FX Weekly Strategy: Asia, September 30th - October 4th

US employment report the focus

EUR/USD upside looks more restricted

Still scope for JPY and AUD gains

Strategy for the week ahead

US employment report the focus

EUR/USD upside looks more restricted

Still scope for JPY and AUD gains

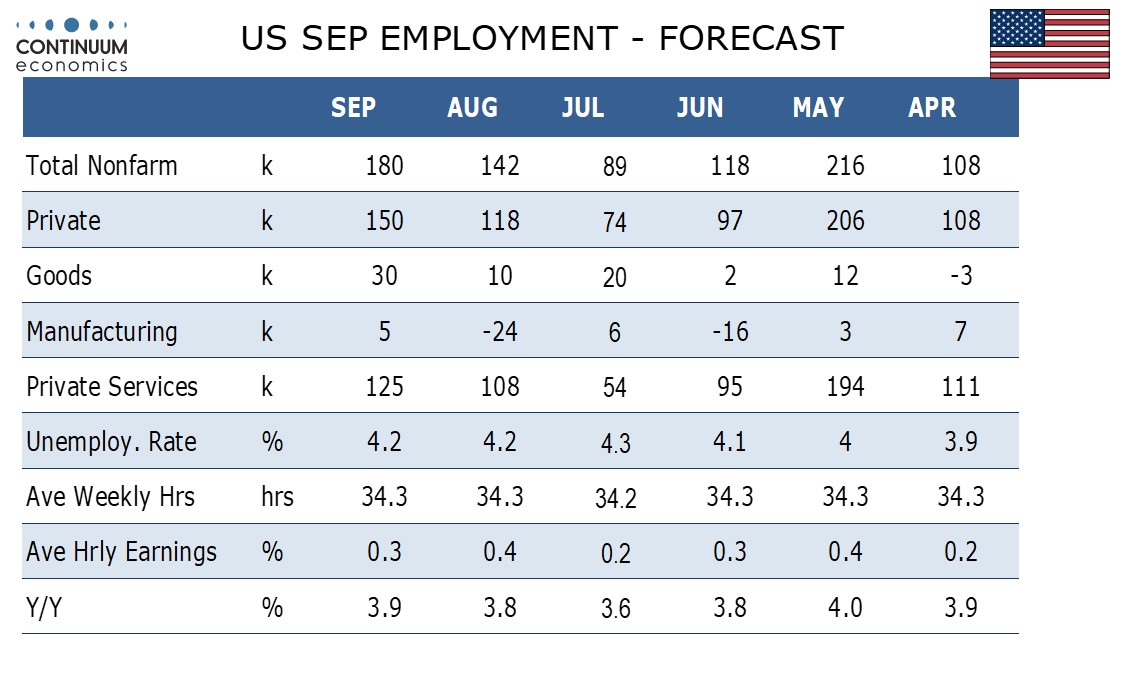

The US employment report at the end of the week is obviously the main focus, and we look for a significantly stronger than consensus report, with a 180k rise in non-farm payrolls. This suggests an underlying USD positive picture for the week, but the payroll number isn’t released until Friday.

