FX Daily Strategy: APAC, December 10th

FOMC likely to cut 25bps but with dissents

Market may see the move as a “hawkish ease”

USD has upside scope, but JPY weakness looks extreme

CAD unlikely to be impacted by BoC

FOMC likely to cut 25bps but with dissents

Market may see the move as a “hawkish ease”

USD has upside scope, but JPY weakness looks extreme

CAD unlikely to be impacted by BoC

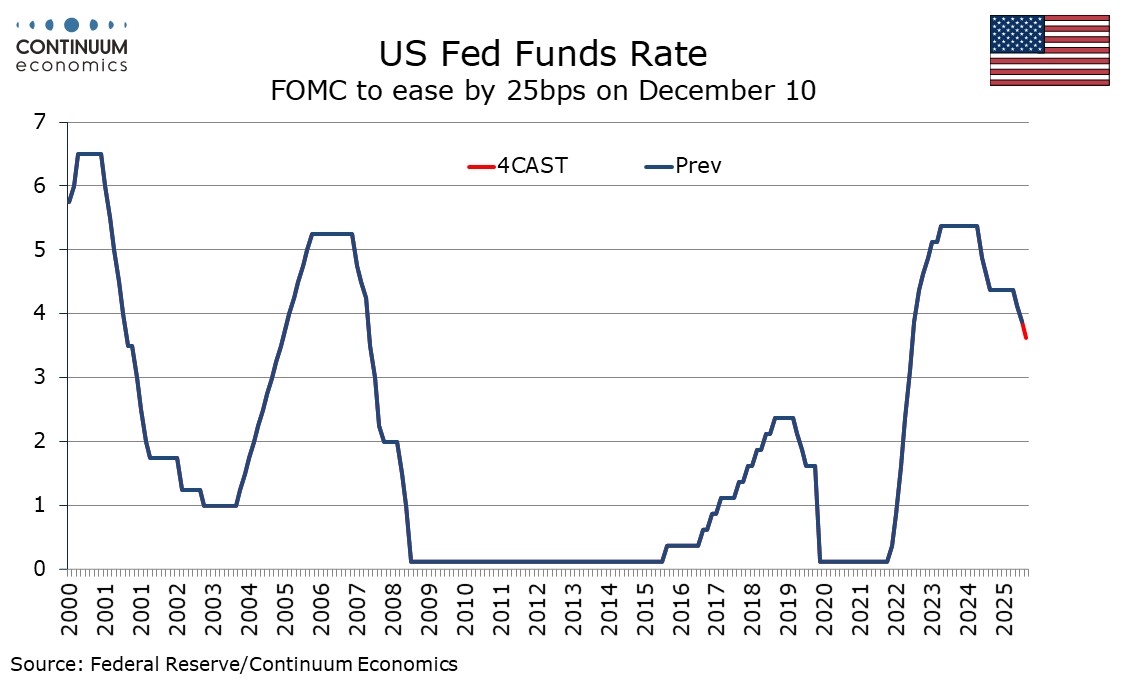

Wednesday sees the main event of the week in the FOMC meeting. A 25bps easing in the Fed Funds target range to 3.50-3.75% looks likely, justified by labor market risks. However, at least two hawkish dissents for unchanged policy are likely. The meeting will deliver updated dots, though we expect changes from those in September to be modest. After the last meeting on October 29 Chairman Powell stated that there were strongly differing views on December and that easing was far from sure. Whatever the decision, the vote is unlikely to be unanimous.

The market is pricing a 25bp cut as an 88% chance, which is somewhat more confident than we are. We also see some risk that the cut is seen as a “hawkish ease” in that it suggests this could be the last move for some time. We would expect Powell at the press conference to signal that policy is now at an appropriate level, and that sufficient insurance against labor market weakness has been taken. Given that the market is pricing in a further 50bps of easing in 2026, this suggests some risk that front end US yields rise even with a 25bp cut. However, the first 2026 cut is only priced in for June, so we wouldn’t expect a large reaction. Some further easing is still likely to be priced in for 2026. The USD may therefore see a mild positive reaction, with the JPY and CHF still looking like the most vulnerable currencies short term.

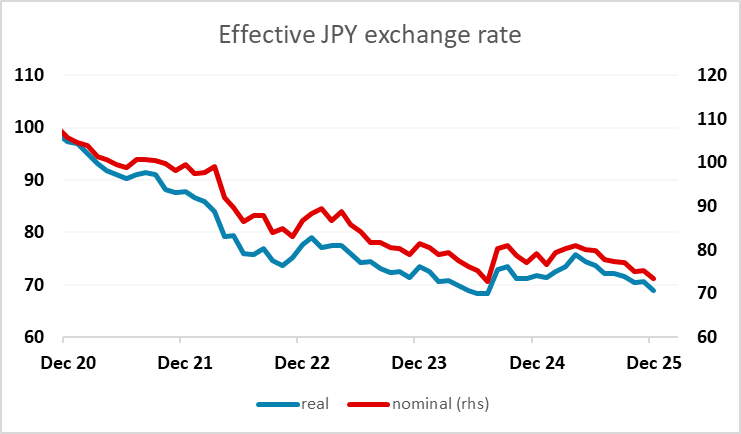

Tuesday saw EUR/JPY trade to new all time highs and GBP/JPY to a new post 2008 high without a clear trigger. Comments from BoJ governor Ueda if anything supported the likelihood of a BoJ hike next week, but he did also suggest that the BoJ would limit further rises in 10 year JGB yields by more bond buying if necessary. This might normally be seen as JPY negative, but the failure of the JPY to respond to the rise in JGB yields and the narrowing of yield spreads in the last 6 months suggests other factors are more dominant. Rising US yields and the consequent decline in the implied US equity risk premium may be more relevant drivers for the JPY. More rises in US yields might drive the JPY lower still, unless there is an outsize negative response from equity markets. We remain wary of potential BoJ intervention if we see a threat of new lows in the JPY trade-weighted index given recent comments.

There is also a BoC meeting, but this is generally expected to produce no change in policy, and the impact on the CAD should be modest. After easing in both September and October, the BoC after its October move stated rates were now at about the right level if the economy evolved in line with its expectations. With Q3 GDP and November employment having come in stronger than expected, further easing looks increasingly unlikely, but the strength in the data is not yet convincing enough for the BoC to start considering tightening. The market is pricing the next move as being up, but only modestly and not until H2 2026, so we doubt the BoC will say anything to undermine this view.