USD flows: USD lower despite slightly stronger than expected employment report

US employment report broadly consensus but marginally on the storng side. But market reaction yield and USD negative

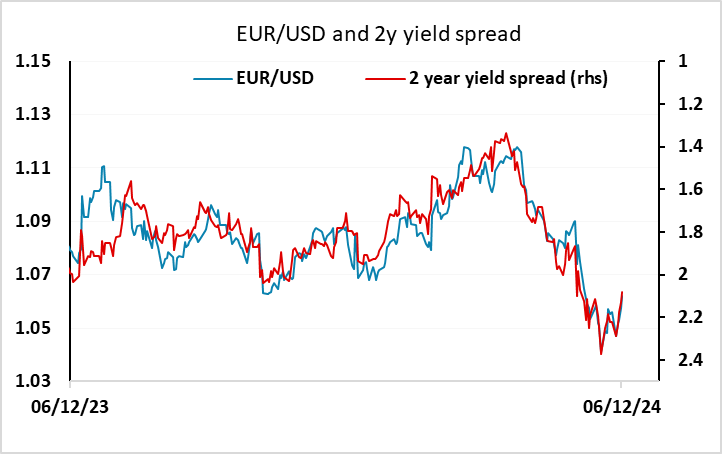

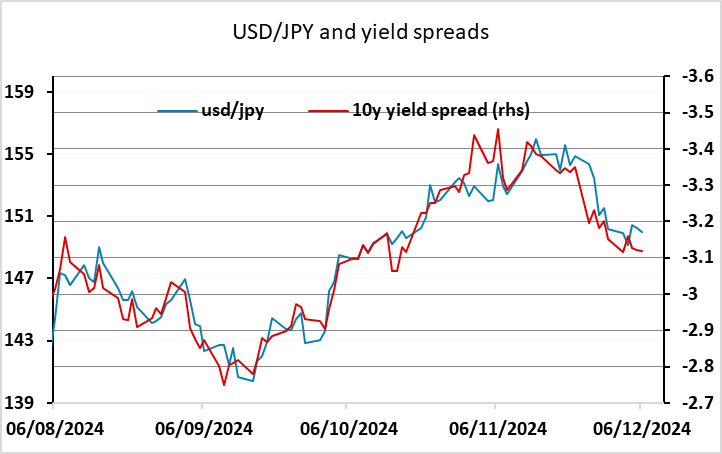

The US employment report has come in slightly stronger than expected. Payrolls at 227k were slightly above consensus with a small upward revision as well, while average earnings growth at 0.4% was above the 0.3% consensus. The unemployment rate rose to 4.2% but this was in line with market expectations. However, the initial reaction has been for US yields and the USD to slip lower, with the market seemingly taking the view that the data isn’t strong enough prevent the Fed from easing. We’re less clear that this reaction will persist, as although we see a 25bp Fed cut as likely, we don’t think it’s the 85% chance the market is currently pricing in. Still, USD/JPY gains looked overdone in the high 150s, and something below 150 is more consistent with the yield spread seen even before the data. It’s less clear that there is scope for EUR/USD to advance above 1.06. The AUD continues to look the most out of line with recent yield spread moves.

USD/CAD is also a tad lower, but although the Canadian payroll gain was a little above consensus, the rise in the unemployment rate to 6.8% will tend to undermine CAD sentiment.