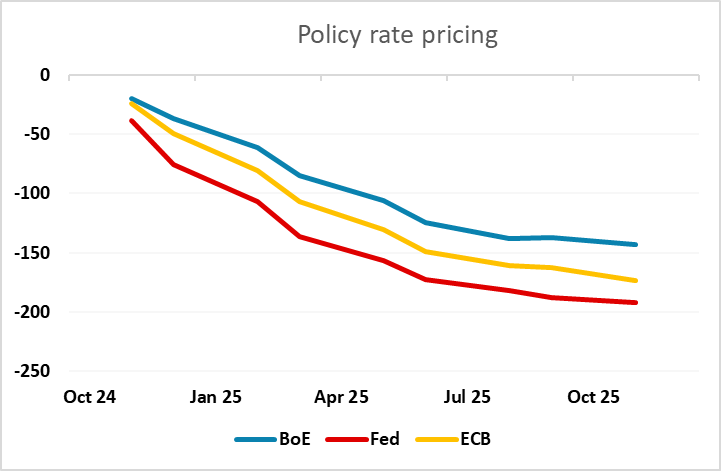

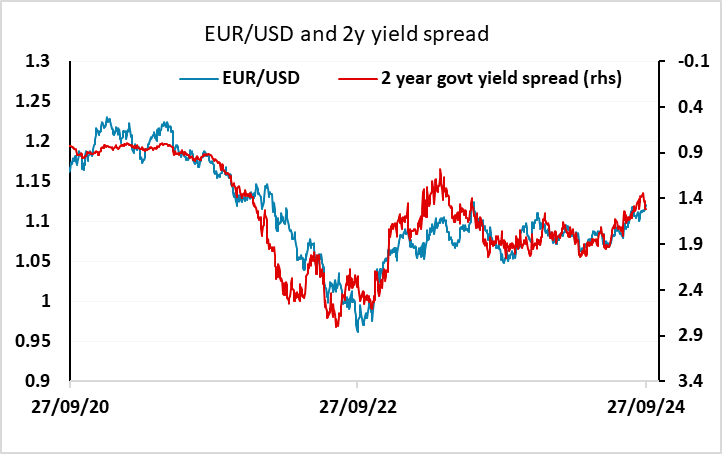

Ahead of the employment report, the dominant influence may be the preliminary September Eurozone HICP data on Tuesday. The weak French and Spanish data released on Friday suggests downside risks form the published median, albeit likely mostly due to energy. After Friday’s weak French and Spanish data, the market has already nearly fully priced an ECB rate cut in October, so there is little scope for a further decline in EUR yields. But EUR/USD risks may nevertheless be slightly on the downside, as the USD weakness seen after the weaker than expected US PCE price data on Friday looks a little overdone, at least against the EUR. The Fed is now probably more concerned with real data than inflation data, and the rest of the US data last week was generally solid, with better home sales and solid Q2 GDP and a higher Atlanta Fed Q3 GDP estimate. As it stands, the Fed is still priced to ease more aggressively than the ECB or the BoE, and this doesn’t look wholly convincing with US growth still outperforming. We would therefore see some EUR/USD downside risks if, as seems likely, the Eurozone CPI data confirms the picture from France and Spain, with risks of more significant losses on a strong US employment report.

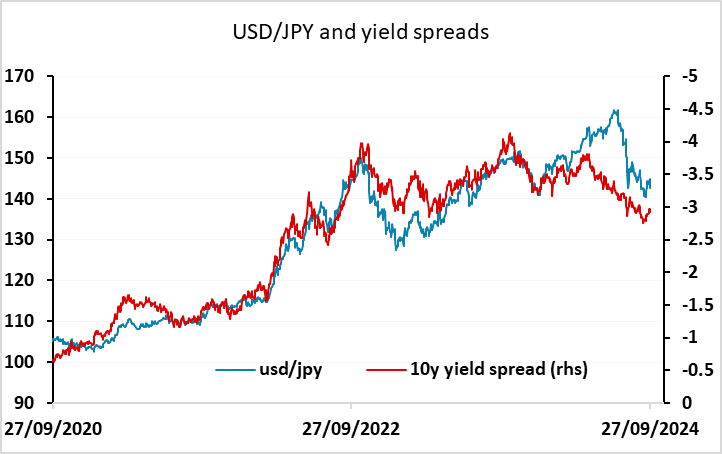

The case for USD gains elsewhere is less convincing. USD/JPY had a volatile day on Friday, sharply reversing early gains as the LDP elected Ishiba as the new PM, reducing fears of pressure for less hawkish policy that might have been seen under the alternative candidate Takaichi. However, the size of the JPY move was surprising, as these policy uncertainties had not been evident in Japanese money market rates, which were barely changed around the election. It is possible that the BoJ was involved in the reversal of JPY weakness, as the JPY’s decline was getting out of hand. Since the FOMC meeting the JPY has fallen consistently and exceeded the moves that would normally be expected based on the usual yield spread and risk metrics, so it is quite possible that the Japanese authorities saw the need for some action. Even after the JPY recovery, USD/JPY remains some way above the level that looks consistent with the yield spread correlation that has held in recent years, so we would still favour the JPY upside.

