FX Daily Strategy: Europe, October 25th

Japanese Tokyo CPI more significant than usual…

…but USD/JPY still more drive by US treasury yields

Risk of BoJ tightening likely greater than is being priced in

German IFO should be strong enough to prevent significant EUR losses.

Japanese Tokyo CPI more significant than usual…

…but USD/JPY still more drive by US treasury yields

Risk of BoJ tightening likely greater than is being priced in

German IFO should be strong enough to prevent significant EUR losses.

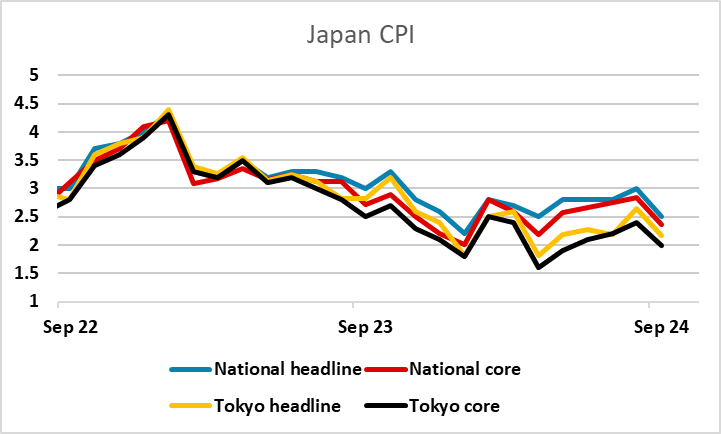

In what has generally been a quiet week for data, Friday sees what is normally a fairly minor piece in the form of the Tokyo October CPI. However, context is everything, and in a week where USD/JPY has gained 3 big figures and attracted verbal intervention from Japanese officials, the CPI data becomes more significant ahead of next week’s October 31 BoJ monetary policy decision. As it stands, the market is pricing no more than a 15% chance of a 10 bp BoJ tightening at this meeting, which reflects the dovish comments from Ueda and new PM Ishiba earlier in the month. But with USD/JPY up 10 big figures over the course of October, the case for a dovish stance is less clear, and if there is evidence of persistent inflationary pressures there is a larger risk of a BoJ move next week than is currently being priced in.

While there have been no signals of any imminent tightening and Ueda’s latest comments suggest no urgency, the weakness of the JPY changes things, as Ueda also said in his latest comments that FX moves were having a bigger impact on inflation than previously. He also highlighted the October CPI as important data for a BoJ decision. The BoJ have a recent history under Ueda of providing very little warning of policy changes, so we think the market is underpricing the risks. The risks continue to be on the upside for Japanese rates in any case, as the market is only pricing 6.5bps of tightening by the December meeting.

Headline Tokyo CPI moderared it o 1.8% y/y, below the 2% target again. But ex fresh food and energy CPI also rose to 1.8%, which suggest underlying trend inflation is indeed supportive for BoJ’s further tightening.

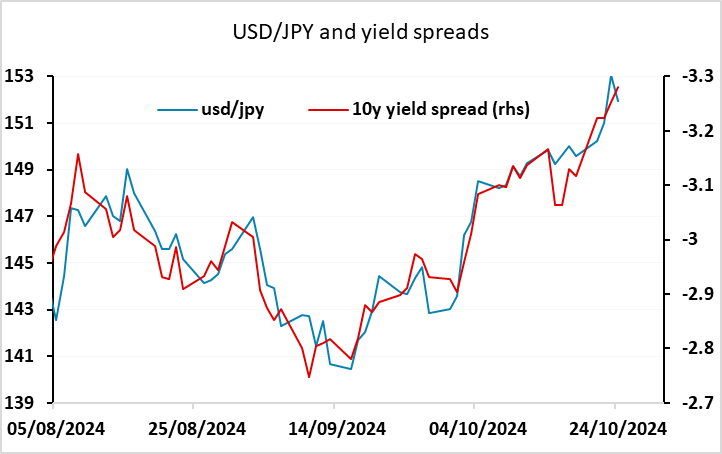

Having said all this, it is still the case that USD/JPY remains largely driven by the movements in longer term yield spreads, which themselves are driven much more by the more volatile UST yields than by JGB yields. So while Tokyo CPI may be important for BoJ policy, a decisive turn lower in USD/JPY is unlikely unless UST yields top out. Thursday’s dip in initial claims and solid S&P PMIs don’t suggest any significant economic weakness is imminent, so the most likely triggers for a USD move are the next US employment report on November 1 and the election on November 5.

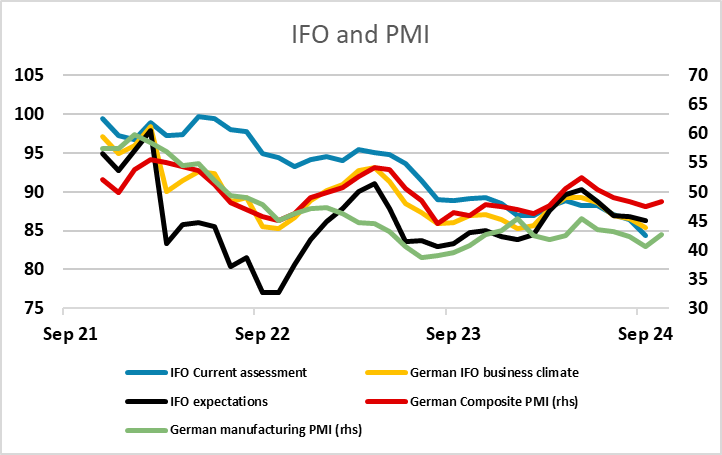

Otherwise Friday sees the German IFO survey and US durable goods orders and the University of Michigan survey, none of which seem likely to have any major impact. The IFO survey nowadays tends to just confirm what we know from the S&P PMI survey, which showed a modest recovery in the German indices. There is still some risk of a 50bp rate cut from the ECB in December, as inflation pressures are clearly weaker than expected, but there currently probably isn’t enough evidence of weak growth to push the ECB into more aggressive easing. This being the case, EUR/USD looks likely to hold above the 1.0750 support area near term.