Published: 2024-09-30T15:33:19.000Z

Preview: Due October 11 - U.S. September PPI - Energy to slip, core rates seen slightly slower

Senior Economist , North America

2

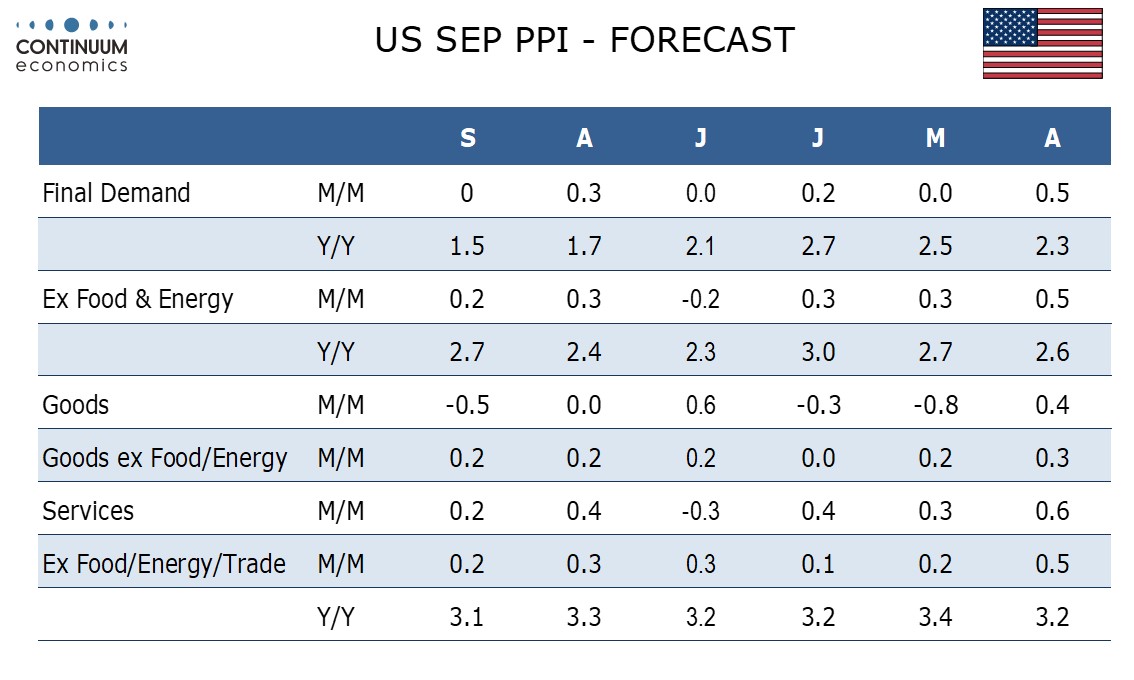

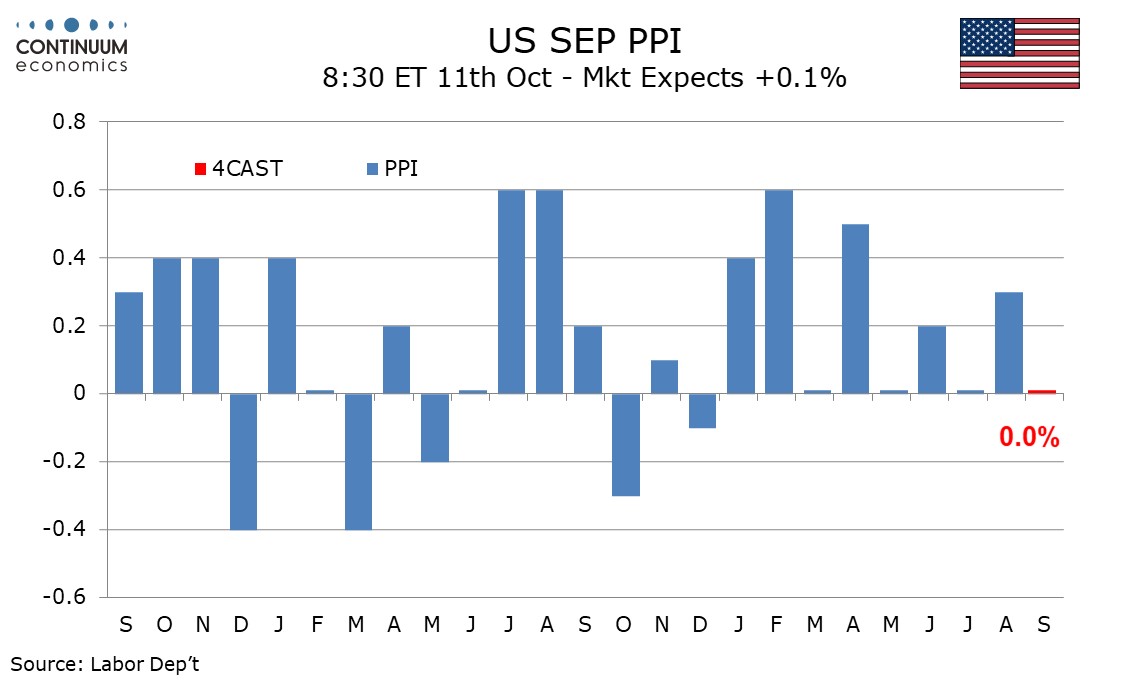

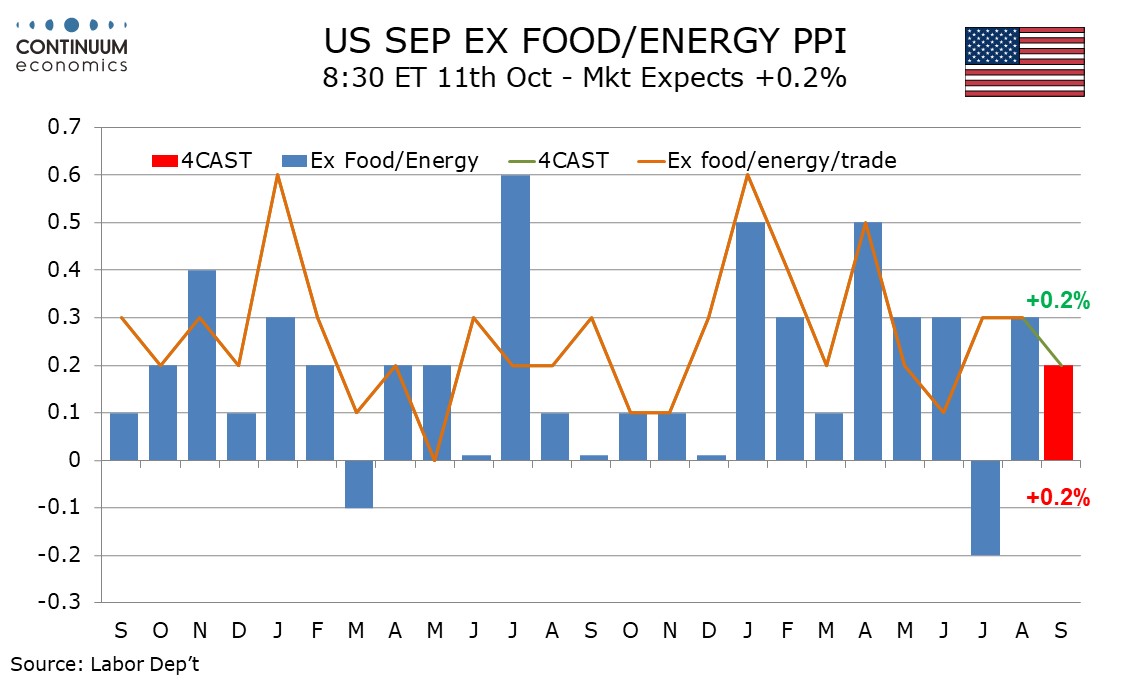

We expect an unchanged September PPI, restrained by slippage in gasoline, with 0.2% gains in the core rates, ex food and energy and ex food, energy and trade, both slowing from 0.3% gains in August.

While two of the last three gains in each of the core rates have been 0.3%, with the exceptions being a 0.2% decline in July’s ex food and energy PPI, and a modest 0.1% increase in June’s ex food, energy and trade PPI, trend is probably closer to 0.2%. We expect a fairly neutral contribution from the volatile trade sector, which surged by 1.3% in June, plunged by 1.7% in July and rose by 0.6% in August.

Energy prices look set to slip on weakness in gasoline and we also expect a soft month for food after three straight gains, with intermediate food prices having fallen in August.

Yr/yr PPI would then slow to 1.5% from 1.7% overall, and to 3.1% from 3.3% ex food, energy and trade, but rise to 2.7% from 2.4% ex food and energy. The core rates are still a little higher than the Fed would like..