FX Weekly Strategy: Europe, October 7th-11th

US CPI the main focus with the USD well supported

EUR could fall further as Friday rise in EUR yields unjustified

JPY remains under pressure with little chance of reversal of recent losses near term

Oil price will be watched for any impact from Middle East developments

Strategy for the week ahead

US CPI the main focus with the USD well supported

EUR could fall further as Friday rise in EUR yields unjustified

JPY remains under pressure with little chance of reversal of recent losses near term

Oil price will be watched for any impact from Middle East developments

After the much stronger than expected US employment report on Friday, the USD comes into the week very well supported, with US yields generally higher and expectations of Fed easing pared back. Nevertheless, there is still a 25bp rate cut priced in for November, and while US yields are lower, yield spreads haven’t really moved far enough to suggest there is scope for further USD gains. Indeed, USD/JPY continues to trade at levels that look significantly too high relative to yield spreads, while EUR/USD is broadly moving in line. But it will be hard to reverse any of the USD strength seen after the employment report unless there is news that goes against the narrative of a stronger than expected US economy. This could come in the shape of the US CPI data on Thursday. But our forecast of a 0.1% rise on the month is in line with the market consensus, so shouldn’t have too much impact. As long as this is at or below consensus, we wouldn’t expect the expectation of a 25bp Fed cut in November to be disturbed, and US yields should broadly hold close to the levels reached after Friday’s employment data.

There is some potential for EUR weakness to extend beyond the lows seen on Friday, as the higher yields in the US were largely mirrored in Europe, but Europe lacks the justification of stronger data. This could mean EUR/USD losses extending towards 1.09, but the decline is unlikely to be dramatic as there is little data this week and there isn’t a lot of scope for yields to fall with a 25bp rate cut still fully priced in for October.

The JPY was the main victim of the strong US data o Friday, but had been suffering all week due to the comments from BoJ governor Ueda and new PM Ishiba, both of whom indicated that there was no current desire for any further monetary tightening. The comments look a little unwise, as the markets have taken them as a green light to sell the JPY. In reality, while their comments do likely rule out an October rate hike, there is still potential for a December move, especially if the data show recent wage increases starting to feed through to prices in the October CPI data. This week, there is key labour cash earnings data on Tuesday. There have been signs of a pick up in recent months, but bigger gains will be needed to convince the BoJ that the way is clear for a further rate hike this year. There has been a significant rise in JGB yields in the last week, and there may be scope for the BoJ to allow a further rise from here if they are concerned about the weakness of the JPY. But even though yield spreads suggest there is some scope for a JPY recovery, the Ishiba comments make it hard for sentiment to turn without some clear support from data or a turn in risk sentiment.

GBP suffered declines in the last week after BoE governor Bailey suggested more aggressive easing was on the cards, so there will be interest in this week’s GDP data. This is expected to be solid enough, with both the market and ourselves looking for a 0.2% m/m rise. With the market near enough fulling pricing in a 25bp easing in November, the risks from here may be that stronger data undermines that expectation, so risks might be slightly on the GBP upside, even though we see scope for longer term GBP declines from here, at least against the EUR.

There is also still a risk of market reaction to geopolitical events. In particular, the market awaits the Israeli reaction to the Iranian missile attack last week. Reports suggests that the US is discouraging any attempt to hit Iranian nuclear facilities, and suggesting that any retaliation should rather be aimed at oil facilities. The oil market could well react to any serious disruption of Iranian oil production and distribution, especially if the Iranians reacted with their own disruption of the straits of Hormuz. Equity risk premia remain very low by historic standards, so risks are towards greater risk aversion. However, f it comes with higher oil prices, the USD will likely be the biggest beneficiary, with some positive impact also likely for the CAD and NOK, while the JPY an the CHF might outperform the EUR but might struggle to make ground against the oil producing currencies.

