FX Daily Strategy: N America, October 9th

NZD downside risks on dovish RBNZ

AUD/NZD has substantial upside scope

CHF may extend Tuesday decline, especially against the JPY

EUR/USD looking toppy near 1.10

NZD downside risks on dovish RBNZ

AUD/NZD has substantial upside scope

CHF may extend Tuesday decline, especially against the JPY

EUR/USD looking toppy near 1.10

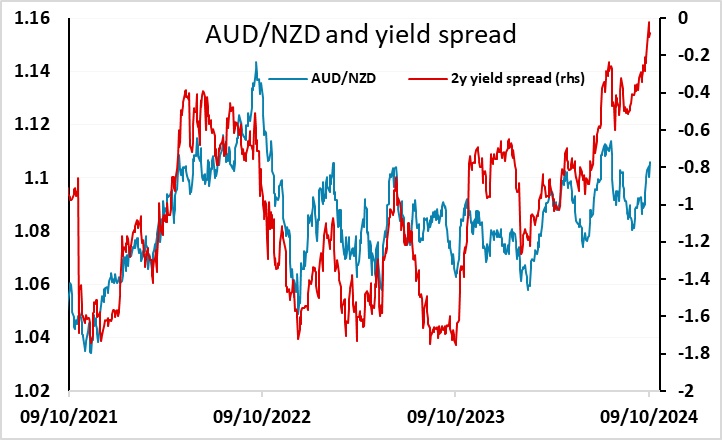

Wednesday kicked off with the RBNZ rate decision. The market was fully pricing in a 50bp cut, with another 40bps priced for November. The RBNZ delivered the expected 50bp cut and suggested another was on the way. The NZD fell in response, losing around 0.5%, with the market now pricing another 50bp cut in November as a 90% chance. We still see plenty of upside scope for AUD/NZD, with yield spreads at their narrowest since 2019.

However, the AUD is dragged down more by weakness in Chinese equities than the NZD, and Chinese equities softened again overnight. But the losses of the last two days have only reversed the gains seen in the futures during Golden Week, and equities are still at much better levels than they were before China announced its stimulus measures. We would expect the AUD to find support above 0.67 and AUD/NZD to advance beyond 1.11.

Elsewhere the calendar is quiet with the US CPI data on Thursday still the main market focus. There was generally not much movement in G10 currencies on Tuesday, with EUR/CHF gains perhaps being the most notable development, although even these were relatively modest. Still, EUR/CHF has pushed above 0.94, and should have scope for some further gains is risk sentiment remains steady. The CHF has significantly outperformed the JPY in recent weeks, benefitting from reduced expectations of BoJ tightening and concerns around the Middle East. But despite the more dovish BoJ tone, longer term JGB yields have risen and yield spreads have moved in the JPY’s favour. We still look for a substantial decline in CHF/JPY over the coming years, and current levels look likely to be toppy.

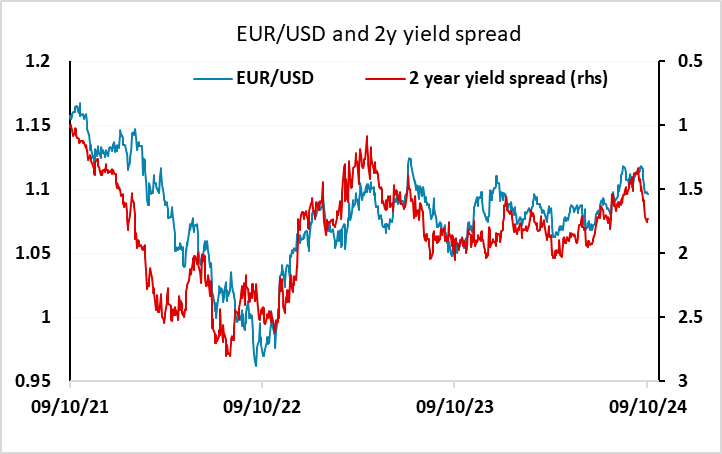

EUR/USD has remained resilient in the last couple of days, holding fairly steady in spite of the rise in US yields since the employment report last week. But yield spreads are pointing fairly clearly to downside risks here, and anything close to 1.10 looks likely to be a selling opportunity for the short term, as there is little reason to expect the market to reduce its expectations of ECB easing, while if anything the risk in the US is that the two 25bps rate cuts priced by the end of the year are seen as less than certain.