FX Daily Strategy: APAC, October 2nd

ADP to provide more data ahead of the US employment report

USD well supported against the riskier currencies on Middle East tension

NOK can benefit against SEK on higher oil price

Less scope for CAD gains despite traditional benefit from rising oil

ADP to provide more data ahead of the US employment report

USD well supported against the riskier currencies on Middle East tension

NOK can benefit against SEK on higher oil price

Less scope for CAD gains despite traditional benefit from rising oil

Wednesday sees more preparations for the US employment data at the end of the week with the ADP employment release. We expect a 140k increase in September’s ADP estimate for private sector employment growth, above August’s 99k and July’s 111k but a little below where trend was in June, when the 3 month average was 166k. Lower initial claims suggest some pick up in the labor market in September. Our forecast is a little above the market consensus, but 140k versus 124k isn’t particularly significant given that the ADP report is taken with a large pinch of salt. Tuesday’s weak employment index in the ISM manufacturing survey was offset by an increase in job openings in the JOLTS report, so as it stands we still favour a stronger employment report than the market, and the ADP number ought to provide the USD with some support.

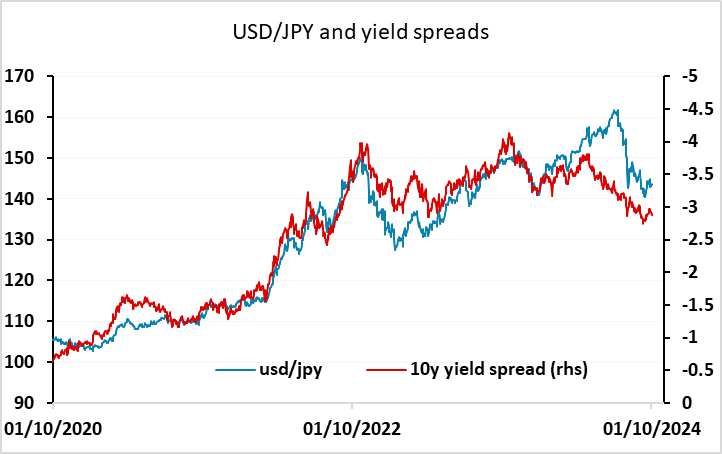

However, USD gains may be concentrated in the riskier currency pairs, as the JPY and the CHF both managed gains on Tuesday on increased Middle East tension. Israel is preparing a ground invasion of southern Lebanon, and there are reports of an Iranian attack on Israel being planned. Tension is clearly high, and the oil price was up $3 on Tuesday. Even though it would require fears of genuine supply disruption for the oil price to rise further, and currently it is not at levels that are a concern, it is likely that he tension will increase in the coming days, so we would still favour the safe haven currencies.

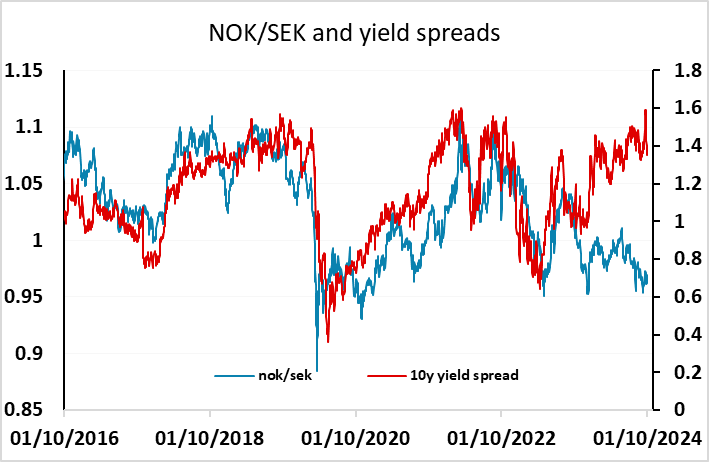

The CAD and NOK traditionally have tended to benefit when the oil price rises, but their correlation with oil has weakened dramatically in recent years. Nevertheless, the NOK rose strongly against the SEK on Tuesday in response to the Middle East news, and given that it is starting from levels that look much too low relative to the historic correlation with yield spreads, there is scope for it to advance further.

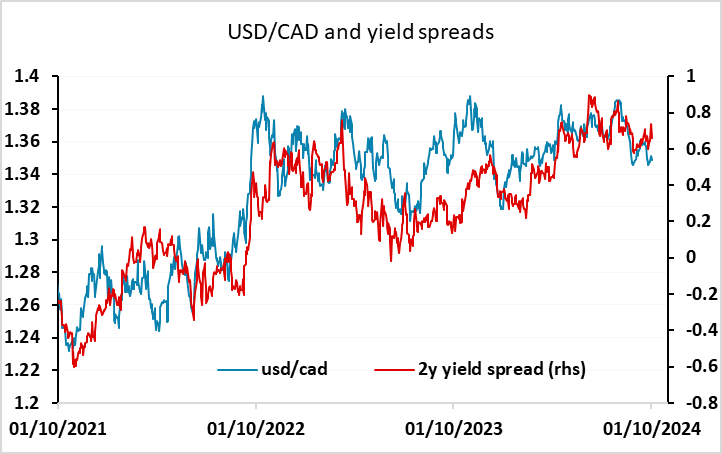

For the CAD, the case for gains against the USD looks weaker, with front end yield spreads suggesting the CAD is already trading on the high side relative to spreads. The CAD also tends nit to do well in a weaker equity market environment, even if some of the equity market weakness is oil related. So we doubt there is much scope for USD/CAD losses below 1.35.