FX Daily Strategy: N America, March 21st

Some downside risks for GBP as hawks are expected to turn neutral

CHF slumps as SNB cut rates

NOK slightly firmer as Norges Bank resists pressure to cut faster

EUR little changed after mixed PMIs

Some downside risks for GBP as hawks are expected to turn neutral

CHF slumps as SNB cut rates

NOK slightly firmer as Norges Bank resists pressure to cut faster

EUR little changed after mixed PMIs

UK CPI Headline and Core Inflation Drop Resume in February

Source: ONS, Continuum Economics

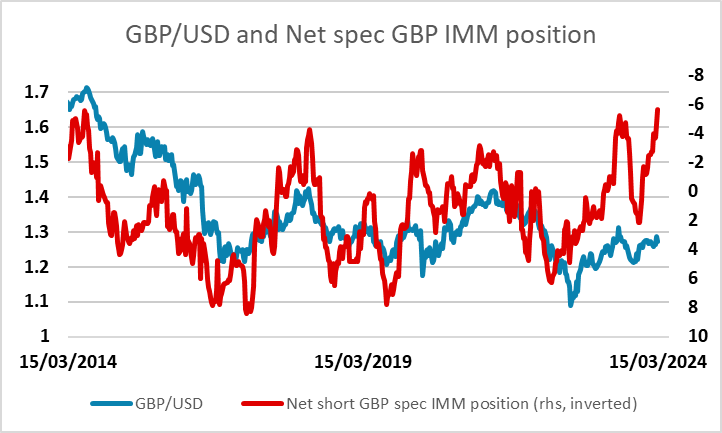

It would be a shock if the BoE was to vote to do anything but keep policy on hold. More likely than not there will be no further dissents in favour of a further hike, merely one again calling for a cut. This is both our view and the market consensus. In the wake of the slightly softer February CPI data, the implicit easing hints offered back at the February decision may be repeated, paving the way for a (25 bp) start to rate cutting at either the May 9 or Jun 20 meetings, especially as headline CPI may be below target by the latter date. This should pave the way for around 100 bp of cuts this year and almost as much in 2025! Given that the market currently only prices around a 10% chance of a May cut and a 65% chance of a cut in June, this suggests some downside risks for GBP. These risks look all the more significant given the current net speculative long in GBP/USD reported in the CFTC data.

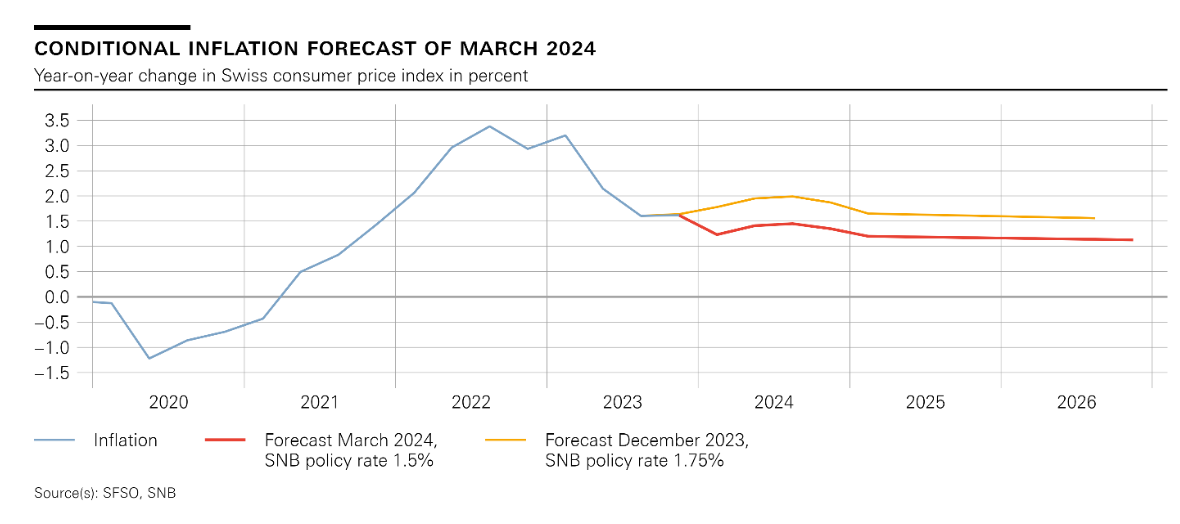

Before the BoE meeting we had the SNB and Norges Bank. The SNB has cut the policy rate 25bps to 1.5% at today’s meeting, This had been priced as around a 40% chance ahead of the meeting, although only 22% of forecasters were looking for a cut in the latest Reuters survey. The inflation forecasts have also been cut sharply, with the 2025 forecast at 1.2% from 1.6% previously, suggesting scope for further rate cuts at upcoming meetings.

