FX Daily Strategy: N America, October 8th

Japanese wage data of interest given recent JPY weakness

AUD still has upside scope as RBA minutes gives no surprise

GBP weakness can extend

NOK/SEK starting to move higher

Japanese wage data of interest given recent JPY weakness

AUD still has upside scope as RBA minutes gives no surprise

GBP weakness can extend

NOK/SEK starting to move higher

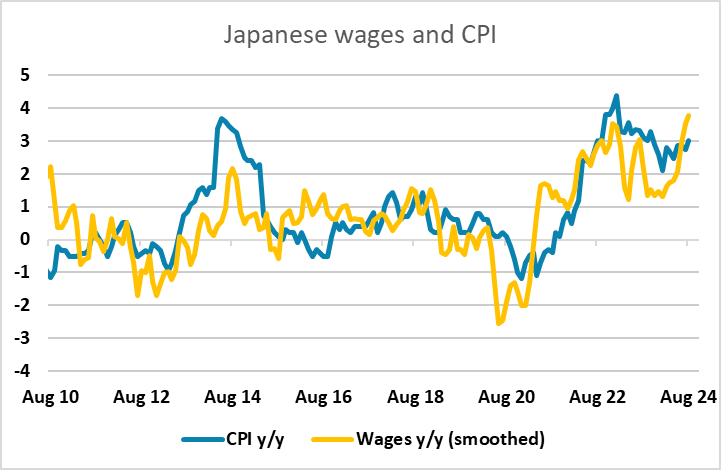

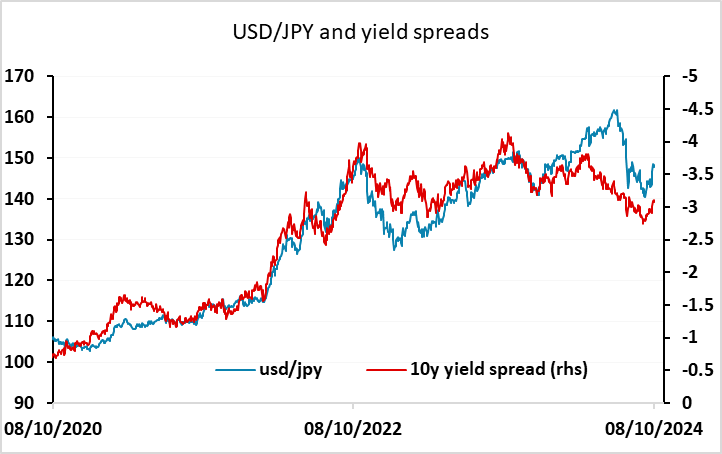

Tuesday is a fairly quiet day for data, with most of the market focus on the US CPI data later in the week. However, given the weakness of the JPY in recent weeks, and particularly since the employment report, the Japanese wage data was of some interest. Labor cash earning continued to grow strongly at 3% y/y in August while the data may not be as strong as forecast, it continues to point to a consumption rebound for Japan in Q3. However, Japan economy minister Akazawa left a remark after August labor cash earning data being released and says that the drop in real wages is not good news. He also voiced support that the Japanese government will create favorable environment for wage hikes but so far these are just words.The comments from Ueda and Ishiba recently indicate that an October tightening is not on the cards, but we still see scope for a move in December, and unless the wage data is much weaker than expected, we will continue to anticipate a December hike. As it stands, the market is pricing only 8bps of December tightening, and 33bps by the end of 2025. This still seems on the low side to us, and the JPY has potential for a recovery if the wage data strengthen given recent weakness and yield spreads that still suggest current JPY levels are too low.

There were also minutes from the last RBA meeting, but these provided no surprises. Currently a 25bp December rate cut is seen as close to a 50-50 chance, and while the minutes kept hopes of an easing alive, they didnt have much impact. Nevertheless, the AUD fell back because Chinese equities weakened on the reopening of the cash market after Golden week.