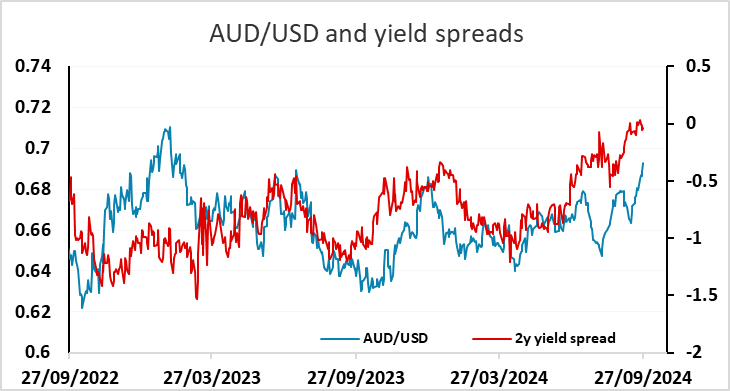

The AUD also still looks supported by yield spreads, as it has for some weeks. However, it had been held back for some time by concerns about the weakness of the Chinese economy and the Chinese equity market. While these concerns haven’t disappeared, the Chinese stimulus announced last week has allowed the AUD to throw them off for the moment, and if the Chinese equity market remains supported in the coming week, there may be scope for AUD/USD to trade as high as 0.70.

Data and events for the week ahead

USA

US data will see a focus on employment, though before that eyes will be on a speech by Fed Chairman Powell to the NABE on Monday, a day which sees only minor data releases. Other Fed speakers scheduled during the week are Bostic, Barkin and Collins on Tuesday, Hammack, Musalem and Bowman on Wednesday, and Kashkari on Thursday.

Lower initial claims lead us to forecast a stronger September non-farm payroll increase on Friday of 180k, 150k in the private sector, with an unchanged unemployment rate of 4.2% and an in line with trend 0.3% increase in average hourly earnings. Wednesday sees ADP’s estimate for private sector employment growth, which we also expect to show some improvement, with a 140k increase. Other labor market indicators to watch are August’s JOLTS report on job openings on Tuesday, and weekly initial claims on Thursday.

We expect September’s ISM surveys to show manufacturing slowing to 47.0 from 47.2 on Tuesday and services unchanged at 51.5 on Thursday. Other data scheduled are August construction spending on Tuesday and August factory orders on Thursday. The debate between candidates for Vice President Tim Walz and JD Vance takes place on Tuesday.

Canada

In Canada September manufacturing PMIs are due from S and P on Tuesday and Ivey on Friday while S and P’s services PMI is due on Thursday.

UK

Final PMI data (Tue/Thu) for September are not likely to be revised much, with perhaps more interest in the Construction PMI (Fri) which has been perky of late, but where the BoE DMP survey (Thu) may be more equivocal. Otherwise, the BoE releases FPC minutes (Tue) but with more interest in two speeches from BoE Chief Economist Lane (Tue/Fri).

No material revision is seen either in the Final Q2 GDP data (Mon) but the Q2 current account data to be released alongside may show a clear deterioration from the 3.1% Q1 reading. Monday sees fresh BoE-compiled money and credit data that may be of increasing importance. Firstly, they will show the extent to which cash-strapped households are still turning to borrowing to fund everyday spending, this important given some MPC views suggesting consumers are building up savings. Secondly, they will highlight how BoE balance sheet reduction is having a wider impact, given the drop in bank deposits that has occurred until recently late, the question being to what extent is this is providing downward pressure on private sector credit.

