FX Daily Strategy: APAC, October 3rd

ISM the focus in more USD positive environment

Risk recovery could be derailed by Middle East events

JPY weakness getting extreme again, aided by Ueda and Ishiba comments

CHF to see further declines if risk stabilises

ISM the focus in more USD positive environment

Risk recovery could be derailed by Middle East events

JPY weakness getting extreme again, aided by Ueda and Ishiba comments

CHF to see further declines if risk stabilises

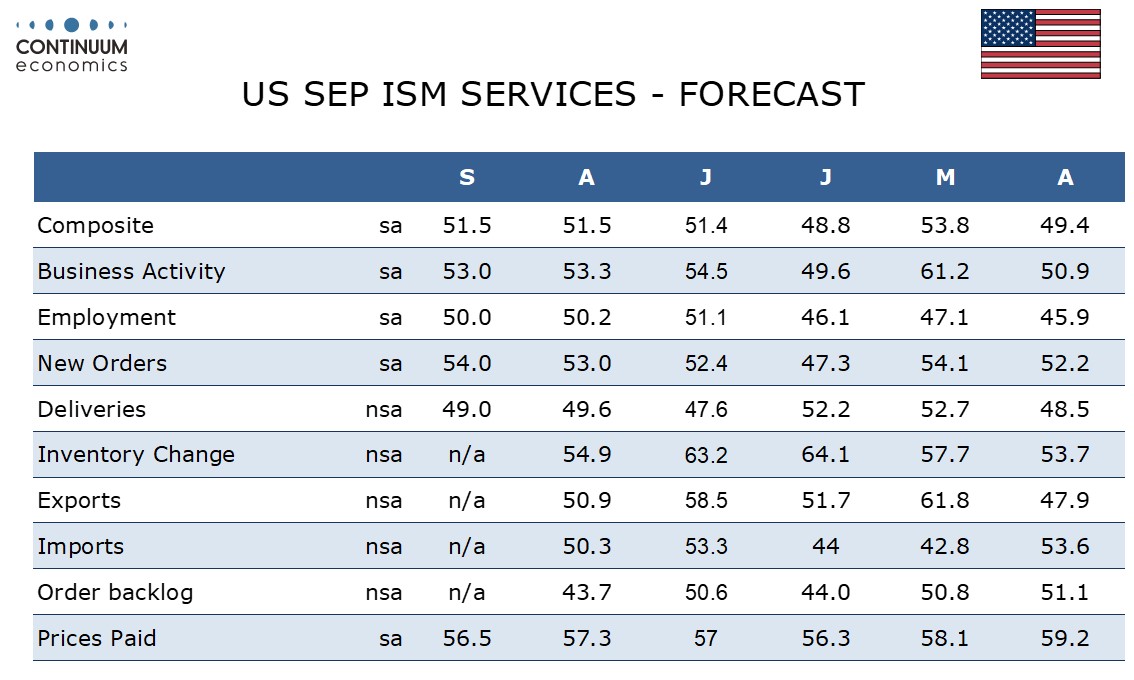

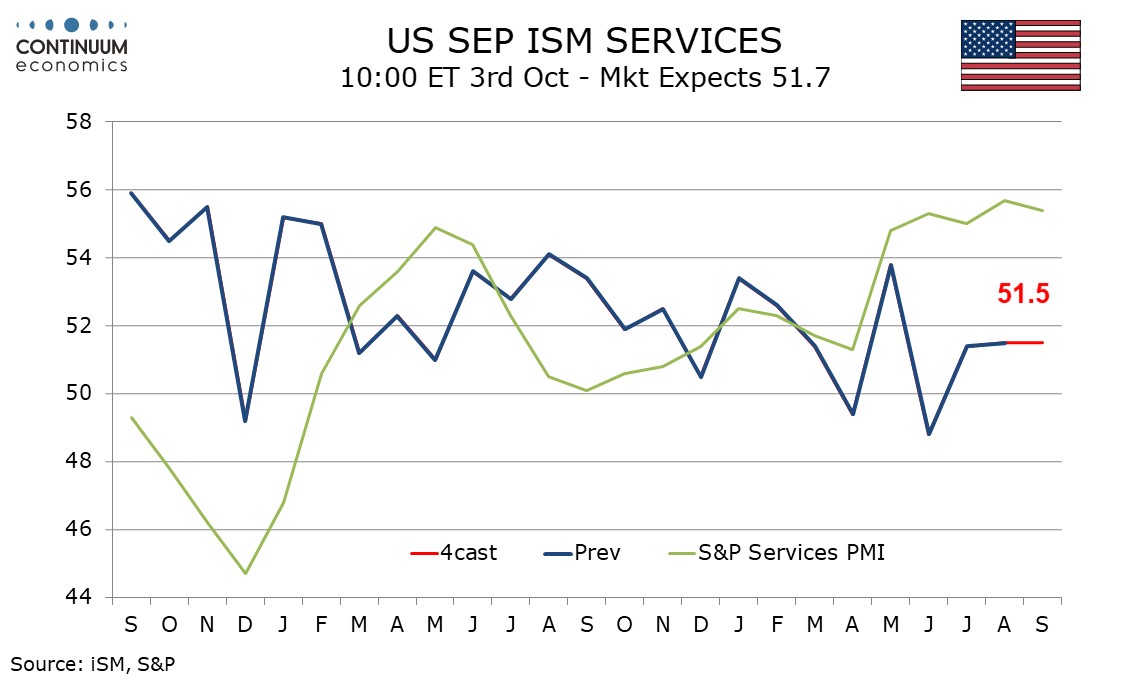

Thursday sees the September US ISM services survey, which is the last significant data ahead of Friday’s employment report. The market is more concerned with employment, and with the S&P services PMI and the services ISM not really giving the same readings, it will be hard to conclude a great deal from the ISM data. We expect September’s ISM services index to be unchanged from August’s reading of 51.5, and also almost unchanged from July’s 51.4, and implying only a modest pace of expansion through Q3. A stable pace is probably a more important signal than a continued strong level from the S&P services PMI, with the S&P index looking more sensitive to prospects for lower rates. Regional Fed service sector surveys have been mostly subdued, though those from the Philly and Richmond Feds were significantly less negative, arguing against deterioration in the ISM services index. There will naturally be more of a focus on the employment index ahead of the employment report, and given the Fed’s increased focus on the labour market. The employment index has improved in the last couple of months, and while in reality it tends not to be a great indicator for the employment data, we would expect another solid number to maintain the positive USD tone.

