FX Daily Strategy: Asia, October 1st

Eurozone CPI should be well anticipated. EUR/USD confined to a 1.11-1.12 range

Market on watch for any evidence of US employment weakness in ISM or JOLTS data

AUD remains well supported if Chinese equities hang onto recent gains

Eurozone CPI should be well anticipated. EUR/USD confined to a 1.11-1.12 range

Market on watch for any evidence of US employment weakness in ISM or JOLTS data

AUD remains well supported if Chinese equities hang onto recent gains

Tuesday sees preliminary Eurozone CPI data for September, but this should contain few surprises as we have already had all the major country data. The numbers will likely be below the surveyed median, albeit not by much. For the EUR, this has diminished in significance after the comments from Lagarde on Monday. While she of course didn’t come out and say that the ECB will cut rates in October (we never pre-commit), her tone, indicating weaker than expected growth and inflation well under control, suggested that he October meeting s close to being a done deal .That is certainly how the market saw it, with the probability of a 25bp cut going from 90% to 100% after her comments. The EUR weakened accordingly, although it only reversed the gains seen earlier in the session after the slightly stronger than expected German CPI data. 2 year EUR yields edged a little lower, and with US yields higher this kept spreads moving in the USD’s favour. But they are still at levels that suggests EUR/USD will be contained in a 1.11-1.12 range near term.

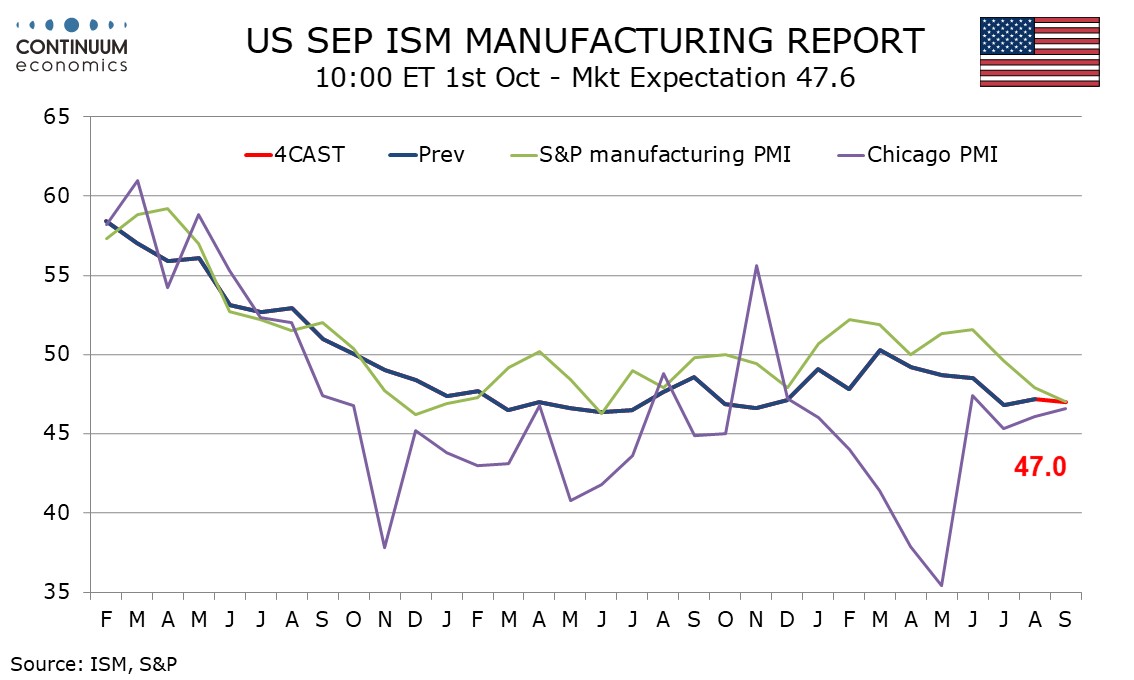

Otherwise, there was a general mild risk positive tone in the markets on Monday, helped by the further gains seen in the Chinese equity market overnight. USD/JPY gained a big figure form the European open and EUR/CHF also edged high, although it lost some of its gains after Lagarde’s speech. For this to be maintained the Chinese market will need to hold its recovery levels, and the ISM manufacturing survey on Tuesday will need to produce a broadly solid outcome. There will be a bit more attention on the employment component than usual given the employment report this week, but there may also consequently be as much focus on the JOLTS data. These have been trending steadily lower through the year, and July saw the lowest since January 2021. We would expect the USD to remain reasonably resilient, as recent data has been solid, but the market is on watch for weaker labour market data, so the USD could be vulnerable if there is any evidence of labour market weakness.

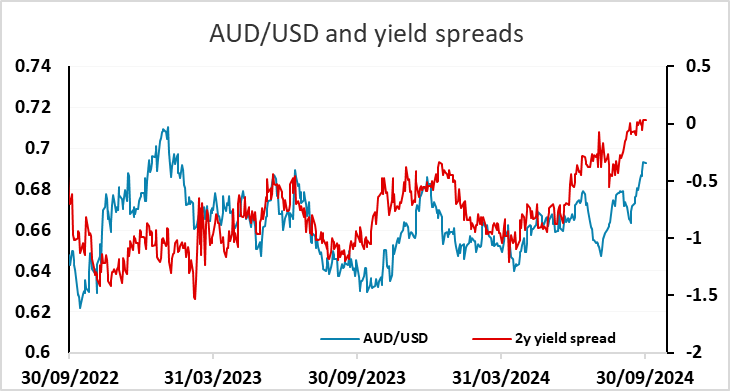

AUD/USD continues to look like one of the best supported currencies in the current environment. Yield spreads have been indicating upside risks for some time, but the AUD had been held back by the weakness in the Chinese equity market. The big recovery in China in the last week has taken those concerns away for the moment, and if the recent strength isn’t reversed, there should be scope for AUD/USD to test 0.70 near term.