FX Daily Strategy: N America, April 18th

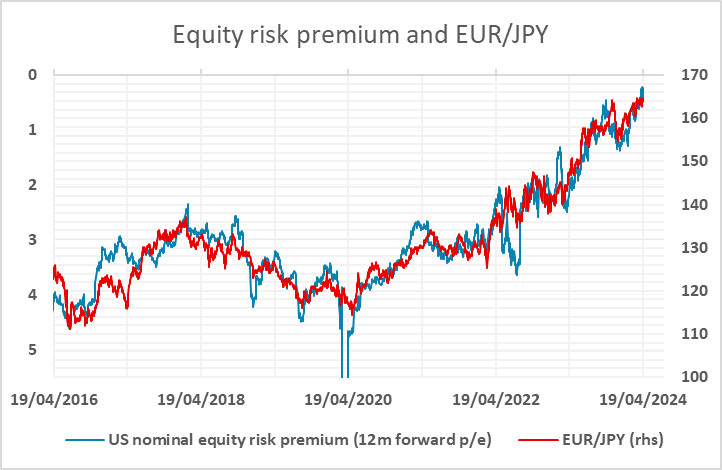

Japanese CPI Continue to Moderate

Underlying weak JPY trend only likely to turn with lower US yields

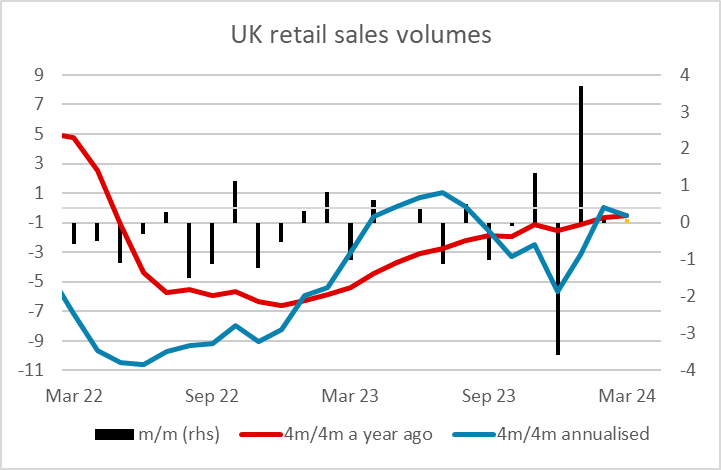

GBP downside risks on retail sales

EUR/NOK due to turn lower

UK retail sales were unremarkable at flat on the month. The trend is similarly quite flat. Although the volatility in December/January has made the 3 month annualised gain very strong, the 4m/4m trend remains very flat, but we are seeing a steady if slow improvement in the y/y trend. GBP is little changed on the data and looks set to hold in the 0.8550-0.8600 range near term.

The JPY was also essentially unaffected by the as expected Japanese CPI data overnight, but did get a boost from the general risk sell off triggered by the Israeli attack on Iran. But Iran has minimised the significance of the damage, and it looks like this will be the end of the skirmish, so we doubt there will be any extension of the risk decline. Indeed, we may see a risk recovery through the day as the markets judge the tension in the Israel/Iran situation has dissipated. This could mean that EUR/JPY and EUR/CHF (and other risky currencies vs the CHF and JPY) recover further.

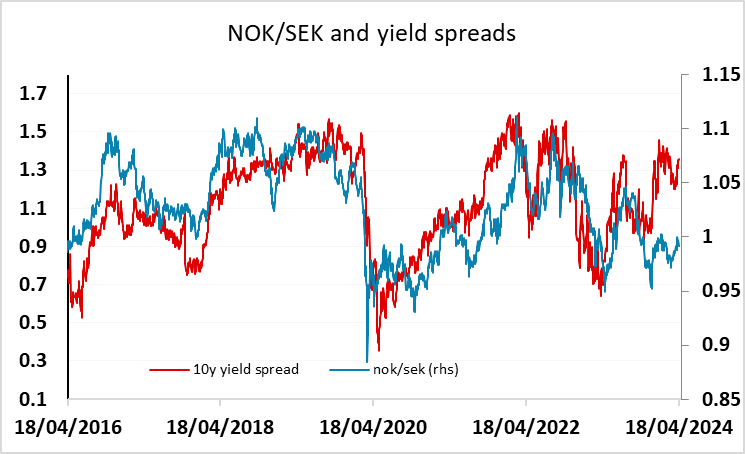

Thursday saw some initial strength in the SEK, which produced a retreat from a test of parity in NOK/SEK. We continue to favour the upside in this pair based on the history of the correlation with the yield spread, but the move is likely to need to come from EUR/NOK, with EUR/SEK also looking too high relative to historic correlations.