FX Daily Strategy: Europe, August 14th

CPI data the main focus on Wednesday

But RBNZ stole the spotlight

USD remains soft but downside limited against EUR

GBP may reverse Tuesday gains if CPI comes in as expected

SEK may be vulnerable to softer CPI

CPI data the main focus on Wednesday

But RBNZ stole the spotlight

USD remains soft but downside limited against EUR

GBP may reverse Tuesday gains if CPI comes in as expected

SEK may be vulnerable to softer CPI

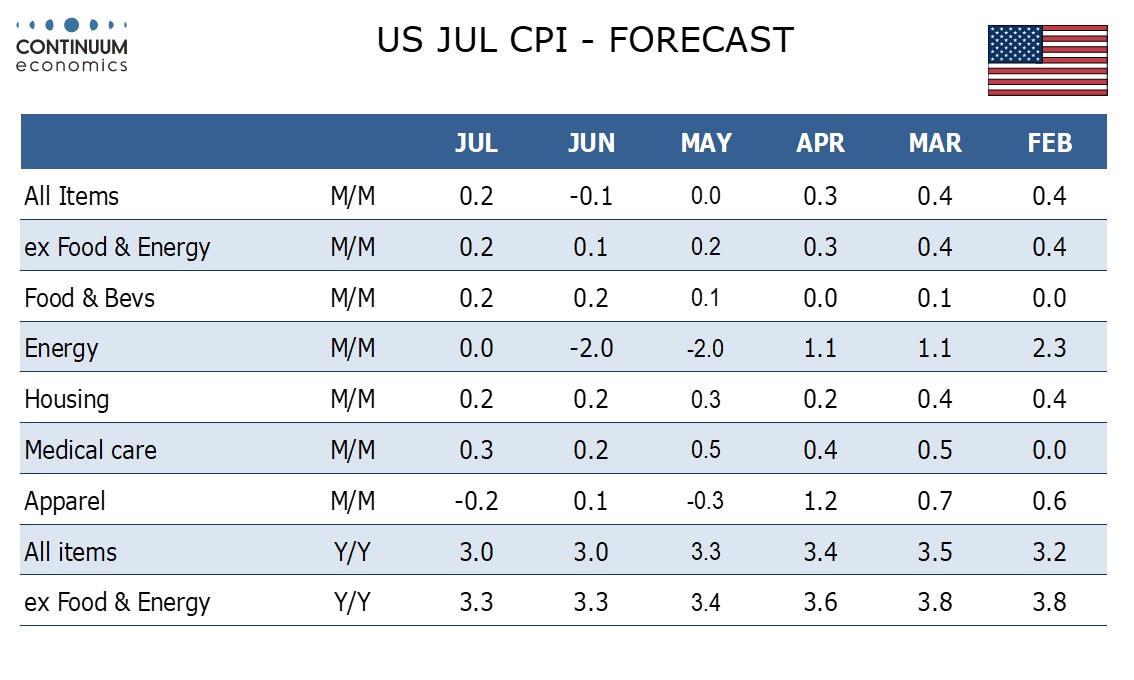

Wednesday sees US, UK and Swedish CPI data, and these are likely to be the main market drivers, with the US numbers obviously having the most potential for global impact. We expect July’s CPI to be acceptably subdued, but a little stronger than the preceding two months with gains of 0.2% both overall and ex food and energy. We expect the core rate to rise by 0.23% before rounding, up from 0.065% in June and 0.163% in May. Our forecasts are in line with consensus, and consequently unlikely to trigger a significant reaction. However, after the weaker than expected PPI data on Tuesday, the USD has come under a little pressure, and the USD tone will probably remain soft unless the CPI data is on the strong side.