Eurozone

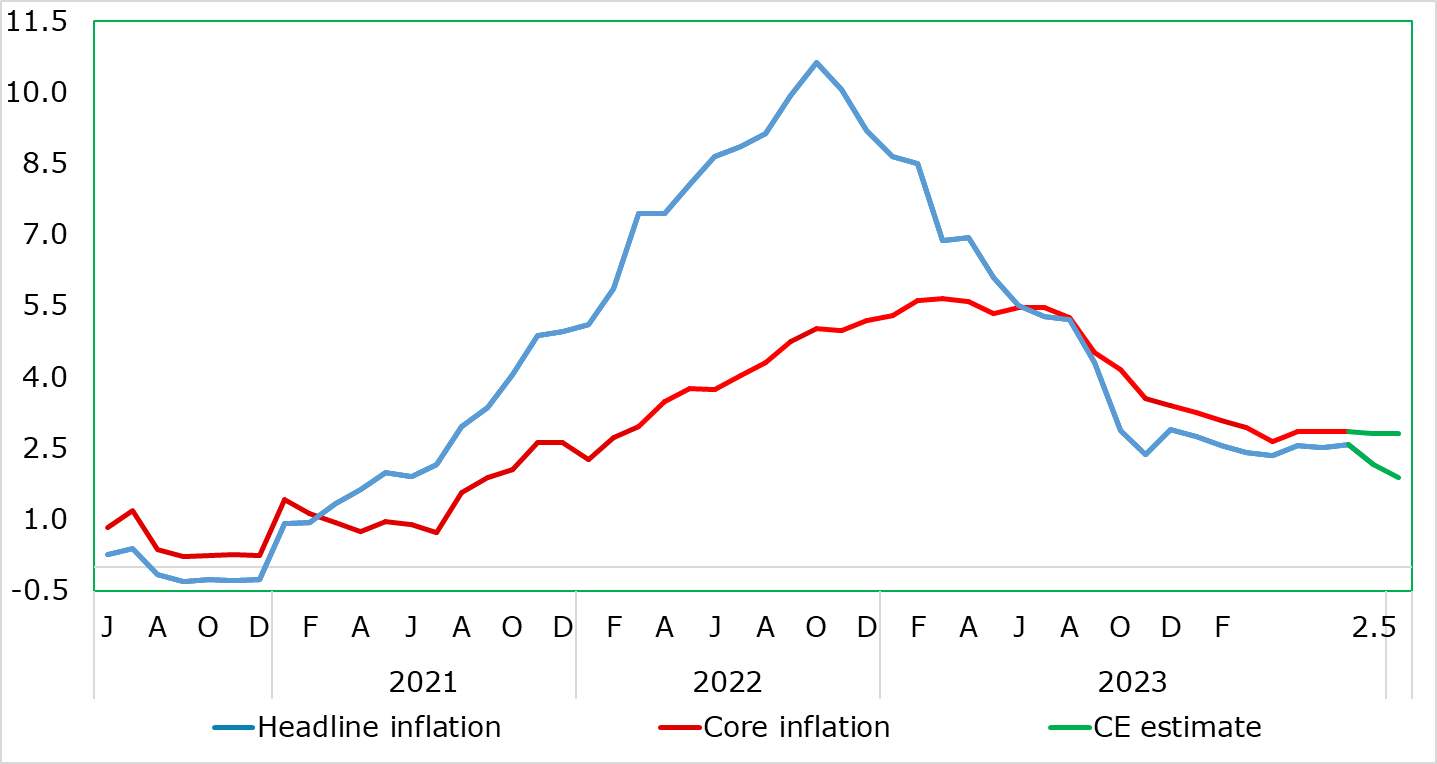

Datawise, the main interest will be the September HICP (Tue). Lower fuel prices will be a key factor in September, and could be enough of a factor to pull the y/y rate down 0.3 ppt to a below-target 1.9%, which would be the lowest in over three years and this despite still little change in services inflation. German HICP (Mon) will provide a foretaste. We see the HICP rate lower in September with a drop to 1.9%, also helped by lower fuel prices.

Headline Below Target?

Source: Eurostat, CE

Final PMI data (Tue/Thu) for September are not likely to be revised much, with perhaps more interest in the Construction PMI (Fri) which has been even weaker of late. There is an array if ECB speakers next week, the most notable being President Lagarde who testifies to the EU Parliament – will the weaker survey data seen of late feature in her remarks or that from any of her colleagues? Otherwise, Unemployment data (Wed) may show clearer signs of a n increase.

Rest of Western Europe

In Sweden on Tuesday are the minutes to this month’s Riksbank meeting verdict which cut the policy rate 25 bp to 3.25%. It will be interesting to see how the possibility of a looming 50 bp cut came about in the discussions. On Thursday, Swiss CPI numbers may see the y/y rate fall another notch to 1.0%, but be mainly energy driven.

Japan

Mostly tier two data from Japan next week. Kick starting the week with Retail Sales on Monday, along with industrial production, consumer confidence and housing starts. Retail trade carries the most weight as it will give us a glimpse into the consumption picture with real wage turning positive, where we forecast to be slow. Unemployment rate and BoJ summary of opinion will be on Tuesday and we expect no surprises.

Australia

The highlight of the week will be Retail sales on Tuesday and Trade Balance on Thursday. Neither would be market moving in a medium run for RBA is stuck with the inflationary picture above their target rate.

NZ

Business activity and confidence on Monday and business confidence on Tuesday.