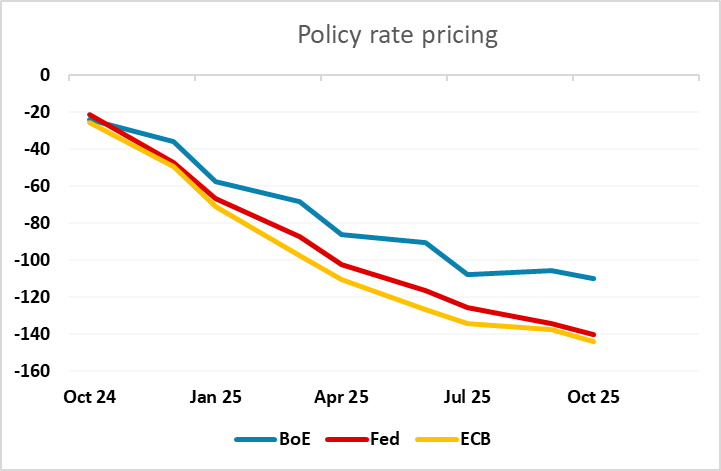

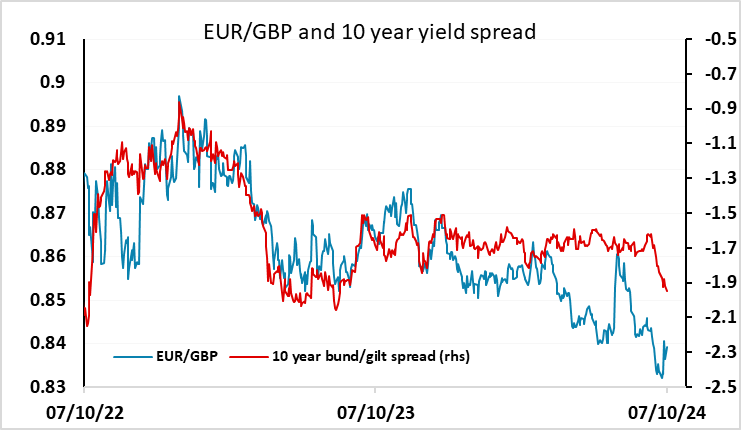

There isn’t a great deal of note on the European calendar, but it was noticeable on Monday that EUR/GBP moved back up towards 0.84 after dipping following Friday’s employment report. The market is now pricing the BoE moving more closely with the Fed and ECB in the coming months, but is still pricing relatively tighter BoE policy further out. We still see scope for the market to price in easier BoE policy in 2025 and this would suggest more GBP downside scope. As we have noted before, EUR/GBP remains quite cheap from a longer term perspective, and if the BoE matches the ECB, there should be scope for a move up well above 0.85 over the coming months.

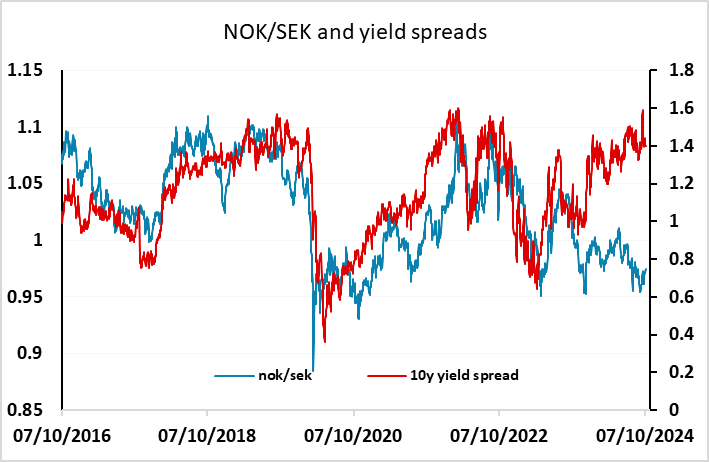

Finally, it’s worth noting that NOK/SEK is starting to make some upside progress, hitting its highest since August on Monday. The NOK may be being helped by the rise in the oil price and concerns about potential supply disruption due to the Middle East conflict, but in the bigger picture yield spreads have been suggesting scope for substantial gains for some time. If sentiment is turning there is scope for a sharper move up towards parity.