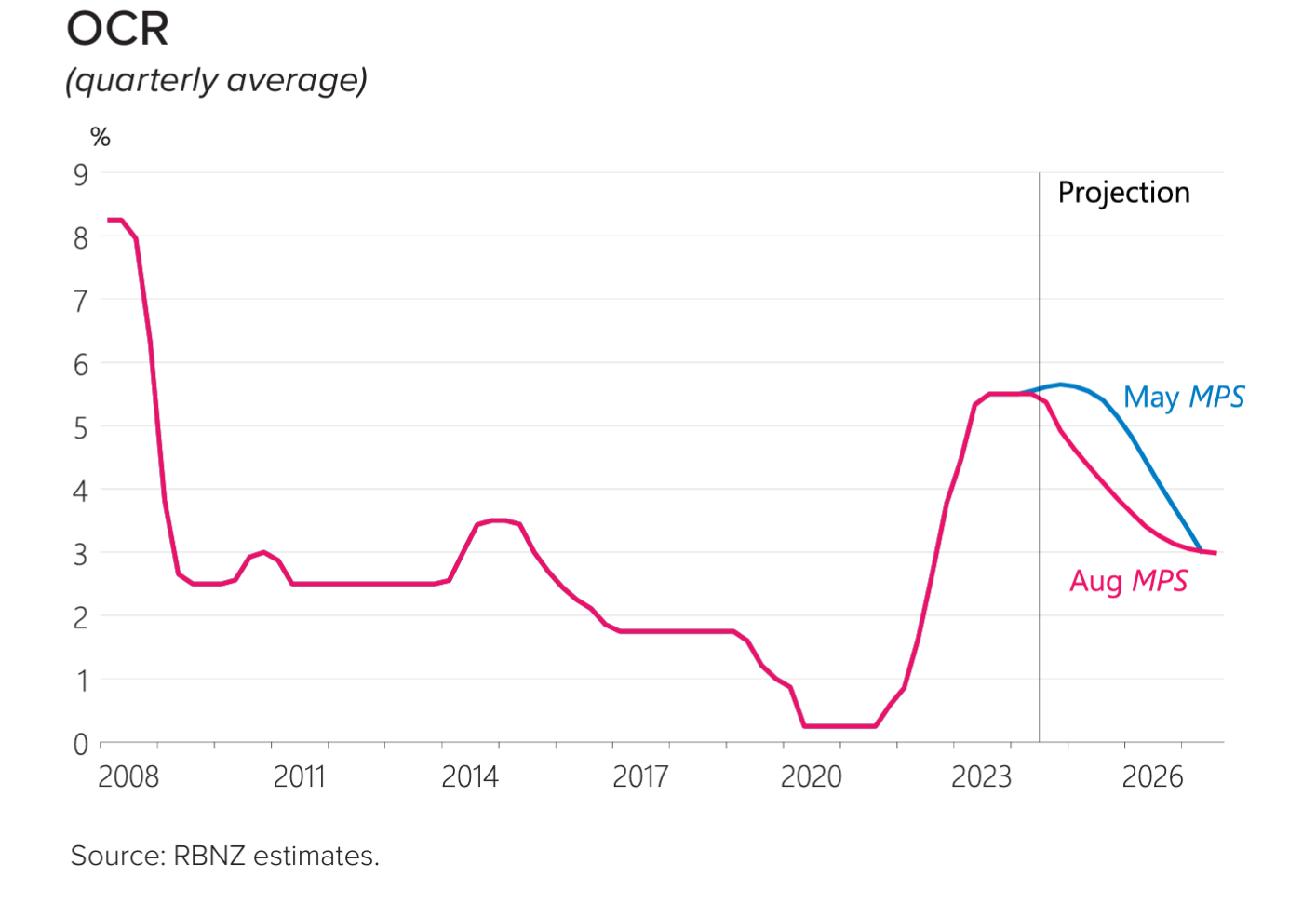

The market was tilted towards a hold from the RBNZ as Q2 CPI remains above 3% at 3.3% y/y while the latest labor report came in red hot with higher participation rate and headline figures. Yet, preliminary data point towards further moderation in the first months of Q3 2024.

The RBNZ cut its cash rate by 25bp to 5.25% in the August meeting with significant revision in their forecast and expects inflation to return to three percent in September 2024. The RBNZ reinforce their view that inflation will continue to tread lower after Q2 CPI came in lower than forecast at 3.3%, shaking off the hot labor report in Q2. They cited "Surveyed inflation expectations, firms’ pricing behaviour, headline inflation, and a variety of core inflation measures" are all aligning with their forecast, which was revised significantly. The OCR forecast has been revised lower to 4.92% in December 2024 from 5.65% and at 3.85% in December 2025 from 5.14%. The OCR path shows continuous easing until year end 2026 at 3% terminal rate. Q2 2024 CPI has been revised lower to sub-two percent from three percent.

The August meeting is a turning point for the RBNZ as they entered the easing cycle. The inflation picture seems to be cooling rapidly in the recent months and prompted the RBNZ to ease earlier than expected. However, the labor market remains red hot and could be a speed bump for RBNZ's smooth cutting plan if wage growth picks up.