Data and events for the week ahead

USA

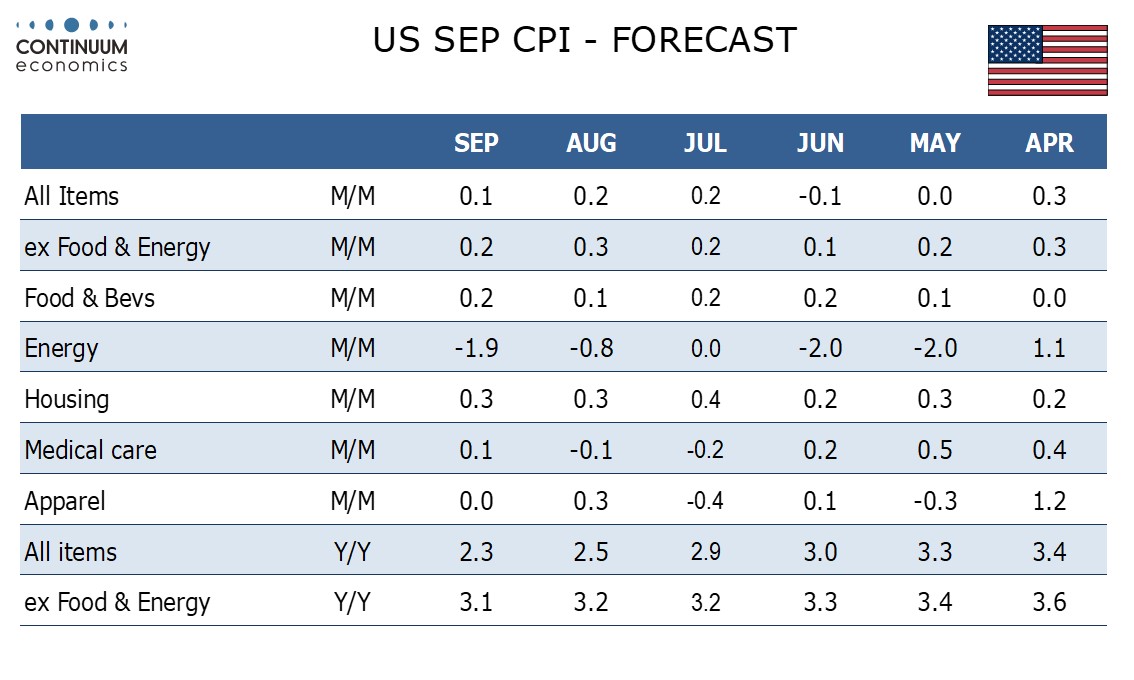

The US calendar highlight will be September’s CPI on Thursday, where we expect a rise of 0.1% overall and a little less before rounding, with the core rate at 0.2% and very close to that even before rounding. Thursday also sees weekly jobless claims. On Friday we expect September’s PPI to look similar to the CPI, unchanged overall and up 0.2% ex food and energy. Preliminary October Michigan CSI data is also due on Friday.

There are plenty of Fed speakers scheduled. Monday sees Kashkari, Bostic and Musalem, and Tuesday Kugler, Bostic and Collins. Minutes from the September 18 meeting are due on Wednesday, which we expect will show a serious debate between the 50bps easing that was delivered and a smaller 25bps move, with risks on both sides discussed. Those on employment are likely to have been crucial in the decision. Bostic, Logan, Goolsbee Collins and Daly also speak on Wednesday. Williams speaks on Thursday and Goolsbee and Logan are scheduled on Friday.

Other data releases include August consumer credit on Monday, and on Tuesday September’s NFIB small business optimism survey and August’s trade balance. We expect the latter to show the deficit falling to $71.4bn, the lowest since March, from $78.8bn. August wholesale data is due on Wednesday.

Canada

Canada releases August trade data on Tuesday. Friday’s data will be closely watched by the Bank of Canada, both September’s employment report and the Q3 BoC business outlook survey. August building permits are also due.

UK

Major data awaits with the August GDP data (Fri). We see a small (up to 0.2%) m/m rise, albeit with the data still showing volatility. Indeed, GDP growth has been positive in only one of the last four months, having been flat in both July and June. The day before sees key housing market survey numbers from RICS.

Eurozone

Obviously, the main event is the ECB account of the last Council meeting (Thu). The question is to what degree there would be evidence of resistance a move earlier than December. Datawise, the main interest will be the EZ retail sales data (Mon) which are likely to show some further m/m slippage in July after a negative Q2. Key services production data also arrive on Monday. German industrial production (Tue) is likely to see perhaps a fresh m/m fall as may manufacturing orders numbers the day earlier.

Rest of Western Europe

There are key events in Sweden, with (expected again to be weak but still slightly positive) monthly GDP indicator data (Thu). Norway sees important CPI figures (Thu).