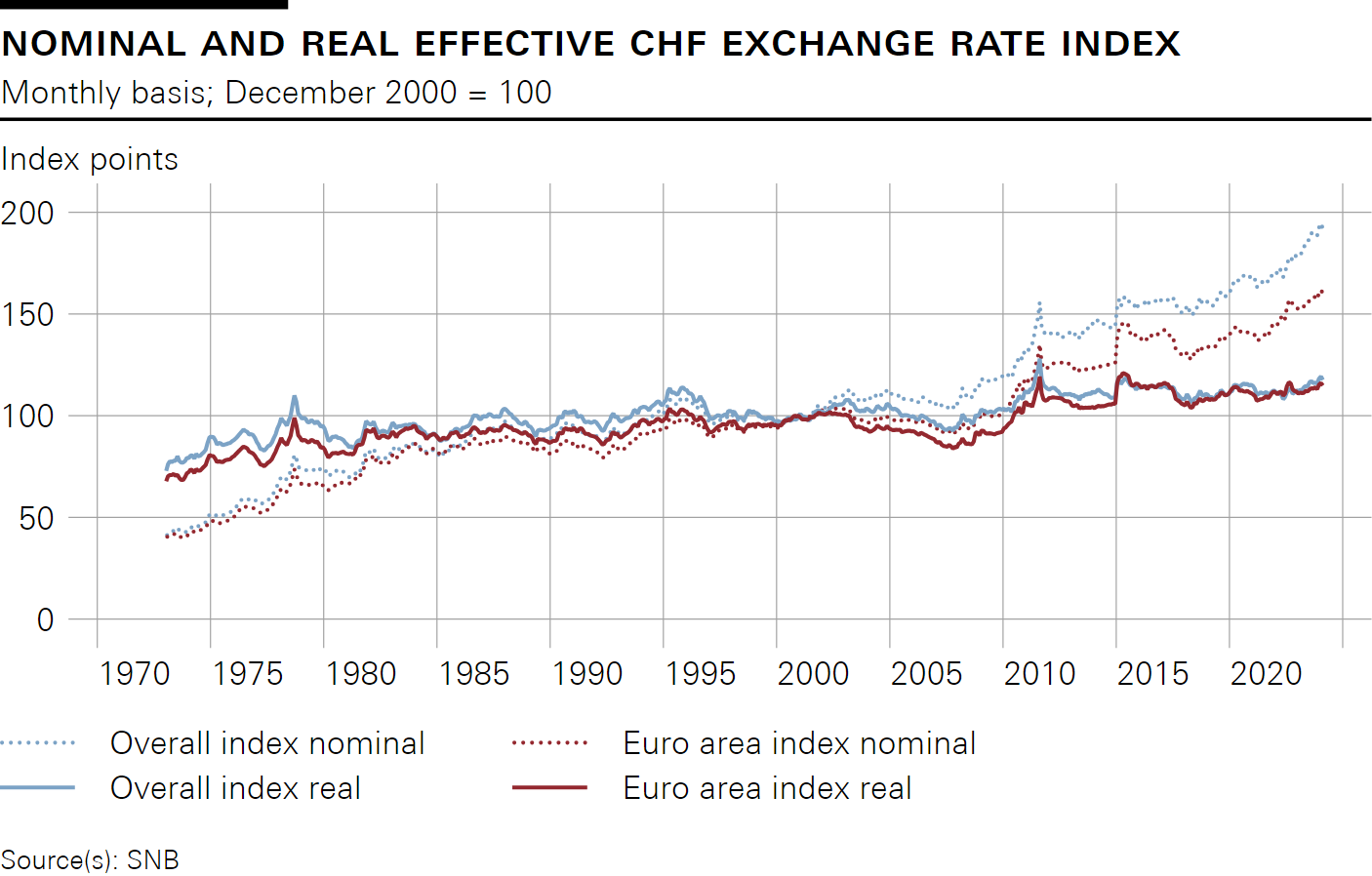

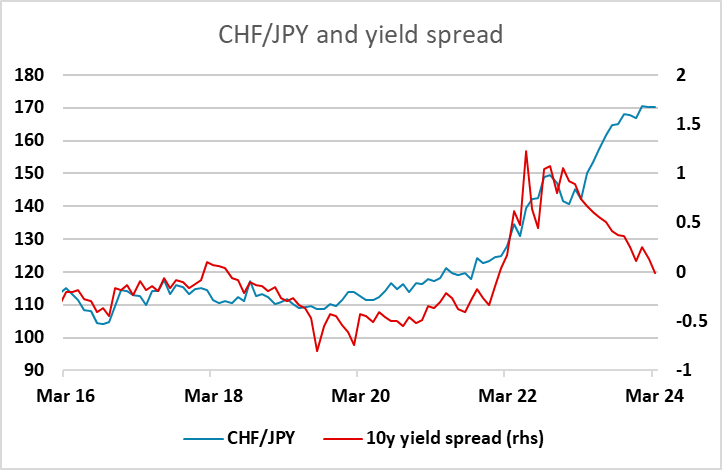

The CHF has fallen sharply, with EUR/CHF gaining a big figure to 0.9775. There is still some potential for further CHF declines against the riskier currencies if risk appetite remain strong. The SNB cited the strength of the CHF as a factor that had been weighing on inflation. However, it is notable that the strength in real terms has been relatively modest, with only the JPY seeing substantial real terms weakness against the CHF in recent years. CHF/JPY consequently looks like the pair with the most scope to decline.

The SNB decision will keep the CHF under pressure in the short term, but in practice this may only be a timing issue, as the SNB cut is likely to be followed in coming months by cuts elsewhere. We do see scope for EUR/CHF to edge higher towards parity, but this is likely to be a slow process, as the CHF strength in the last few years has been justified by the relatively low level of Swiss inflation, so no major valuation correction is likely against the EUR.