USD strength was once again most clear-cut against the JPY on Wednesday, although there were general gains on the back of higher US yields, which were helped to some extent by the slightly higher than expected ADP employment data. But there was also a generally more risk friendly tone to the market, probably based on a perception that the Middle East conflict was likely to be contained. This may be a dangerous assumption, as there is still likely to be Israeli action against Iran, so we would be wary of assuming the better risk environment will persist. USD/JPY at 146 in any case already looks excessive given current yield spreads. JPY weakness was also partly due to more dovish comments from Ueda and Ishiba on Wednesday, but the market is already priced for very little BoJ action, so USD/JPY risks now look to be mainly on the downside.

While USD/JPY rose very sharply on Wednesday, USD/CHF saw a more modest rise, with EUR/CHF holding below 0.94. The CHF is perhaps seen as a safer safe haven than the JPY, but the two currencies have been well correlated over the last year as Swiss rates have fallen back to close to Japanese levels. If risk sentiment continues to stabilise, there should be scope for the CHF to follow the JPY lower.

Bigger picture, it still looks obvious that the JPY is vastly too cheap relative to the CHF (and pretty much everything else). But if the market continues to focus on the prospects for near term BoJ tightening, there may yet be further JPY weakness, especially if we see a positive equity market tone return. The BoJ will not want to see JPY weakness return in earnest but after Ueda’s and Ishiba’s latest comments, there is little they can do to halt a new JPY downtrend.