FX Daily Strategy: Europe, March 5th

EUR/USD still range-bound ahead of main events in the second half of the week

Upside favoured as expectations of ECB easing have faded

Higher Tokyo CPI sees potential of higher JPY

US ISM services data suggests mild USD downside risk

EUR/USD still range-bound ahead of main events in the second half of the week

Upside favoured as expectations of ECB easing have faded

JPY focus on Tokyo CPI, with potential to recover Monday’s losses

US ISM services data suggests mild USD downside risk

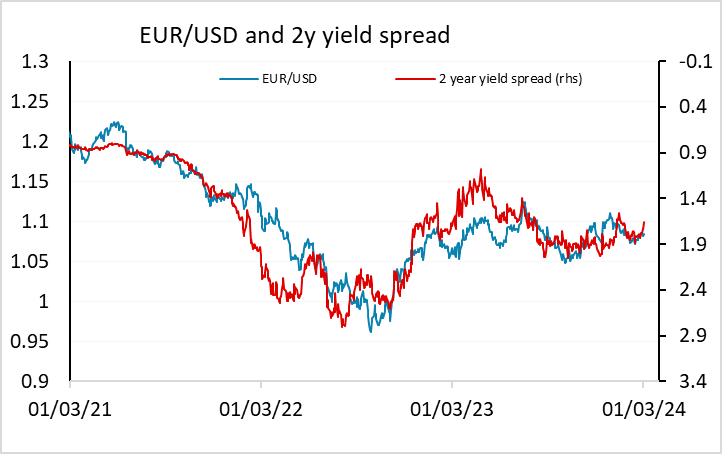

The main focus of the week is the US employment data on Friday and the ECB meeting on Thursday, although Powell’s semi-annual testimony on Wednesday will also be a focus. Before then, major FX moves look unlikely. EUR/USD looks to be stuck in the 1.08-1.09 range, and it will take some news to break it out. In the wake of the Eurozone CPI data, the risks look to be weighted to the EUR upside, as the chances of a more dovish tone emanating from the ECB meeting have diminished, and yield spreads have moved slightly in the EUR’s favour. The market has moved very much towards a June rather than an April ECB cut, with April now only around 20% priced, and June down to 90% from 100%. We may therefore see EUR/USD push towards 1.09 ahead of the ECB meeting, with a modest break higher possible if they effectively rule out an April move. However, the risks may also be slightly to the upside in US yields as well, with the Fed outlook similarly priced and US data more clearly on the strong side, at least ahead of the employment report.

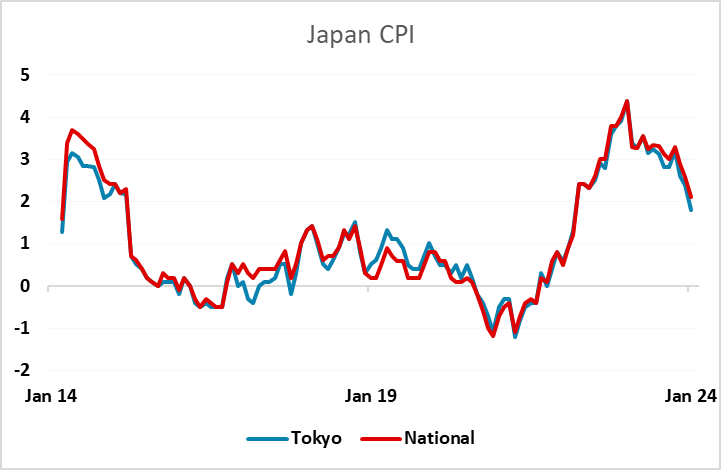

Monday saw EUR/USD stay in the centre of the 1.08-1.09 range, but there was a generally risk positive tone to trading, with the JPY and CHF both on the back foot. JPY weakness came in spite of Japanese press speculation that he government was preparing to announce the end of deflation, in preparation for a BoJ tightening in the spring. Of course this is already close to being priced in, with a 7 bp rise in the policy rate priced for April and a 10 bp rise fully priced for June, so the lack of a JPY reaction was not a big surprise. Even so, there is potential for more movement in longer term yields than there is in the policy rate. The 1% level is no longer a hard ceiling for JGBs, and if the market sees a normalisation to policy coming, the is scope for a move above 1% in JGB yields, which would have a significant impact on yield spreads and the JPY. The Tokyo CPI data early on Tuesday could have an impact, with the market looking for a sharp rise to 2.5% in the y/y rate, due mainly to base effects, but the main focus is still on the age agreements in the spring, which could set the scene for a sustained tightening in policy.

Following a dip below 2% in January, the Japanese Tokyo CPi rebounded in February. Headline y/y CPI came in at 2.6% from prior 1.8%, ex-Fresh Food 2.5% from prior 1.8% and ex Fresh Food & Energy 3.1% from prior 3.3%. Both the headline and ex fresh food see a significant rebound while ex fresh food and energy continues to moderate. The data echoes our forecast to see a rebound in Q1 2024 before further moderation throughout the year. While in a short run the data may affect sentiment and see JPY strength, the key factor remains in labor cash earning to see a sustainable trend of inflation.

