s 19.4%.

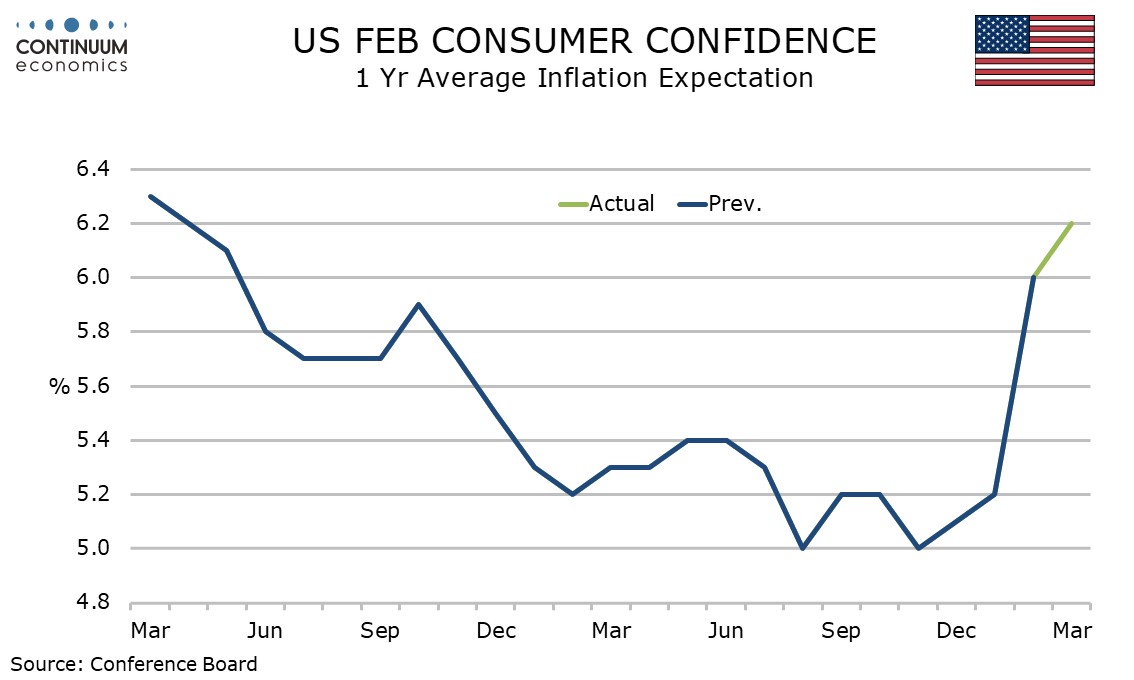

Inflation expectations are picking up with the average at up to 6.2% from 5.8%, reaching the highest level since April 2023, though still well below the 2022 high of 7.9%. The median view is 5.1% versus 4.7% in January. An average higher than the median suggests some very pessimistic respondents.

New home sales have had little direction for almost two years and are holding up better than some housing sector surveys, such as the NAHB’s, which has softened in recent months.

Monthly detail shows gains in the Midwest and South but weakness in the Northeast and West. Prices were softer, the median down 1.5% yr/yr and the average down 4.4% yr/yr.