Preview: Due July 26 - U.S. June Personal Income and Spending - Q2 data implies some surprises, but possibly in back month revisions

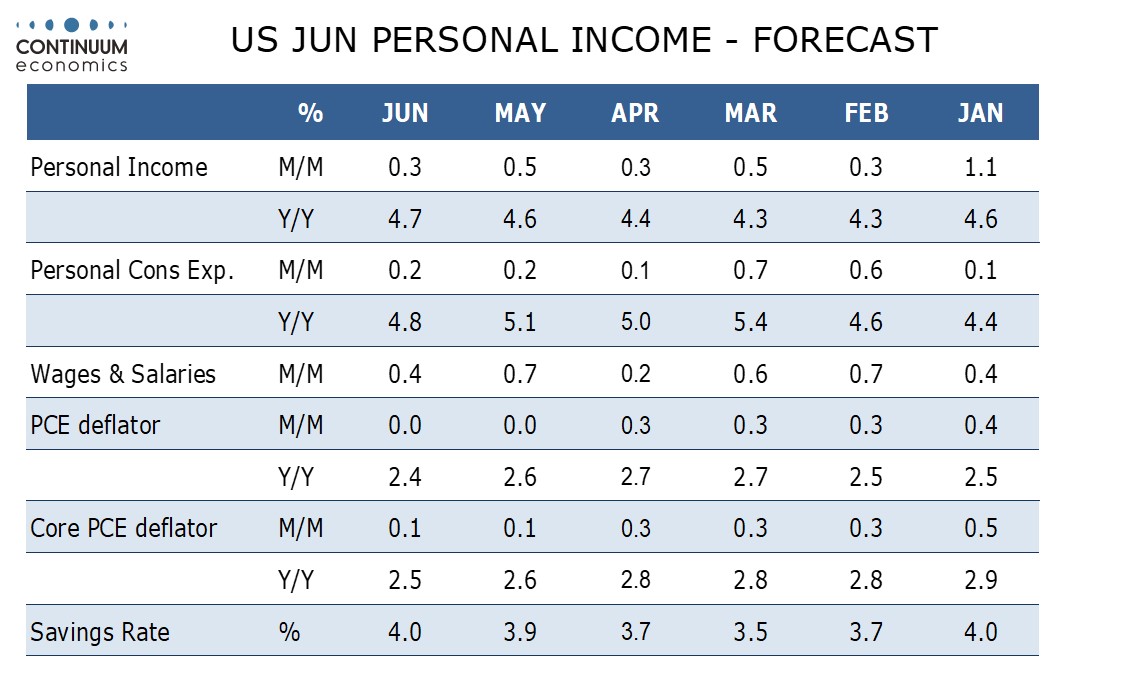

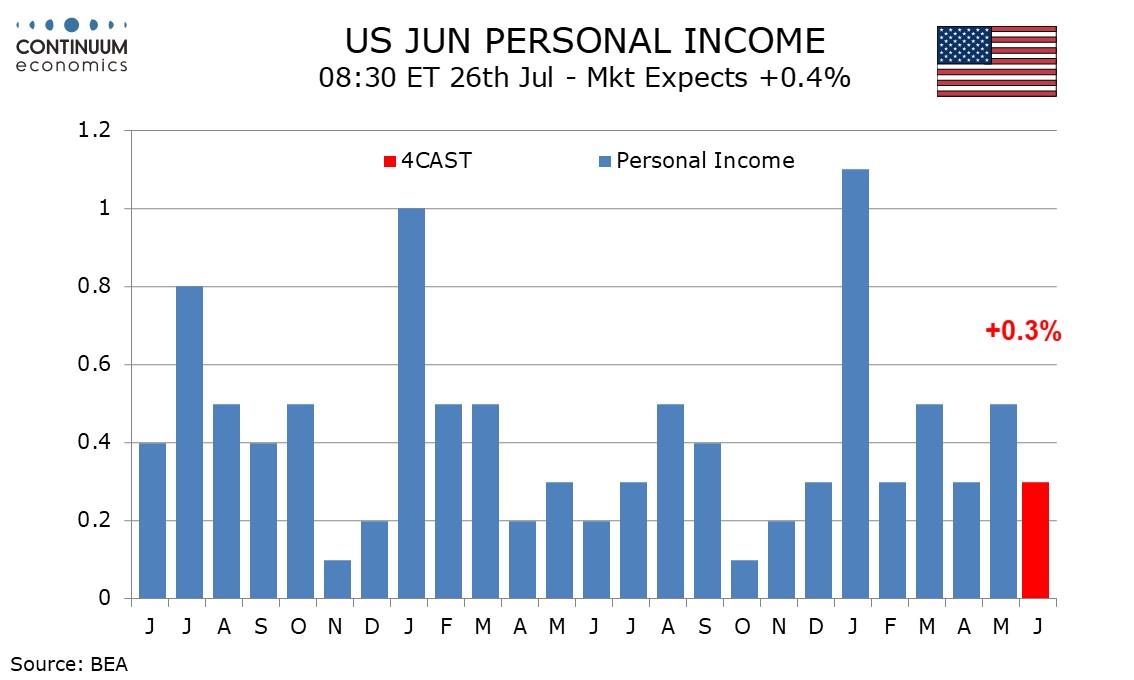

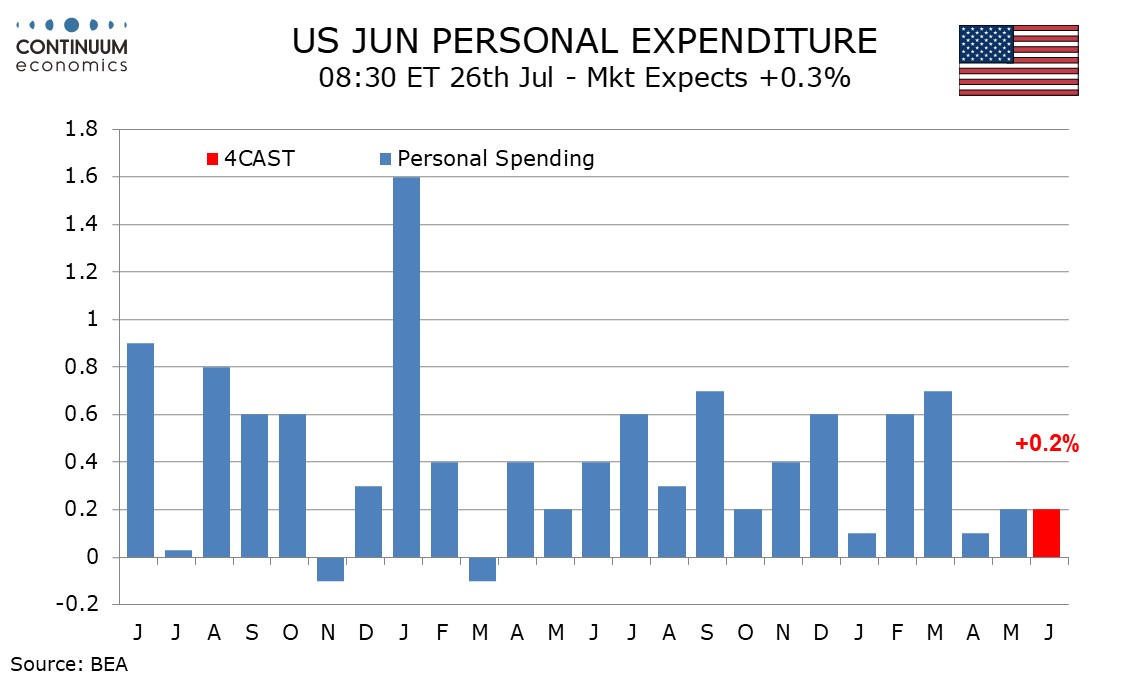

Ahead of the GDP report, we forecast a 0.1% increase in the June core PCE price index, with a 0.3% rise in personal income and a 0.2% rise in personal spending. If there are no revisions to April or May, we would see a core PCE price index rounded up to 0.3%, with personal income unchanged and spending up by a strong 0.9%. However, we expect much of our misses to come in back month revisions.

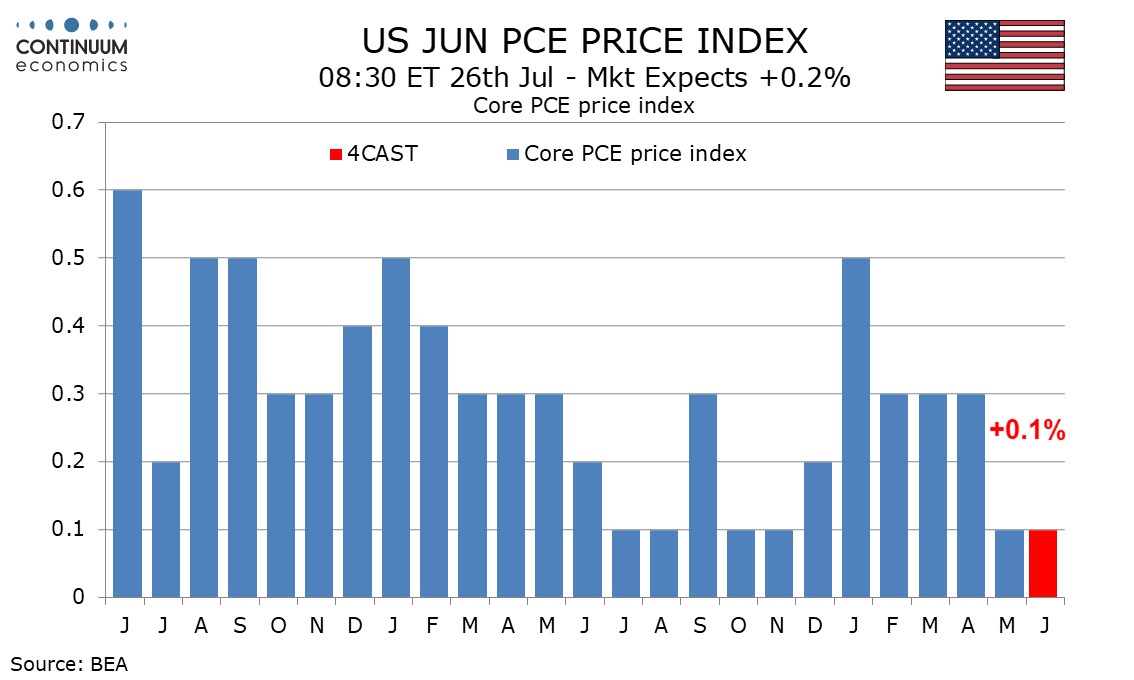

June’s 0.1% core CPI rose by less than 0.1% before rounding which suggests that June core PCE prices are unlikely to reach 0.3%, and with May’s 0.1% core PCE price index coming in softer than a 0.2% May core CPI gain it is unlikely that all the Q2 upside core PCE price index surprise will come from June’s data with no role for revisions.

Ahead of the GDP report we forecast an unchanged overall PCE price index, a little less weak than June’s CPI which fell by 0.1%. Q2 data implies a June overall PCE price index gain on the firm side of 0.1%, but a flat outcome could still be seen if back month data sees upward revisions. Q2’s yr/yr data showed overall PCE prices at 2.6% and core PCE prices at 2.7%. June’s paces are likely to be on the soft side of the Q2 outcomes.