USD flows: USD surges on strong employment report

USD sharply higher on unambiguously strong US employment report

A conclusively stronger than expected US employment report has sent the USD sharply higher, with payrolls 100k above expectations, the unemployment rate falling to 4.1% and average earnings rising more than expected at 0.4%. As usual, the JPY has seen the largest decline, with USD/JPY spiking 2 big figures on the news, while USD gains elsewhere have been more modest. EUR/USD has lost half a figure, and AD around 0.5%, while USD/CAD is only very modestly higher. EUR/CHF has risen modestly in sympathy with the weaker JPY, with equity markets rising even though US yields are sharply higher.

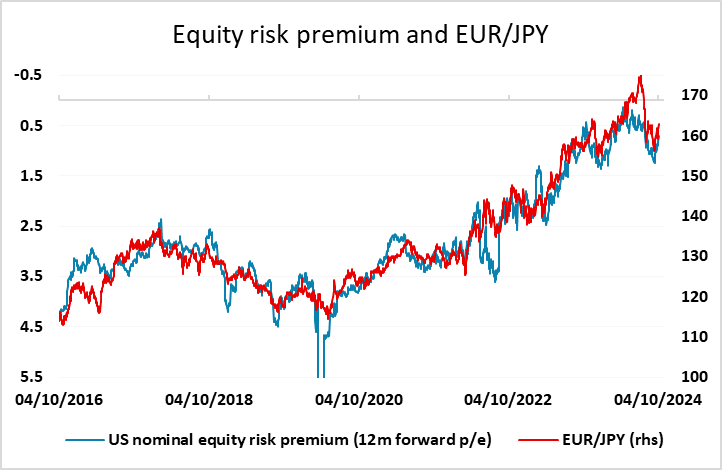

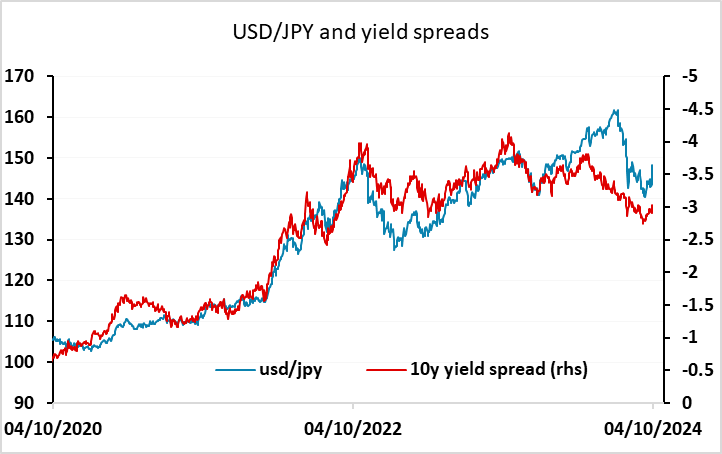

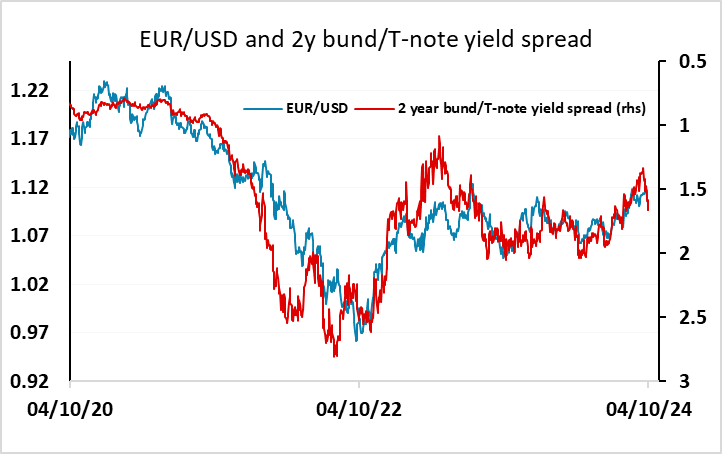

On the basis of the metrics that have guided the markets in recent years, the sharp widening of yield spreads is most positive for USD/JPY, as yields in Europe and Canada have so far risen almost as much as yields in the US. This seems unlikely to persist at the short end of curves, as the stronger employment report will have little effect on ECB policy, so EUR/USD may play some catch up if Eurozone yields drop back. Nevertheless, the rise in US yields and firmer equities implies a decline in US equity risk premia which is typically well correlated with a weaker JPY on the crosses. Even so, while wider spreads are typically USD/JPY supportive, spreads still look too low to justify a move above 150 in USD/JPY. The data has ensured that the market is no longer pricing in a significant risk of a 50bp Fed easing in November, but it will take stronger CPI data to prevent a 25bp ease, so we wouldn’t expect much followthrough from the initial reaction.