U.S. GDP revisions, Initial Claims, Durable Goods Orders details mostly positive

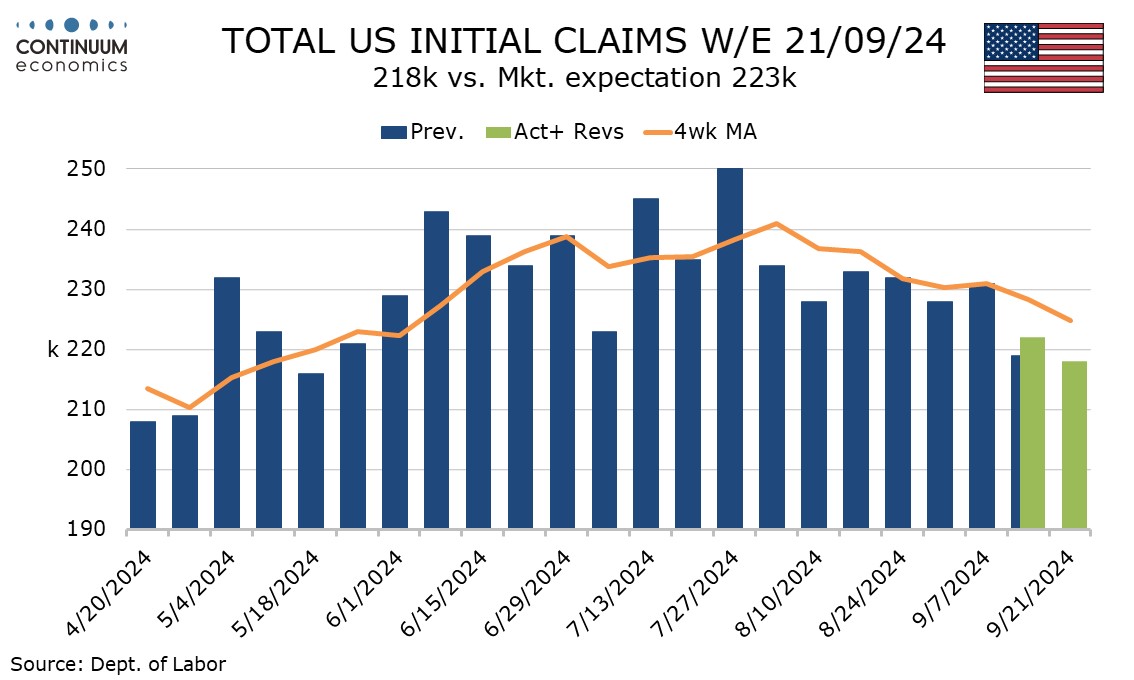

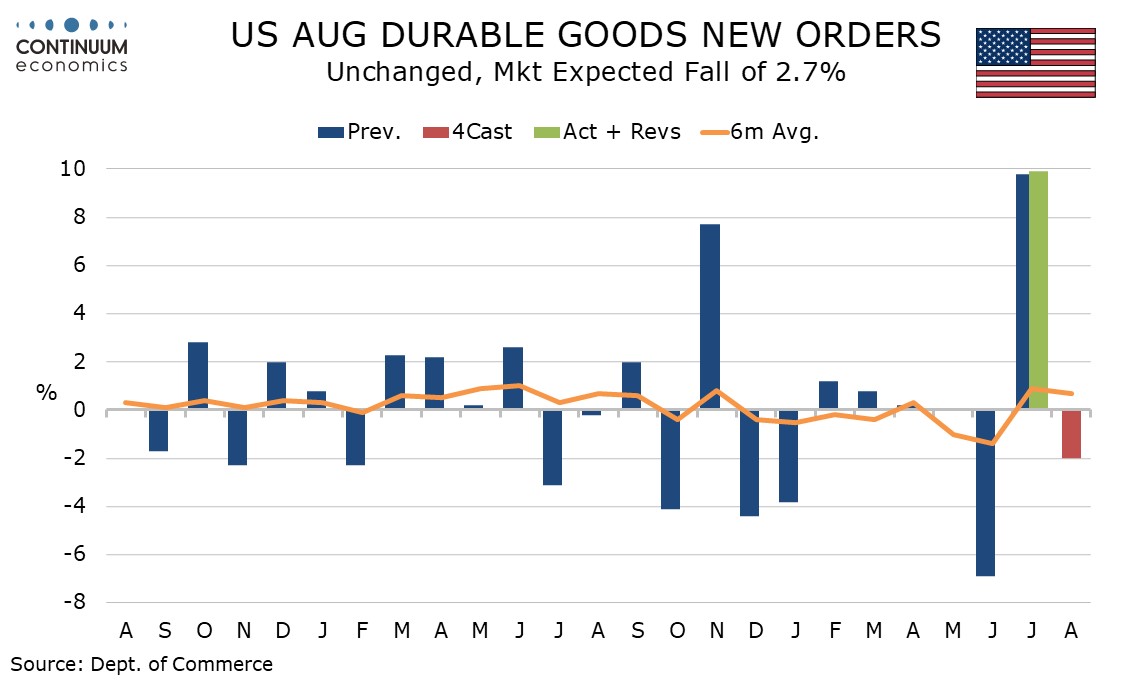

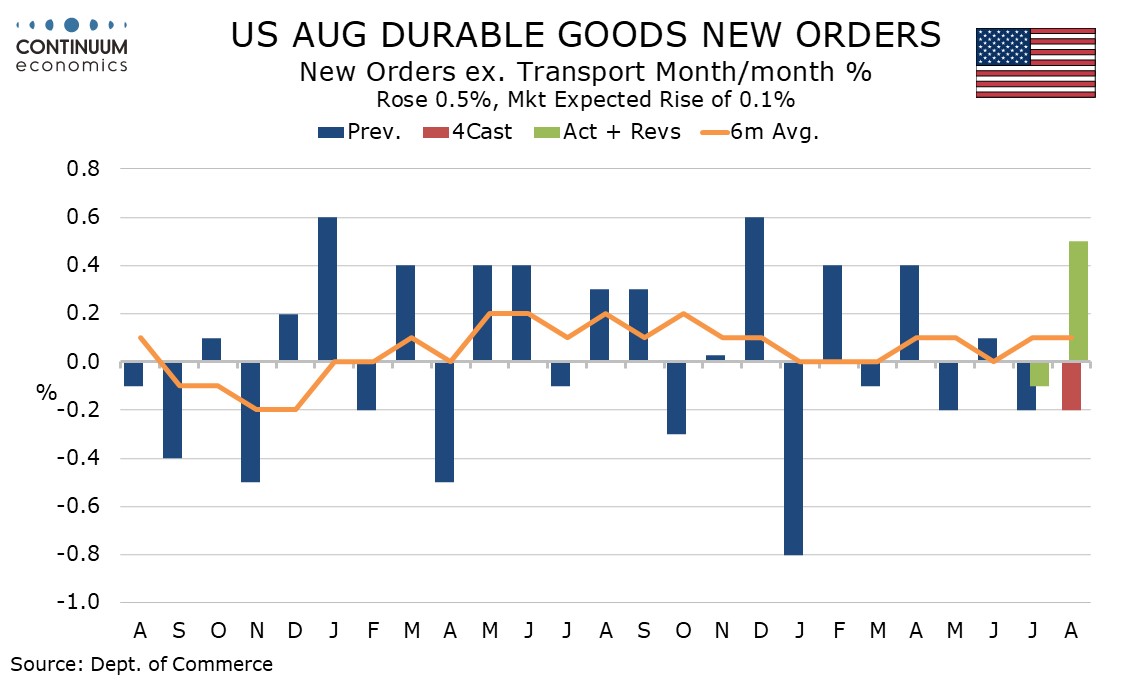

Initial claims at 218k from 222k have fallen further though last week was revised up from 219k, putting the level at the least since May 18 and suggesting no further weakening of the labor market in September. Unchanged durable goods orders have held up better in August after July’s 9.9% aircraft-led surge with ex transport with a 0.5% increase more than reversing a 0.1% July decline. Final Q2 GDP at 3.0% and the core PCE price index are unrevised but historical revisions saw income revised significantly higher, making it more consistent with spending.

