FX Daily Strategy: N America, December 6th

U.S. November Employment Rebound from October's hurricanes and strike

Labor Cash Earning Will Capture BoJ's Eye

And Could Drive the JPY Lower

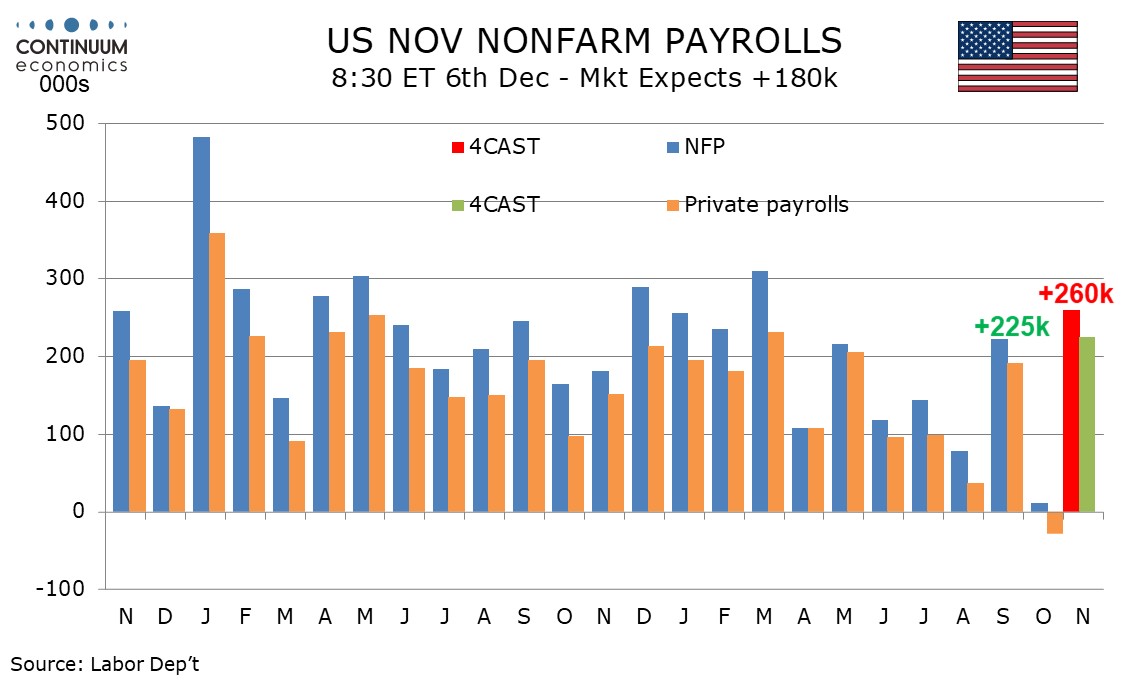

We expect an above trend 260k increase in November’s non-farm payroll, with 225k in the private sector. This will follow weak October outcomes of up 12k overall and down 28k in the private sector, depressed by two hurricanes and a strike at Boeing. We however expect unemployment to be unchanged at 4.1% for a third straight month and a slightly lower 0.3% increase in average hourly earnings. The two month non-farm payroll averages would then stand at 136k overall and 98.5k in the private sector. In September the 3-month averages were slightly stronger than this, at 148k and 109k respectively. We expect manufacturing to increase by 40k after a 46k October decline that was largely due to a now settled strike at Boeing.

How much October’s payroll was influenced by Hurricanes Helene and Milton is hard to say, but initial claims saw a significant spike after Hurricane Helene in early October and Hurricane Milton arrived in the survey week for October’s non-farm payroll. Initial claims have since fallen to see their lowest level since April but continued claims have not seen a similar dip. While the unemployment rate was unchanged at 4.1% in October both the labor force and employment saw significant dips, suggesting some impact from the hurricanes. We expect both series to bounce in November, though employment to rise by more. Before rounding we expect an unemployment rate of 4.11%, down from 4.145% in October but above September’s 4.052%.

The latest Japan labor cash earning and household spendng data was released on Friday's Asia session. Household spending is showing improvement m/m while labor cash earning continues to grow above 2% at 2.6%. These are positive signs for the BoJ and supportive for our call of a 25bp rate hike in December. But ths is still not certian, as the latest month of wage growth shows no real acceleration and may make the BoJ want to look for confirmation in early 2025 wage negotiation. Labor cash earnings have been strong since the second half of 2024, averaging around 3%. However, the latest spike of inflation in Q3 has eaten into it, holding down real wage growth in recent months. The BoJ would love to see wages continue to grow strongly, at least above 2%, to be confident inflation will be sustainably driven by wages rather than cost. Early reports have shown unions will likely for asking for another huge wage hike in 2025 and this should be encouraging for the BoJ to further move into the tightening zone. But small and medium sized businesses continue to struggle to keep up with wage growth from large enterprises.

USD/JPY's correction has been stalled the 150 figure as market participants remain suspicious about a December hike from the BoJ. The key trigger of USD/JPY correction from recent high was the pricing change of a potential rate hike in December from close to zero, to around sealing in 10bps now. Market participants are hesitant to place more bets right now with the BoJ sending mixed signals and their tendency of surprising moves. We expect the BoJ to hike by 25bps in December because of the current inflationary dynamics provides a suitable window for BoJ to further tighten. If such happens, there will be further weakness in the USD/JPY as it was not fully priced in.

On the chart, the bounce from the 148.64 low to regain the 150.00 level has seen prices reaching resistance at 151.28. Daily studies have turned up from oversold reading and suggest room for stronger corrective bounce. Higher will see room to the 152.00 level then the strong resistance at 153.28. Corrective bounce expected to give way to renewed selling pressure later and below the 150.00 level will expose the 148.64 low to retest. Break here will open up room to the strong support at 148.15/00, 50% Fibonacci retracement and congestion area.