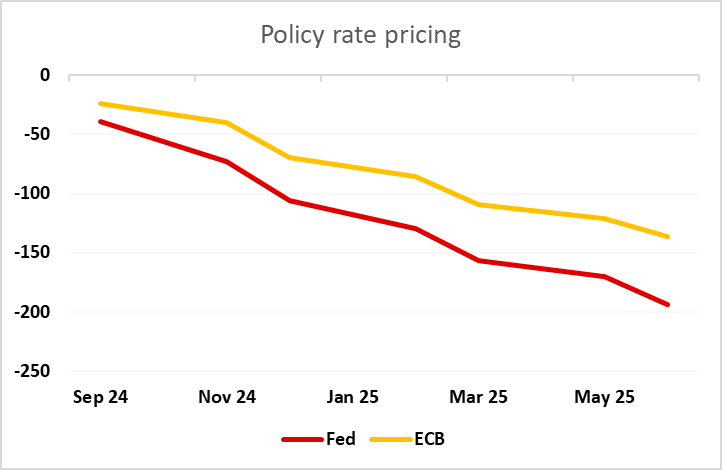

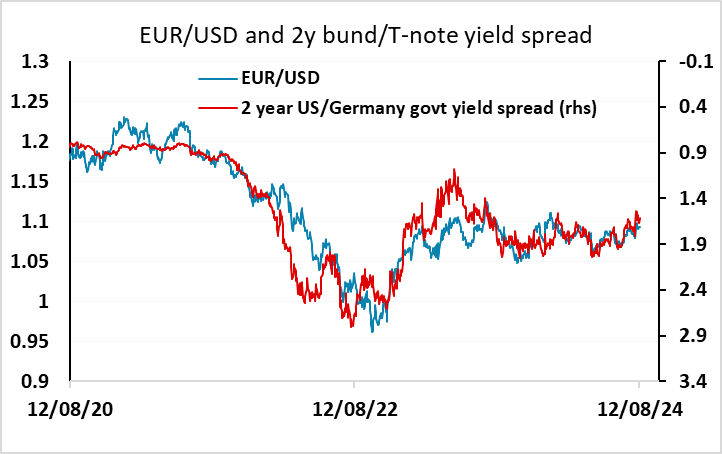

Having said this, the market is pricing for the September FOMC as being around a 50-50 chance between a 25bp and a 50bp rate cut, and at this stage we would see a 25bp move as much the more likely, as the data has softened a little but could hardly be called surprisingly weak. So while the USD may remain a little soft, it will require further evidence of weakness if we are too see significant losses against the EUR, with current short term yield spreads consistent with EUR/USD remaining fairly stable. There remains a stronger case for JPY gains, as yield spreads have been pointing sub-140 for some time, but JPY gains will continue to be hard to achieve as long as risk sentiment remains well supported.

In the UK, CPI inflation’s flirtation with the 2% target is likely to be short-lived. We see the rate rising back up to 2.3% in July from 2.0%, with the core edging down to 3.4%. This projection is a notch below BoE thinking, but in line with market consensus. The rise is solely due to energy base effects related to the Ofgem price cap changes, so shouldn’t have a significant impact on BoE MPC thinking.

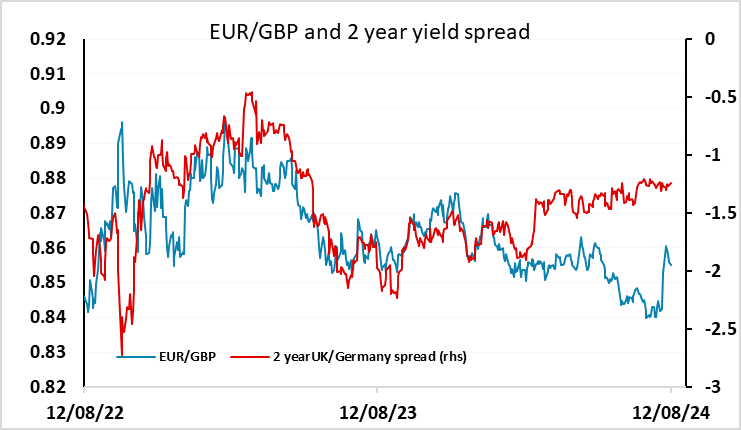

GBP managed gains on Tuesday after the labour market data, with the FX market perhaps focused on the decline in the unemployment rate to 4.2%. But the moves in the short term rate market didn’t support this interpretation, with UK 2 year yields down 6bps on the day, and the GBP gains faded by the end of the European session. EUR/GBP still looks a little low relative to short term yield spreads, so unless we see CPI data come in above expectations, we may see a further retracement in EUR/GBP back up above 0.8550.

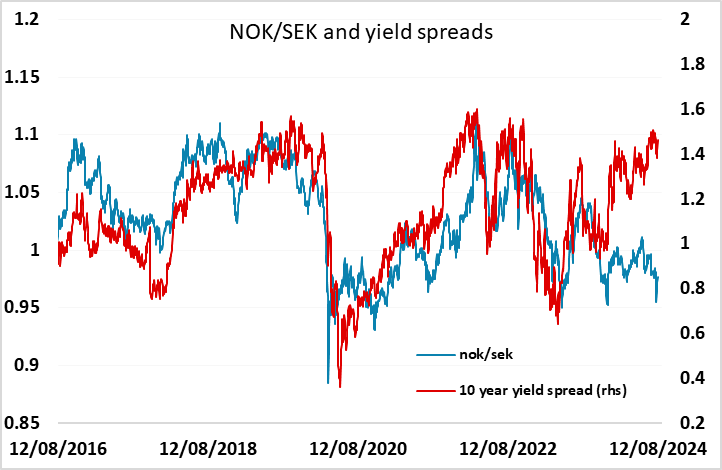

Swedish CPI data is made all the more interesting by the below- expectation and below-target 1.3% outcome in June for CPI-ATE. We see a small rebound to around 1.5% in the July update, which is slightly below the market consensus of 1.5%. The SEK has performed well in recent weeks, but looks a little expensive relative to yield spread moves, particularly relative to the NOK, so a sub-market CPI could trigger some gains in NOK/SEK, especially if the general risk tone remains positive.