Brazil: Moody’s Upgrade Brazil’s Rating

Moody's upgraded Brazil's rating to Baa1, one level below investment grade, citing growth and structural reforms like tax and labor reforms. While Brazil's fiscal framework still faces challenges, adherence to it could stabilize the Debt/GDP ratio. Analysts were surprised by the upgrade, but maintaining growth above 3.0% could lead to further improvements, with potential for an investment-grade rating by 2025 if growth persists.

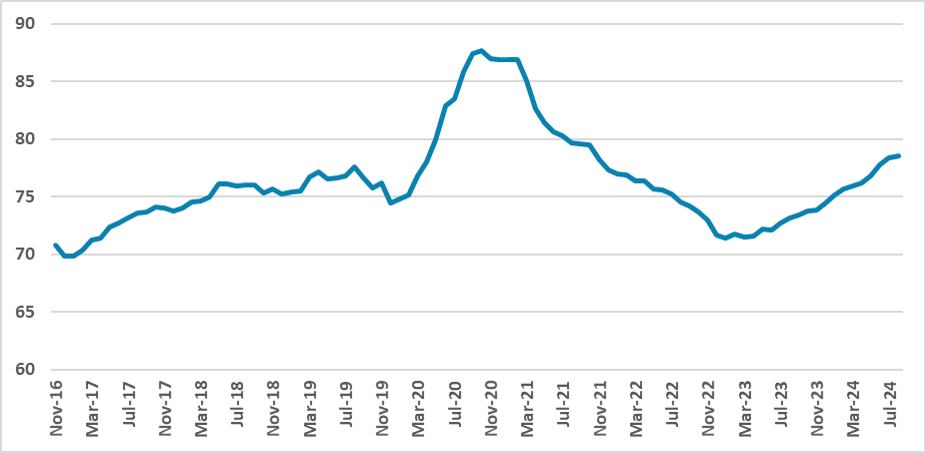

Figure 1: Brazil General Government Debt/GDP (%)

Source: BCB

Moody’s has upgraded Brazil's rating to Baa1 from Baa2, maintaining a positive outlook. Brazil is now only one level below investment grade, and with Moody’s outlook being positive, there is a real chance that Brazil could recover its investment grade during Lula’s mandate, provided there is no deterioration in Brazilian fundamentals.

The reasons for the upgrade were mainly associated with Brazil's growth. Moody’s highlighted the structural reforms approved in recent years, such as the Tax Reform, Labor Reform, central bank independence, and recent digitalization measures. According to Moody’s, although the credibility of the fiscal framework is still moderate, adherence to it, coupled with strong growth, will ensure that Debt/GDP stabilizes at around 82% in the long term.

The implementation of spending measures was highlighted by Moody’s as one of the factors for the improvement, signaling that Moody’s clearly believes in the gradual fiscal adjustment proposed by government officials. The government believes that potential GDP growth in Brazil is around 2.5%. If the economy continues to grow at this pace and the fiscal framework ensures that spending grows below revenues, a scenario where the Debt/GDP ratio stabilizes is plausible.

The improvement in Brazil’s rating surprised most analysts. Recently, several criticisms have been made regarding Brazil's fiscal framework, as it is seen locally as difficult to maintain. Local analysts also differ from the government’s perspective on whether this strong growth can be sustained, and we share this view. However, Moody’s will likely be more influenced by actual results than by expectations.

Our forecast is that Moody’s will keep Brazil's debt at Ba1 for at least another year. With the economy projected to grow 2.0% next year, it will be challenging for Moody’s to upgrade Brazil until the end of 2025. Additionally, with 2026 being an election year, doubts will remain about whether the government will maintain the fiscal framework or find ways to increase spending within it. We believe the only way Moody’s will improve Brazil’s rating back to investment grade in 2025 is if Brazil's growth exceeds 3.0% in that year, which is not an impossible scenario.