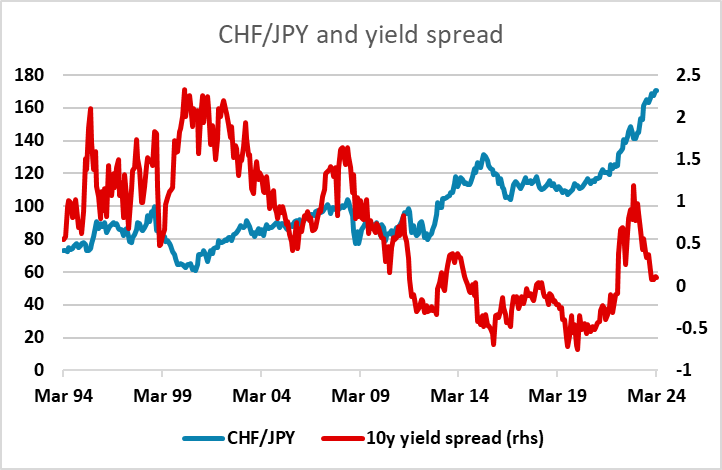

Nevertheless, the JPY was soft on Monday along with the CHF, with the higher yielders benefiting from the low volatility. The CHF did see some initial strength on the back of a marginally stronger than expected February CPI number, but after the sharp drop in January this still left CPI well below the SNB’s projections, and the CHF quickly reversed gains, with EUR/CHF making a new post-December high above 0.96. We continue to see scope for CHF weakness, but CHF/JPY remains the clearest value trade, with potential for the JPY to benefit from tightening BoJ policy just as the CHF starts to suffer from an easier SNB stance.

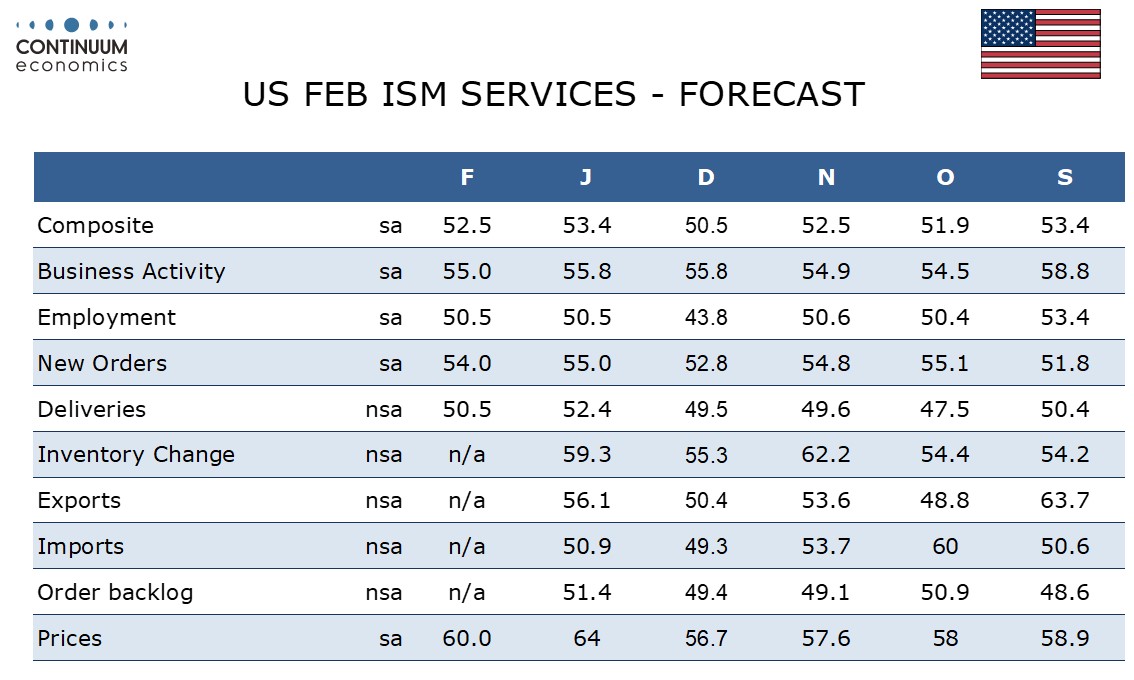

The ISM non-manufacturing data in the US is probably the data with the most potential for market impact on Tuesday. We expect February’s ISM services index to slip to 52.5 from January’s stronger reading of 53.4, putting the index back at November’s level which preceded a weaker 50.5 in December. This is slightly weaker than the market projection, so suggests we could see the USD testing the bottom end of Monday’s ranges.