FX Daily Strategy: Asia, October 4th

Upside risks for US employment, and market is already overpricing the risk of a 50bp Fed cut in November…

…but USD strength in the last week has already taken it above the levels consistent with yield spread correlations, so some USD downside risks on neutral data

Market remains on watch for Middle East developments

JPY weak but JPY bears vulnerable to a risk negative turn, especially on crosses

Upside risks for US employment, and market is already overpricing the risk of a 50bp Fed cut in November…

…but USD strength in the last week has already taken it above the levels consistent with yield spread correlations, so some USD downside risks on neutral data

Market remains on watch for Middle East developments

JPY weak but JPY bears vulnerable to a risk negative turn, especially on crosses

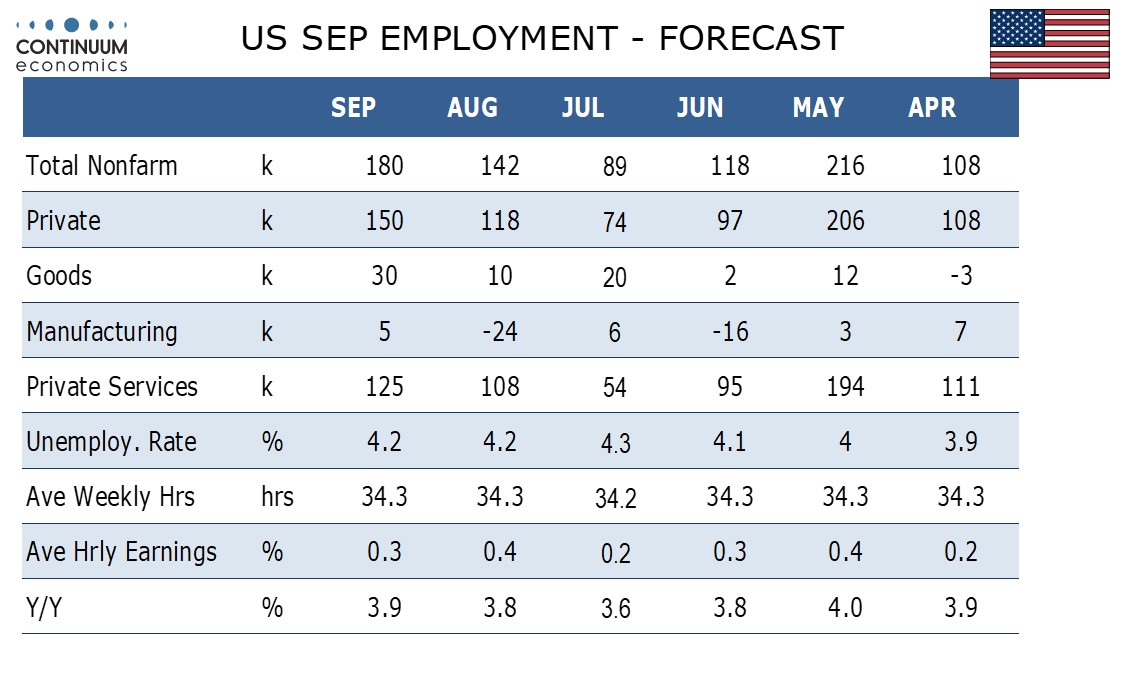

The US employment report dominates Friday’s calendar. Lower initial claims suggest September’s nonfarm payroll will be a little stronger than the three preceding releases, which averaged 116k. We expect a 180k increase, with 150k in the private sector. We expect unemployment to be unchanged at 4.2% and an in line with trend 0.3% increase in average hourly earnings. Our forecast is on the strong side of market expectations form payrolls, where the consensus is a 148k increase, but in line with the consensus on earnings and unemployment. While 30k here or there in the payroll number really shouldn’t be seen as significant, the increased focus on the employment picture means that a number in lie with our forecast could be expected to give US yields and the USD a boost.

As it stands, the market in any case looks to be overpricing the risk of a 50bp Fed rate cut in November at around a 33% chance, so we see scope for US short end yields to rise even on as expected numbers. But EUR/USD has traded a little weak relative to yield spreads over the past week, and USD/JPY substantially strong, and the USD has been generally firm, so there may be some positioning risk of USD declines on neutral data.

There isn’t a lot else on Friday’s calendar, but the market is still waiting to see the Israeli retaliation to the Iranian missile attack. Reports indicate that the US has asked for significant restraint from Israel, and if there is no response there is scope for a further modest risk recovery, other things equal. The most immediate market impact would come if Israel were to hit oil terminals, spiking the oil price higher, but this would seem an unlikely strategy as it would be bad news for all except the other oil producers.

From a valuation perspective, the JPY continues to look much too weak here, but the comments from Ueda and Ishiba this week have effectively given the market a green light to sell JPY in the short run without fear of BoJ tightening. The risk for JPY sellers is a risk negative turn in the markets, either from a weak employment report or from geopolitical events. JPY crosses may consequently be more risky for JPY bears, as the USD could be expected to be well supported in the event of risk negative geopolitical developments.