EUR, USD, JPY flows: EUR/USD ambiguous after trade deal, JPY weak

EEUR/USD failes to maintain initial gains on trade deal. EUR/JPY continues to advance towards all time high

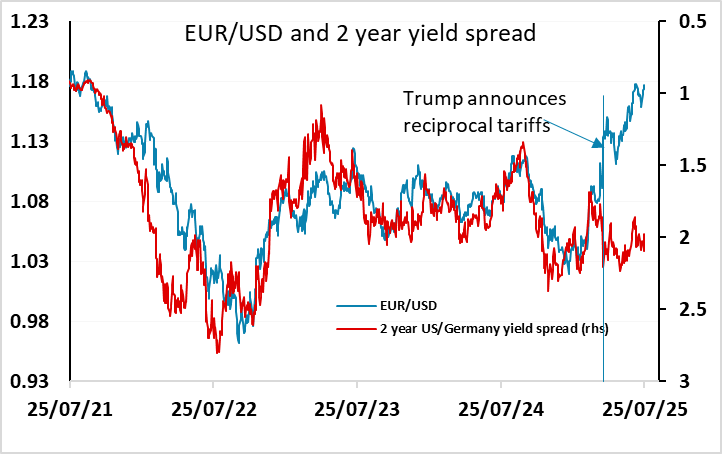

The EUR initially benefitted slightly from the announcement of the US/EU trade deal at the weekend, but is trading lower in early trade this morning. The details of the deal are similar to the deal with Japan announced at the beginning of last week, with a 15% tariff on EU exports to the US and a chunk of EU investment in the US, with no retaliatory EU tariffs. This is along the lines of what most expected towards the end of last week after comments from EU negotiators. As we noted before, the implications of the deal for EUR/USD are not entirely clear. The fact that EUR/USD has gained sharply since the initial announcement of (a higher level of) reciprocal tariffs at the beginning of April suggests this more moderate deal could be seen as USD positive. However, it could be argued that the initial level of tariffs was never seen as likely to persist, and the move over the past few months anticipated a deal along these lines. Also, the structural shift of international investors away from US assets triggered by the initial deal seems unlikely to be reversed, as there is still less international confidence in exceptional US growth than there was before the tariff announcement. So while we see a small USD positive move as the most likely market impact, we doubt we will see much of a EUR/USD decline, with the 1.16 area still likely to provide good support for now.

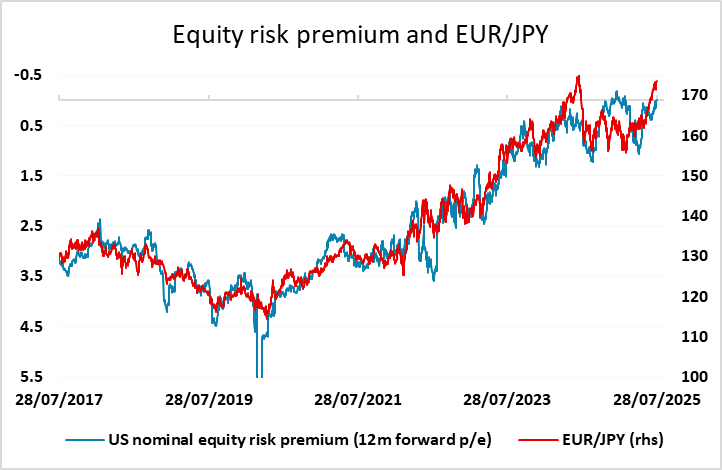

More broadly, the market response has been risk positive, with all the main equity futures up, with the exception of Japan. The FX reaction has been similarly risk positive, with the JPY initially falling back across the board. EUR/JPY has made another new 1 year high and is approaching the all time high above 175 from a year ago. The opening gap in EUR/JPY overnight hasn’t been closed, but the gaps in most of the other JPY crosses have. We continue to see equity markets as being overvalued here, notably the US. While tariffs are a little lower than feared, we have 15% tariffs on the US’s major trading partners, which is a growth negative development, so markets look vulnerable if we see any evidence of growth weakness. However, for now there isn’t much to stand in the way of the positive sentiment, and JPY weakness against the USD and high yielders may well extend.