USD, EUR, JPY flows: USD firm, JPY weak after Fed, BoJ decisions

USD gains on less dovish Fed. JPY weak as Ueda still in no hurry. French data suggests EUR to get support from GDP

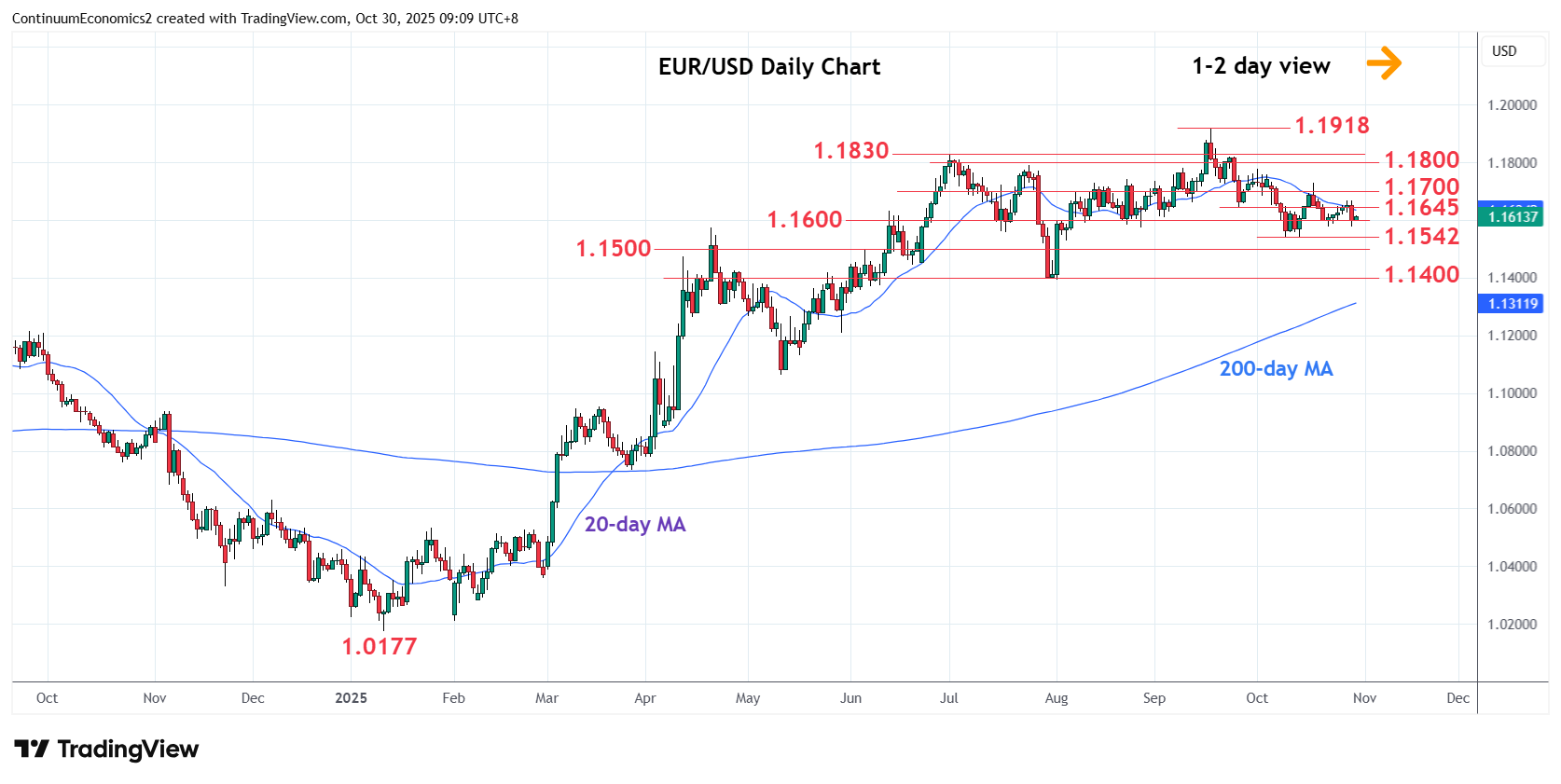

French preliminary Q3 GDP has come in much stronger than expected at 0.5% q/q, driven by exports, which rose 2.2% q/q, while imports fell 0.4%. Whether this is due to intra- or extra-Eurozone trade is unclear at this stage. If the former, there won’t be an impact on Eurozone GDP, if the latter, the numbers are clearly positive for Eurozone GDP, and it is reasonable to assume that some of the gain was due to ex-EZ, so the numbers must be seen as positive. In any case, domestic demand added 0.3% to GDP, which itself is more than the 0.2% total gain expected, so the data has to be seen as positive. We get the Italian, German and total Eurozone data over the rest of the morning. Thus far, there has been no impact on the EUR, which remained broadly steady overnight after the post-Fed dip, but the data looks like being broadly supportive.

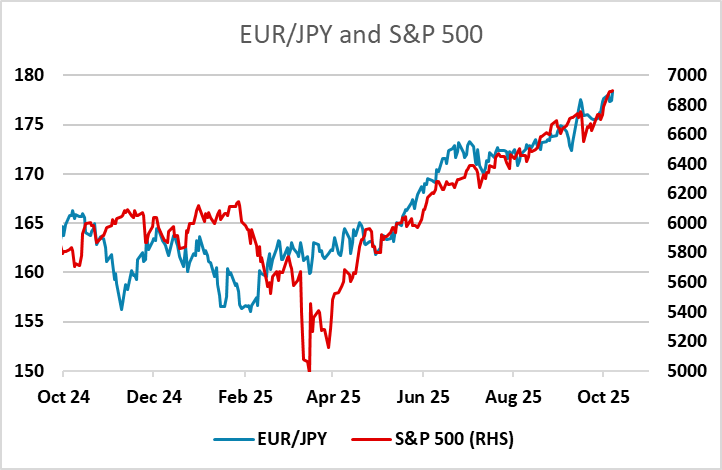

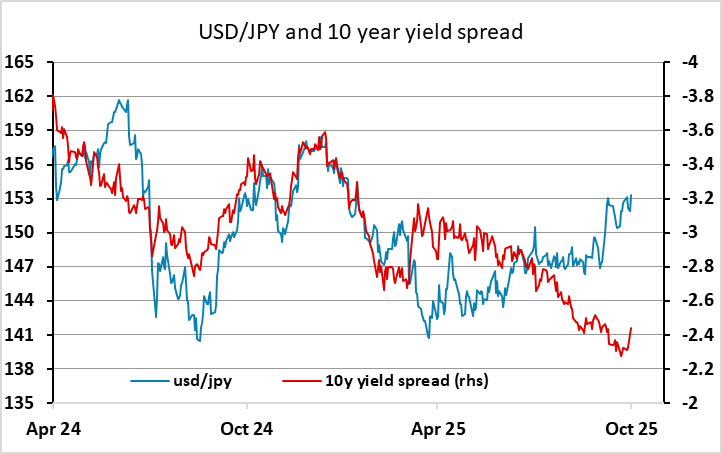

Overnight the Fed sounded a little more hawkish than expected and the lack of certainty on a December hike has pushed up US yields and the USD. Gains have been most notable against the JPY, which fell back after the BoJ left rates unchanged and BoJ governor Ueda sounded as if he was in no hurry to hike in December either. The probability of a December hike form the BoJ is now priced as around 25% from near 50% before the BoJ. Equities showed no clear directional reaction to the quarterly results from Microsoft, Alphabet and Meta, which produced mixed responses in their individual share prices. But the rise in US yields post-Fed means there has been a decline in implied equity risk premia, so valuations look a little more extended than before. There is optimism on the Trump/Xi talks, although no clear-cut result as yet despite some upbeat comments from Trump. Trump said he had agreed to trim tariffs on China in exchange for Beijing resuming U.S. soybean purchases, keeping rare earths exports flowing and cracking down on the illicit trade of fentanyl. But details were scant.

All in all the overnight news is USD positive and JPY negative, with the EUR supported by the French GDP data this morning.