Initial claims cover the week after the September non-farm payroll was surveyed, but the 4-week average, now 224.75k, has been falling since reaching 241k in the week to August 3.

Continued claims cover the week before initial claims, and this this week’s data covers the payroll survey week, and saw a 13k rise to 1.834m. However, this fails to reverse a receding 22k decline and the 4-week average of 1.836m is the lowest since June 22.

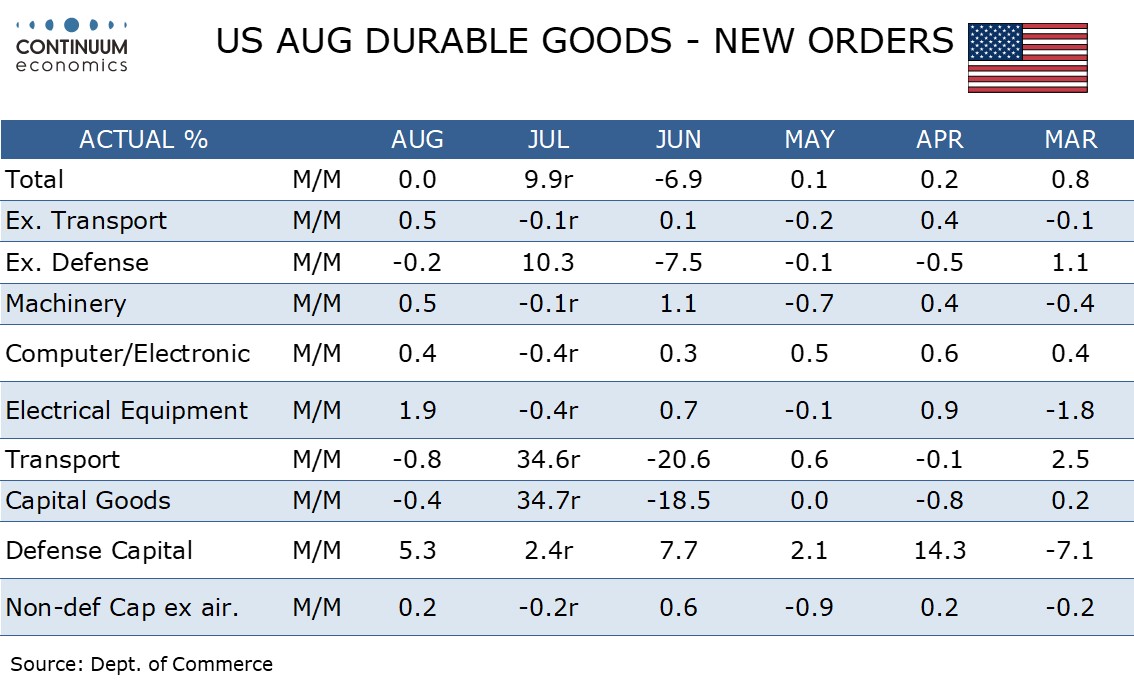

The durable goods detail shows transport orders down only 0.8% after a 34.6% July surge that followed a 20.6% June decline, with non-defense aircraft down 7.5%, defense aircraft up 8.4% and autos up 0.2%. Excluding defense, orders fell by 0.2%.

The 0.5% rise ex transport is more consistent with positive August manufacturing output than weak ISM manufacturing orders. Non-defense capital orders ex aircraft, a key indicator for business investment, rose a modest 0.2%.

Final Q2 GDP and the core PCE price index were unrevised at 3.0% and 2.8% respectively and the historical revisions to these series were quite modest in recent quarters. However the big story in the GDP revisions was upward revisions to income, reducing past underperformance of spending and making a severe economic slowing less likely. We will cover this in more detail in a subsequent comment.