European PMIs have come in mixed this morning, but broadly in line with expectations. Eurozone manufacturing is a little weaker, but services stronger so the composite is a little higher than expected. The UK has the opposite balance with better manufacturing but weaker services and the composite is marginally softer. But the data doesn’t deviate far enough from expectations to have much of an FX impact.

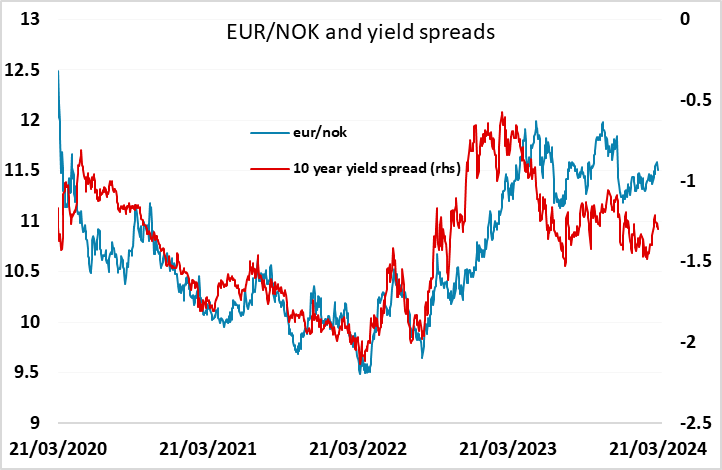

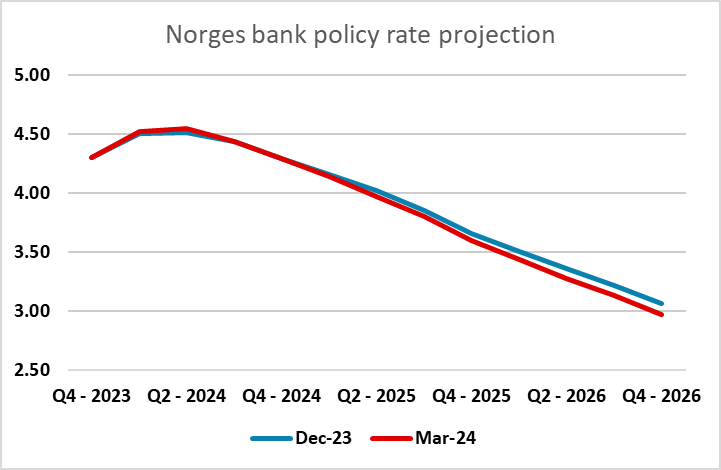

The NOK has firmed slightly on the Norges Bank decision to leave rates unchanged and their reiteration that the cost of borrowing could start to fall in the autumn. There had been some expectation that Norges Bank would turn more dovish and look for earlier rate cuts in view of the lower than expected inflation outcomes we have seen. But even though they have reduced their inflation forecast for 2024 to 4.1% for core CPI from 4.8% in December, they have refrained from indicating an earlier rate cut, and have only marginally reduced their policy rate forecast. This may reflect a concern not to weaken the currency, which continues to look undervalued, but may have scope for some more recovery.